Podcast Is Spain at the gates of a new real estate bubble?

The rate hike will still take a few months, but the

Euribor

is already showing signs of things to come.

The index to which most variable mortgages in Spain are referenced has been climbing for several weeks -and has even entered positive territory one day- and its ride has begun to stir up the ghosts of the latest real estate bubble in our country.

No one wants history to repeat itself, so given the unpredictability of variable rates, homebuyers

are flocking to the fixed rate.

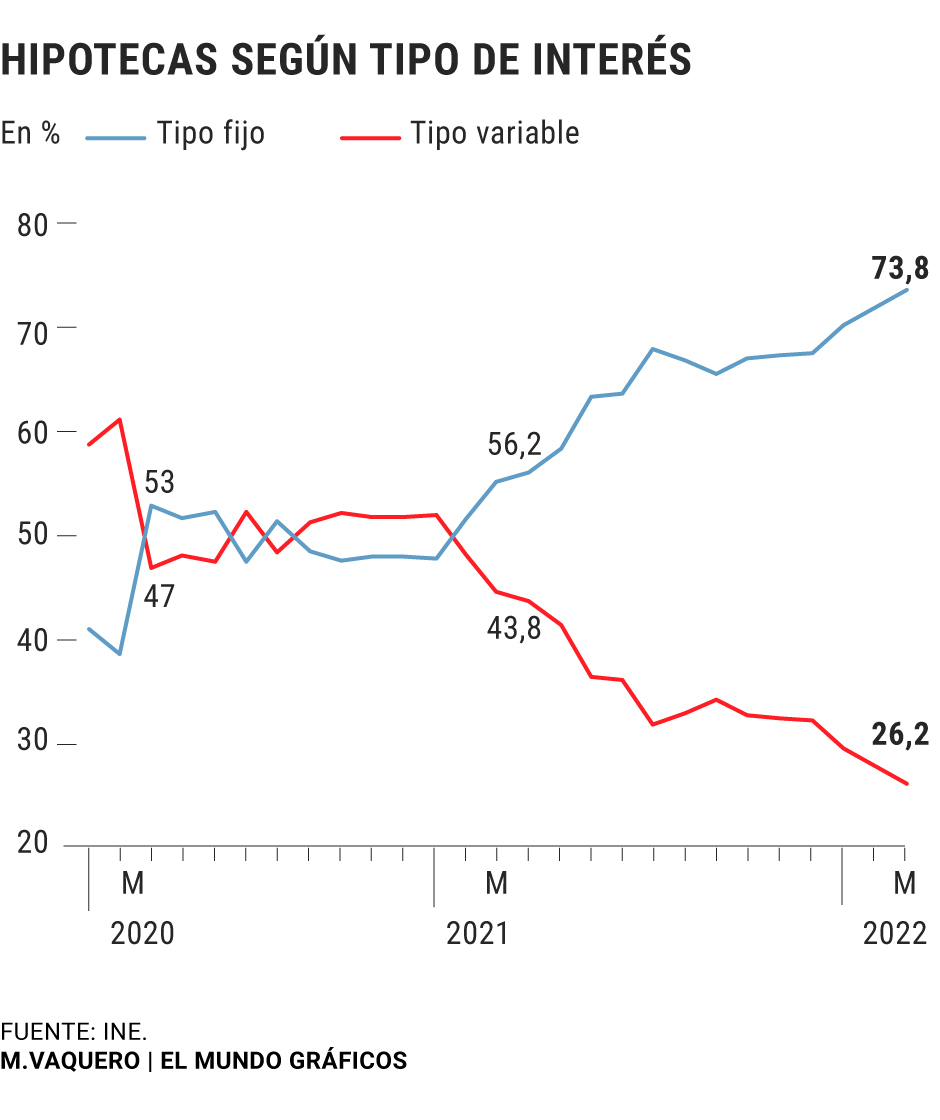

The numbers prove it.

