The Bank of Russia presented the concept of the digital ruble, which was developed taking into account the feedback from respondents and market participants following the discussion of the report on this project.

The document talks about the advantages of the project, the target model and the key stages of the implementation of the digital ruble platform.

"The introduction of the digital ruble will help reduce costs for citizens and businesses, increase the speed of payments and the emergence of innovative products and services in the financial sector and in the economy as a whole," the Central Bank said in a statement.

As the first deputy chairman of the Central Bank Olga Skorobogatova noted during a press conference, the new form of money requires a sensible approach, as well as confidence that all possible instruments for security, liquidity management and a "seamless transition" from cashless to digital and vice versa are used.

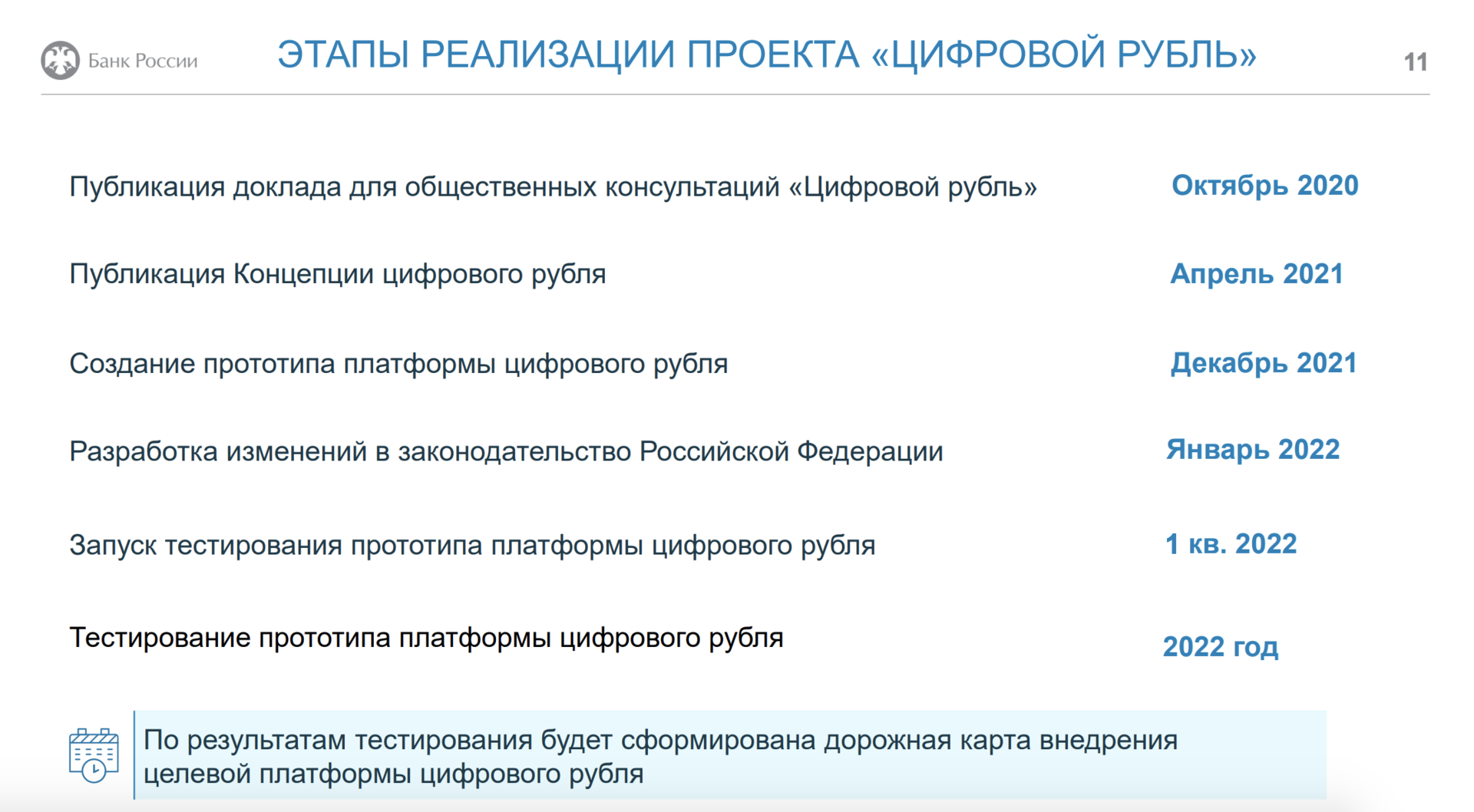

“Based on all these points, we believe that we need to create a prototype of the digital ruble platform by the end of the year, and next year, in test mode, together with market participants, try and test this prototype from all points of view,” she said.

According to her, the Bank of Russia will act in stages as part of the launch of the digital ruble prototype.

“For this entire testing stage, we expect to spend the entire year 2022.

And only based on the results of testing, we will understand which roadmap for the implementation of the target platform will be implemented and in what time frame, ”added the Deputy Chairman of the Central Bank.

© Central Bank of the Russian Federation

She emphasized that the digital ruble project and its launch is a "megaproject of the country."

“I believe that only through joint efforts and very good coordinated actions, we can build with you a new innovative payment structure that will complement the existing ones and strengthen our sovereignty,” Skorobogatova explained.

Answering questions from journalists, the deputy chairman of the Central Bank said that preliminary transfers between individuals will be free.

“From the point of view of commissions, we plan to define the rules for the operation of the digital ruble and commissions later - at the next stage, after the concept,” she said.

Also, the regulator does not plan to set limits on balances on digital wallets of citizens and businesses: "The entire amount that will be on the digital wallet, absolutely all, it will be available in full for a person, for business."

© Central Bank of the Russian Federation

Recall that in October 2020, the Bank of Russia announced the development of the digital ruble, submitting a report for public consultation.

“We do not set ourselves the task of crowding out some kind of money.

This will be the third form, in fact, money along with cash and non-cash, which now exist.

Both citizens and businesses will choose for what cases what type of ruble it is more convenient to use, "said the head of the Central Bank Elvira Nabiullina, noting that the spread of the new currency" will be smooth. "

In November, the first deputy chairman of the Central Bank Sergei Shvetsov called the main mission of the project - "to make settlements and payments faster, easier, cheaper and more reliable."

In March, Nabiullina announced that an important feature of the digital ruble would be its guarantee by the Bank of Russia.

She also pointed out that it is the ability to preserve the digital ruble, in particular, in the event of loss of the carrier, that can become a key advantage of the new form of money.

“There is an opportunity to create such a system, since each digital ruble will have its own unique number, which will allow it to be restored if the gadget is lost.

But it is important to see how to avoid fraudulent schemes in this case.

We are working on this now, "she said in an interview with the Izvestia newspaper.

In turn, the chairman of the State Duma Committee on the Financial Market, Anatoly Aksakov, in an exclusive interview with RT, called the digital ruble the highest form of money at this stage.

“Probably, at the end of 2021 or at the beginning of 2022, testing of this form of money may begin, and in two or three years the electronic currency will be tightly included in our calculations.

It is worth noting that, unlike cryptocurrencies, the risks for holders of digital rubles are minimal, since the issuer in the person of the Central Bank is known, there is financial support.

In fact, this is the same ruble, but in digital form, ”the parliamentarian said.