Why the yen appreciated against the dollar due to the spread of the new coronavirus? March 9, 16:09

Why is the yen depreciating against the dollar due to the spread of the new coronavirus? One is the continued spread of infections in the United States and the sale of dollars, which is concerned about the economic downturn in the world's largest economy.

Initially, the spread of the new coronavirus was limited to Asia, such as China, and some investors thought it would not last long.

However, in late last month, when infections were confirmed in the United States one after another, the atmosphere of the market changed completely and the United States economy became worried about the future.

In particular, the recent emergence of emergency declarations in New York and other countries over the past few days has heightened investor concerns, and in the Tokyo foreign exchange market on the 9th, the movement to sell dollars and buy yen has accelerated.

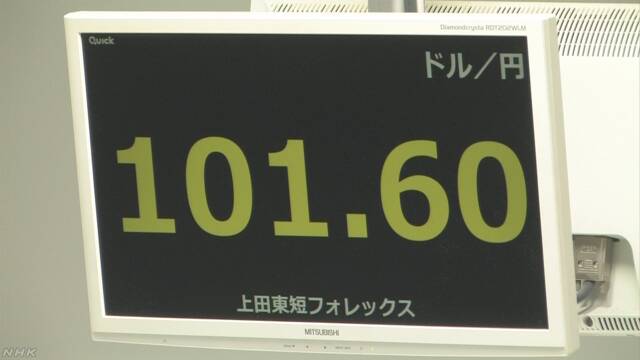

At one time, the yen appreciated against the dollar until the dollar = 101 yen.

Another reason is the urgent rate cut on the 3rd by the Federal Reserve Board, the Federal Reserve Board, which is the US central bank.

The Fed has decided to cut interest rates significantly in order to curb market volatility, making dollars with lower interest rates easier to sell in the foreign exchange market than before.

In addition, the sharp decline in international oil prices has spurred market volatility.

The trigger was that the talks between OPEC and the non-member Russia ended unsuccessfully and we could not agree to continue cooperative production cuts, but the futures prices of crude oil on the Tokyo Commodity Exchange were lower than last weekend. Over 10,000 yen, a rate drop of more than 30% was recorded.

In addition to Middle Eastern oil-producing countries, the US economy, which is also one of the world's leading oil-producing countries, could be hit harder, prompting investors who want to avoid risk to sell dollars and buy yen.

These factors combine to cause a rapid appreciation of the yen.