- Manda Sanidad.Moncloa disavowes Díaz for his "guide" of the coronavirus while Pablo Iglesias praises his "great work"

- AIReF data.The Government may enter 1.640 million more by eliminating the tax benefit of pension plans

The pension plan industry revolts before the Government and, specifically, before the Minister of Social Security, José Luis Escrivá. The individual plans " are not only for the rich, they are clearly a middle class product " and the accusation that they are regressive "cries out to heaven", in addition to what they allow " is a mere tax deferral " until the moment in which They charge.

Sources of the Spanish Union of Insurance and Reinsurance Entities (Unespa) are so blunt in conversation with this newspaper after, last Thursday, THE WORLD published the increase of 1,640 million that the Executive may record in their income eliminating the benefits Prosecutors of the plans and that the aforementioned Escrivá affirm, before the commission of the Toledo Pact, that it will move the "favorable taxation" of the individuals towards those of employment .

"We have always been favorable to the development of corporate social security, but never at the expense of the third pillar [individual plans]", have an impact from Unespa, who warn that " not everyone would be covered by the collective system since it covers people who are employed by others, but there are freelancers, entrepreneurs, part-time workers ... ".

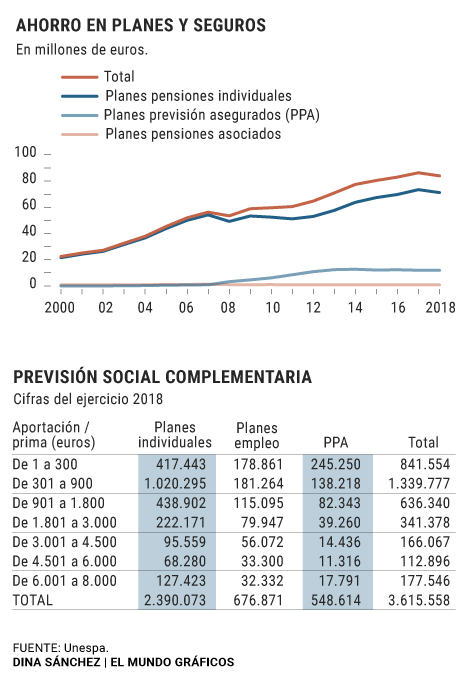

In addition, "according to the figures of the General Directorate of Insurance and Pension Funds, 78% of the participants contribute between one and 1,800 euros [the maximum is 8,000 euros], and there are contributions from all income tranches . And when He says that it only favors 10% of the population, although it is true that year-to-year figures move between three and 3.5 million people, we estimate that in total there are just over eight million people who are participants of some type of pension plan with the majority concentrated on the individual level, "continued the representative body of long-term savings managers.

Taking up the accusation of being a regressive product, Unespa spokesmen state that the individual plans simply allow a deduction of the contributions that will have to be compensated at the time of collection. However, they also point out that if the tax base during the perception of the pension is lower, as is usually the case, the marginal rate to which it will be taxed will be lower and, therefore, there will be a benefit .

And to all this, they add that according to "the report of fiscal benefits of the General State Budgets, the cost to the public Treasury was 814 million in 2019 ". With this last figure, the Union of Insurance Entities wants to rebut that data of 1,640 million that the Independent Authority of Fiscal Responsibility (AIReF) collects in the second chapter of the review of public expenditure, and which according to its estimates is the effect on the State revenue have the tax benefits of pension plans. "But it is also that this figure of 814 million does not include that the Treasury also enters the taxation of the social security that is charged, so this data would be reduced," they underline.

The business association that represents the interests of insurance companies also rejects the allegations that, in many cases, an inadequate commercialization of these products is carried out, forcing a type of client that is not adequate to contract plans for pensions in exchange for better mortgage conditions. And as for the proven low profitability of numerous plans, Unespa points out at this point the importance of promoting financial education.

Mapfre, Inverco and KPMG defend them

Unespa's defense and argumentation is in line with what Mapfre, Inverco or KPMG have done in recent days. The most categorical was José Manuel Inchausti, CEO of Mapfre Iberia, and who last Thursday "welcomed" the objective of promoting business plans but requested that it be carried out without "demonizing" the individuals.

"What we do not understand very well is why it has to be done at the expense of private plans. We do not understand what it has to do to promote one thing with taking away strength from the other , because we understand that they are two completely complementary pillars, since the greater private savings in Spain, the better, "he said, according to Europa Press.

According to the criteria of The Trust Project

Know more- José Luis Escrivá

- Personal income tax

- Pensions

AIReF data The Government may enter 1.640 million more by eliminating the tax benefit of the pension plans

SOCIAL SECURITY 23 ways to save pensions from this week

Pensions and Social Security The Government will tighten penalties for advancing retirement