- Covid-19. Last minute of the coronavirus in Spain

- Covid-19.CEOE estimates a greater economic impact than expected with a drop of up to 9% of GDP and 900,000 more unemployed people

- Covid-19: The coronavirus crisis: a new blow for the generation 'we will never live like our parents'

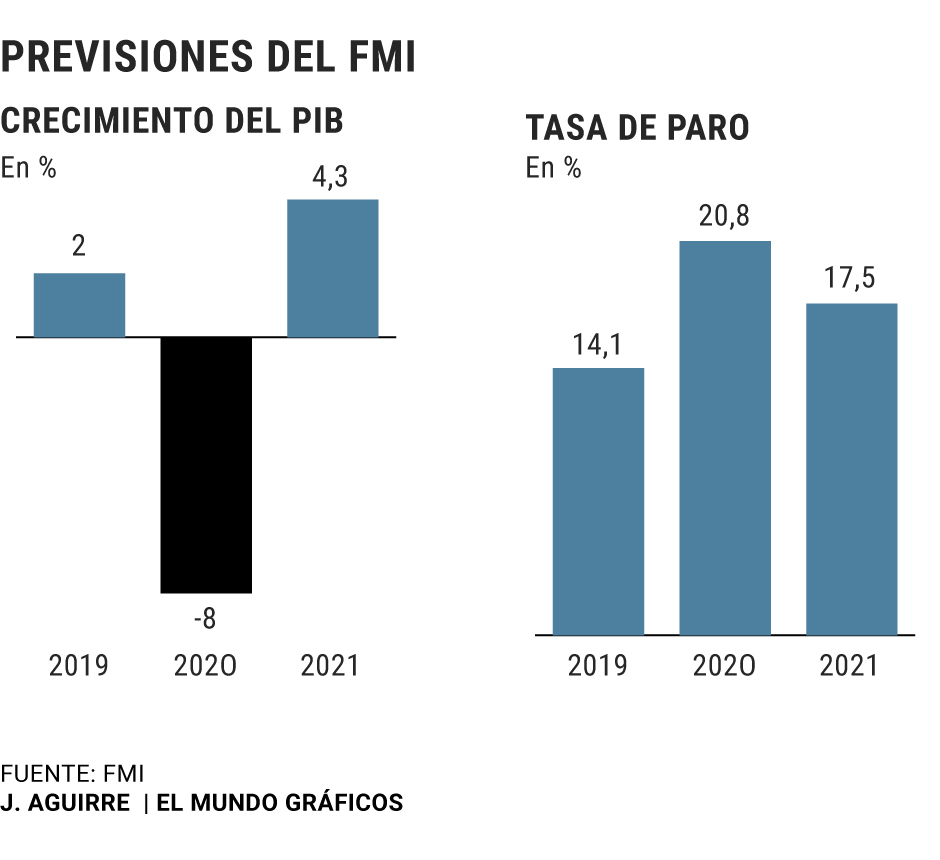

Six years in one . That is the fall that the Spanish economy will experience in 2020, according to the International Monetary Fund (IMF). The expected drop in GDP is 8%, concentrated in the first two quarters of the year, that is, in the six months from January to June. If we take as a reference the six years that go from 2008 - when the crisis of the junk mortgages in the US broke out - to 2013 - the year in which Spain grew again in a sustained way with the end of the Euro-crisis -, the fall was 7%.

That is one of the forecasts in the semi-annual World Economic Outlook report, published today by the IMF, and which is summarized in a sentence from the blog post just published by the institution's chief economist, Gita Gopinath: this is " the biggest recession in the world economy since the Great Depression, "which lasted from 1930 to 1939 in Europe and until 1941 in the US. Globally, the Fund ventures a 3% decline in GDP. For reference, the crisis triggered by the collapse of junk mortgages only decreased world GDP by one tenth. Just three months ago, in January, the IMF anticipated that the world economy would grow by 2020 by 3.3%.

Those forecasts are based on a scenario "that assumes that the pandemic is disappearing in the second half of 2020 and containment efforts are gradually being relaxed." In that case and with "the political support measures" -a euphemism to avoid the term State aid-, 8% of the working days of the year would be lost in the most affected economies, with the damage in the activity concentrated in the April - June period. Even so, they are projections with an enormous degree of uncertainty, given the lack of certainties surrounding the Covid-19. If the worst case scenario of the Fund is taken, which estimates a longer period of closure of the countries and a second outbreak in 2021, the world GDP would fall by 11%.