Never before have so many fixed mortgages been signed in Spain:

26,964 in February

, 73.8% of the total (36,537), according to data published yesterday by the National Institute of Statistics (INE).

The figure marks a

record level

in the historical series and confirms that customers seek the certainty and security that they will pay the same installment throughout the life of their credit.

It is a trend that has been gaining momentum since the pandemic, although it has become especially evident in the last year.

Since January 2021, the market has taken a radical turn and in just 13 months,

fixed mortgages have eaten the ground of variable ones

: if these were previously the majority option of Spanish clients, now they barely account for a quarter of new home loans that are signed every month.

"The new record for the weight of fixed mortgages is a reflection of the priority that consumers give to protection against imminent increases in interest rates," says

Juan Villén

, head of mortgages at the

Idealista

real estate portal .

change of conditions

The change in the monetary policy of

the European Central Bank

(ECB) and the possible rise in rates before the end of 2022 suggest a tightening of the conditions for accessing credit by entities, as well as an increase in the cost of loans.

Given these forecasts, buyers want to ensure the most advantageous financing possible, which is why not only do they sign the new mortgages at a fixed rate, but many who had variable rates have decided

to change them.

Again, the INE data shows this.

In the month of February, up to 15,338 people with a mortgage requested changes in their conditions and of these,

27.6% requested changes in interest rates

, mainly from a variable rate to a fixed rate.

After the change, the average interest on fixed loans decreased 0.8 points while that on variable loans did not change.

"Given the probability of rate increases, if we have a variable-rate mortgage, our quota may fluctuate upwards in the coming months in a notable way. Fixed-rate mortgages have increased in price, but they are still attractive and in the face of a change in interest, we can stay comfortable with the same fee," says

Fernando López Jiménez

, COO of

Gibobs allbanks

, a

fintech

that helps its users understand and take care of their financial health.

Fixed or variable rate?

dropdown

As explained by the fintech Gibobs allbanks, to make the best financial decision when choosing between one type of mortgage or another, you have to turn to experts who have the necessary tools to face this dilemma.

"The answer varies depending on our needs and the risk we are willing to assume. My recommendation is not to sign a mortgage if the installment represents more than 40% of the income after subtracting other fixed expenses or if, putting ourselves in the worst scenario , with a 2.5% Euribor, our mortgage also exceeds 40% of our income", specifies

Fernando López Jiménez

, COO of the company.

"Another option that is open to us in this market situation is to assess the mixed-rate mortgage option. This product allows us to pay a reasonable fixed rate during the first years of the loan, so we can have a fixed fee and then expose ourselves to to the risk of a variable mortgage, but already with less capital and amortized interest than at the beginning of the loan", he adds.

The mortgage market has accumulated almost two years of great dynamism in the heat of the fever to buy a house that caused the pandemic.

As a result of this activity, Spanish entities have waged an

intense mortgage battle

that has significantly lowered prices and has established very attractive conditions for potential buyers.

However, this situation could have its days numbered.

Experts warn that these conditions will be less favorable as the year progresses and assure that in many cases they have already begun to change.

"Prices are still at low levels, as they do not reflect the increases in conditions that banks have been applying since March and that we will surely begin to see clearly - especially in fixed mortgages - in the April statistics," adds Juan Villén .

This is corroborated by

Fernando López Jiménez

, COO of

Gibobs allbanks

, a fintech that helps its users understand and take care of their financial health.

"Our current data shows us a clear rise in fixed rates and a slight drop in mortgages offered at a variable rate. In April, we have seen a rise of 25 basis points in fixed mortgages compared to those we processed in January and this is translates into a mortgage of €200,000 over 30 years, we would pay €8,552.69 more in interest over the life of the loan", he points out.

María Matos

, Director of Studies and spokesperson for

Fotocasa

, has an impact on this line

.

"The mortgage conditions have changed in 2022," she assures, while she warns that they have already detected "small increases and changes in the strategy of some of the most important entities in Spain."

Conforms to The Trust Project criteria

Know more

living place

mortgages

Articles Maria Hernandez