The future and ever closer rise in interest rates hangs like a Damocles sword over the sovereign debt of the countries of the euro zone, especially those that, like

Spain

, have a higher level of indebtedness.

After years of easy credit and monetary stimulus, the tightening of the European Central Bank's (ECB) monetary policy threatens to put an end to the sovereign financing free bar and puts pressure back on bonds and the

anesthetized risk premiums

.

The Spanish, without going any further, stood at

106 basis points yesterday,

establishing itself above 100 integers in just one week and well above the 70 points at which the year began.

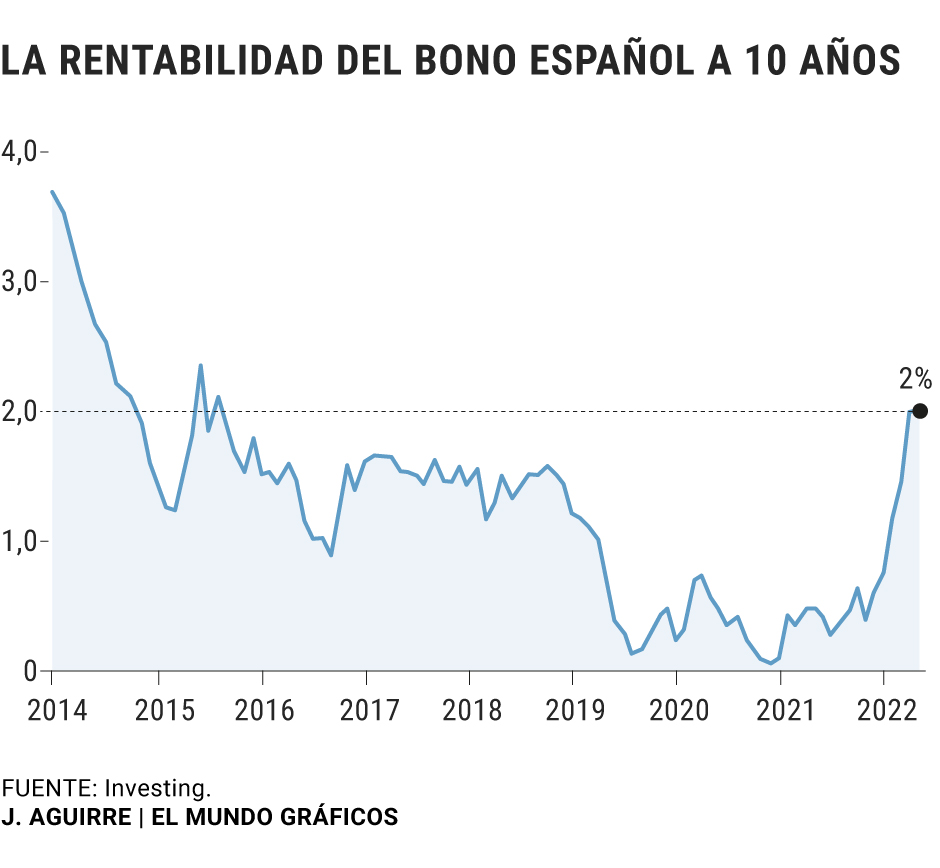

On the other hand, the

yield offered by the Spanish debt

with a ten-year maturity exceeded the 2% threshold on Monday, something that had not happened since September 2015, and yesterday, Tuesday, it repeated it again.

Specifically, the interest on the ten-year Spanish bond reached 2.066%, after dismissing the session the day before at 2.017%.

The increase in the cost of financing is a fact, and the fact is that the level of Spanish debt is not the best cover letter for the markets at a time of widespread flight from fixed income;

and the greater the difficulty in placing the bonds, the greater the yield the State will have to pay to attract investors.

We also found another sign of this yesterday in the

Public Treasury

.

The agency captured 5,011 million euros in the first auction in May, within the expected average range, but had to pay for the 12-month bills for the first time in two years (marginal return of 0.103%, compared to -0.277% previous).

The expectations of tightening monetary policy have led the Treasury to accelerate its placements in the first quarter, to the point that at the beginning of April it had already reached

40% of the financing target for all of 2022

.

And this despite the fact that the Secretary of State for the Economy and Business Support,

Gonzalo García

, recently assured that the entity is prepared to assume a possible rise in interest rates by the ECB in July.

Key meeting of the Fed in the US

dropdown

While the European Central Bank has delayed the withdrawal of monetary stimuli until the summer, the United States Federal Reserve (Fed) is already a few months ahead and this week it faces a crucial appointment.

A two-day meeting began yesterday in which it may decide on a half-point hike in interest rates, as part of an increasingly aggressive central bank strategy to fight runaway inflation.

The president of the Fed, Jerome Powell, already said at the end of April in a round table together with the president of the European Central Bank (ECB), Christine Lagarde, and the managing director of the International Monetary Fund (IMF), Kristalina Georgieva, that a hike of fifty basis points is something that was going to be "on the table".

The rise of 0.5 points would be double that adopted in March, which was 0.25 and marked the first time that the Fed raised interest rates since 2018. The official interest rate of the world's largest economy was It is currently in a range of between 0.25% and 0.5%, so a rise of half a point would leave it between 0.75% and 1.00%.

The main objective of the US central bank at the moment is to mitigate the very high rate of inflation, which last March stood at 8.5%, the highest recorded since 1981.

This context has also boosted the US

treasury

yield to above 3% for the first time since 2018.

assisted breathing

The impact of the war in Ukraine, inflation and the imminent increase in rates have accelerated a change in trend that affects all countries, but the consequences will be greater in those with the highest debt, especially as a result of the impact of the pandemic.

Ludovic Subran,

chief economist at Allianz, ruled out in an interview with this newspaper that Europe is facing a situation similar to that of 2012, when the bankruptcy and rescue of countries such as Portugal, Greece, Ireland or Spain almost ended the project of the common currency.

However, the expert also recognized that countries like Italy or Spain are a source of concern for the Eurozone.

In the Spanish case, since the start of the pandemic, the ECB has become the main buyer of national debt by purchasing bonds, both corporate and Treasury,

worth 267,824 million

.

With this premise, the withdrawal of stimuli announced by Christine Lagarde for next summer will mean the

withdrawal of assisted breathing

to which the Government has clung to to weather the coronavirus crisis;

From then on

, asking for money from the markets will be more expensive and more difficult.

But the problem is not only that the Executive is left without the lifeline that the purchase of bonds by the ECB entails, but that sooner rather than later the EU fiscal rules will come into force again and not enough homework has been done to comply with them.

The debt of Spanish public administrations represents 119% of GDP, according to February data from the Bank of Spain.

The European Commission estimates that the debt will remain at levels close to 120% over the next decade, and in its base scenario, the structural deficit will be between a minimum of 3.7% (2027) and a maximum of 4.0% until 2032. 6% (2023).

For its part, the

International Monetary Fund

(IMF) forecasts a public deficit of 5.3% for Spain in 2022 and predicts that it will remain stagnant at 3.9% per year until 2027.

Brussels must decide this month whether or not to extend the freeze of the Stability and Growth Pact for another year and the recovery of countries like Italy or Spain itself depends to a large extent on it.

Conforms to The Trust Project criteria

Know more