The differences between Donald Trump and Emmanuel Macron were staged at the last NATO summit: laughter between leaders at the expense of the president of the United States, crossed pullas in the statements before the media and a precipitous departure of the American that evidences a shock that already affects All Europe. This Friday, a new fine fell on Google in France; But, apart from specific penalties, it is taxes that determine this tug of war between governments around the world.

Trump protects, after all, the interests of large technology companies on the West Coast, accused of taking a tax below what is required. According to the report that Fair Tax Mark has published this month, there is a gap of more than 90.1 billion euros between the taxes paid by the Big Tech in this decade and those that they should have faced. From worse to better "fiscal behavior", They are listed on the Amazon, Facebook, Google, Netflix, Apple and Microsoft . These companies should have disbursed, between 2010 and 2019, 252.1 billion euros, but they have limited themselves to taxing 162,000 million. "Companies like Amazon and Facebook seem to have tax evasion programmed both in their organizational structure and in their management ethics ," Paul Monaghan, Chief Executive of Fair Tax Mark tells EL MUNDO.

The report also draws attention to the "overwhelming differences" observed between Big Tech itself . For example, corporate tax remains at 3,000 million euros for Amazon, well below the 84,400 million euros paid in the decade by Apple.

The study shows how " the benefits continue to move to tax havens, especially Bermuda, Ireland, Luxembourg and the Netherlands ", the country where Netflix has its European headquarters, the largest streaming service. “Like Amazon, Netflix operates on a very narrow profit margin of 5% over the decade, and has a debt that grows very rapidly. Therefore, its diversion of benefits is more difficult to distinguish, but the way in which European income is computed in the Netherlands serves as an alarm signal, ”says Monaghan.

Macron vs. Trump

Given this situation, there are several nations that have sponsored a tax that saves the misalignment between business activities carried out through the Internet and the taxes paid for that business. Not by chance, this global trend is manifesting this year, in full economic slowdown and when the needs of public coffers emerge . France has established a Google fee and the PSOE has already repeatedly expressed its willingness to follow that same path in Spain. The failed General Budget Project prepared by the Socialists for 2019 included a Tax on Certain Digital Services (IDSD) that serious “online advertising services, online intermediation services and the sale of data”.

The gala rate, approved in July, consists of a charge for companies that invoice more than 750 million euros annually in the world, and at least 25 million of these in France; all this with the goal of raising around 650 million in the next year. A similar digital tax has already been raised in countries such as the United Kingdom, Italy, Hungary, Australia, India, Uruguay and Chile.

In Spain, the Foundation for Applied Economics Studies (Fedea) published a study last week on the challenges of corporate taxation in the era of the digital economy, and highlighted in its conclusions that “ unilateral initiatives, such as taxes on digital services, have disadvantages due to their foreseeable efficiency costs on economic activity that, in turn, may limit, in a second round, tax collection ». Fedea does admit that “these are understandable measures from the perspective of the States involved”, but different digital associations insist that a Google rate would have an impact on the digital ecosystem, including start-ups , and finally on the user, as Amazon already warned in France. This company, consulted by this newspaper, underlines the "risk of double taxation" and the "unilateral distorting measures".

"A digital rate is negative because it is required only to a part of the economy, the digital economy, against the traditional fiscal criterion that taxes must be provided, efficient, neutral and enforceable to the entire business network," says Amalia Pelegrín , Director of Digital Policy and Talent of the Multisectoral Association of Information Technology, Communications and Electronics (Ametic) Companies, Spanish employer of the sector.

The fruits of tax haven

The widespread use of tax havens invites us to think that the application of a digital tax in one country would in practice push to divert even more benefits to other nations. Therefore, the European Union (EU) has tried to agree on a community tax, without achieving the necessary consensus, with which countries such as France make their own decisions as long as a global decision is not agreed within the Organization for Cooperation and Economic Development (OECD).

The objective is to configure a tax that takes into account the territory in which digital consumers are located, without being subject to where the company is physically located, often in low-tax nations. Countries such as Denmark, Sweden, Finland and, of course, Ireland, known for their favorable tax treatment, have attracted that purpose in the EU , which has attracted Google, Apple and Facebook , among other companies. Jorge Onrubia, co-author of the Fedea report and a member of the Complutense Institute for International Studies, is convinced that "the big techs put obstacles because, the more any multilateral tax is enacted, the better for those companies," he says to this newspaper.