Some countries are less damaged than others. This is the case of the US, which has the best forecast in the West, with a decrease in GDP of 5.9% this year, although it will be followed by growth of 4.7% next year . China will grow 1.2% this year, a figure much lower than the 6.1% of 2019. It is a very bad figure politically for Beijing, since the Government of that country has turned economic statistics into a fetish to be achieved. one year yes and another also with a margin of error of one or two tenths. The fact that these numbers do not make sense does not matter to the Chinese Government, which also sees how another political objective of great symbolic importance escapes the coronavirus: the plan to double GDP per capita between 2010 and 2020. To achieve this, Beijing needed to grow this year to at least 5%. Now, that is for 2021. Of course, according to the Fund, that country's massive stimulus plan will cause China to grow 9.2% in 2021. If that forecast is met - although China's statistics are never entirely credible - It will be the highest growth in China since 2011.

But, of the large economies, Spain and Italy are by far the worst stops . The cut in GDP in both countries amounts to 9.6 percentage points in relation to the January forecast of the Fund. That means that three months ago, the institution expected growth in Spain of 1.6%, and now a fall of 8%. Italy goes from a 0.5% expansion to a 9.1% drop. No other major economy comes close in magnitude of deterioration to those two.

The catastrophe does not end there. The Fund estimates that the average unemployment rate will be 20.8% . It is the highest level since 2015. Of course, the situation is actually worse for simple arithmetic reasons. 2019 closed with a 14.1% unemployment, according to IMF statistics. Therefore, and for the average to go from 14.1% to 20.8% in a year, unemployment must approach 30% in some quarters. In fact, that is one of the most complex aspects of the report. Given that the coronavirus hit will be concentrated, presumably, in the first two quarters, the fall in GDP could be around 10% in those periods. The forecasts reflect this situation, since in the fourth quarter the fall in GDP moderated to 7.2%, indicating a recovery.

Recovery in 'L'

But the WEO - which is the acronym in English of the report and, also, the name that it receives colloquially - has a second course: the recovery in Spain will not be in 'V', but, rather, in 'L'. In other words, there will be no way out of the rapid crisis . On the contrary.

Unemployment, for example, is back to stay. With the current economic scenario, the Fund estimates that the unemployment rate will be 17.5% on average in 2021. That would mean less than half of the jobs that are destroyed this year. The same is true of GDP. After the 8% collapse in 2020, it will only recover 4.3% in 2021 . It is, therefore, a slow recovery, with very high unemployment, and many uncertainties. If this scenario is met, it will take years for Spain to recover the level of wealth it had in February.

Europe and Japan will emerge more slowly from the crisis than the US. This does not exclude, far from it, the States that have refused to apply formulas of solidarity in this crisis. The Netherlands, for example, falls 7.5% this year and barely grows 3% next year, according to the Fund. Germany fares somewhat better, with a 7% decline in 2020 and a 5.2% recovery in 2021. The IMF advocates an expansion of state aid to prevent an even greater collapse of economies and, within that politics, welcomes greater European coordination.

There is no country that escapes the catastrophe . And, although they do not make headlines, those who are developing are the ones who will suffer the coronavirus the most. The next steps with these economies will be massive debt relief, something that is already being done by some multilateral institutions, such as the Inter-American Development Bank (IDB).

The 3% drop in world GDP is historic. And the Spanish, more . The 8% collapse is close to the 10.9% that, for example, the Argentine economy contracted in 2002, after that country suspended payments and devalued its currency, and very close to the 8.5% that lost the of the United States in 1930, the first year of the Great Depression.

Spain is going to suffer a greater contraction than Mexico experienced in 1995 , during the famous tequila effect , which, again, forced a devaluation of its currency, broke the banking system, and caused a massive rescue package from the IMF, the Treasury. of the United States and the Bank for International Settlements (BIS). The fall in GDP is also going to be greater than the one suffered by Korea in 1998, which forced that country to carry out a partial suspension of the payment of its debt.

According to the criteria of The Trust Project

Know more- Coronavirus

- Covid 19

- IMF

Macroeconomics The IMF predicts zero or negative growth for the world economy due to the coronavirus

CoronavirusThe Chinese economy resumes its activity after a historic crash

Venezuela 'No' resounding from the IMF to lend 5 billion dollars to Nicolás Maduro