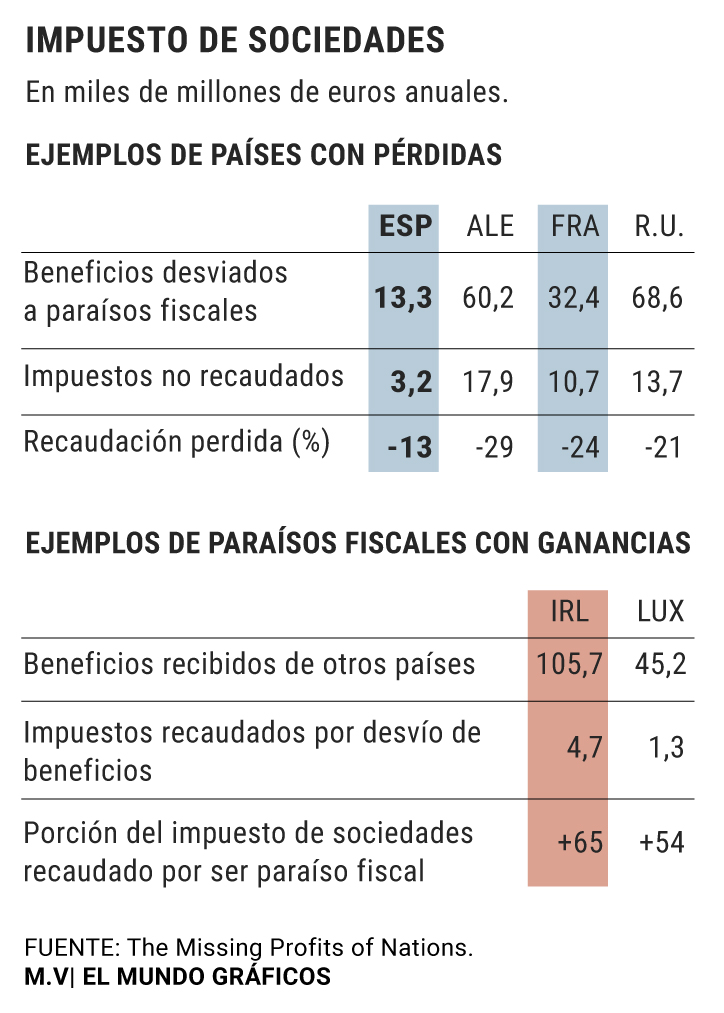

As the document states The hidden wealth of nations , the less taxes a country charges, the more revenue it will generate. This is the case in Ireland, which according to this study would take 105.7 billion euros extraordinary a year as a corporate tax, according to the data for 2016. «Our research suggests that US companies are the most aggressive when it comes to avoiding payment of taxes, ”one of the authors, Ludvig Wier, a researcher at the University of Berkeley (USA), tells this newspaper.

Spain takes 13% less partnerships

Spain suffers this diversion to tax havens, around 13.3 billion euros in benefits that in 2016 were transmitted to other nations with a lax taxation. This transfer between nations would have subtracted 3,200 million euros from the Spanish public coffers, 13% of the corporate tax that could have been injected if there were no tax havens . Wier's study together with Thomas Tørsløv and Gabriel Zucman estimates that, during 2016, 584,000 million euros were diverted globally to tax havens.

Public sectors have reacted to this decompensation, and the so-called Google rate is one of the ways to tackle such a huge mismatch. «Current digital taxes are part of the frustration with the international tax system. Many countries would prefer to fix it through a change in corporate tax, so that companies pay taxes according to their benefits. However, internationally the corporate tax is broken , since companies can derive their income to tax havens, ”Wier continues.

The internationality of a company opens spaces for tax avoidance, a fact that is observed even among Spanish multinationals. According to the Ministry of Finance, national companies of this type assume an effective rate of 12.6% worldwide, despite the fact that corporate tax reaches 25% in Spain and amounts to 30% in the case of banks and oil companies

Engineering is perfected in the case of technological giants. According to The Fair Tax Mark, Amazon would have faced a corporate tax of only 12.7% in recent years.

The US also wants to raise

Trump does not have too many sympathies for Jeff Bezos, founder of Amazon, but still has plenty of reasons to hinder any change in current international taxation: the president of the United States looks after the interests of the American Big Tech , but above all he aspires to impersonate them in their home country; In order to achieve this, it has minimized corporate taxation for these multinationals. «Trump has allowed with his 2017 reform a minimum taxation [of 10.5% in some cases] for his multinational groups with head in the US. Since the capital comes from its territory, it has tried to at least be repatriated and taxed in its country, instead of the benefits freezing in countries like Ireland, ”says Jorge Onrubia.

The OECD has already warned that, from 2014 to 2015, Ireland's Gross Domestic Product (GDP) rose 26.3%: «Attracted largely by low corporate taxes, large multinational corporations have moved their activities to Ireland economic, and more specifically their intellectual property rights ». In the hand of the OECD would be remedied, but more than one country is not willing to wait.

Taxes

Google, Apple, Facebook, Amazon and Netflix: 22 million in Spain

Online colossi do not pay taxes in Spain as they could. Apple, which calls itself "the largest taxpayer in the world," paid tribute last year with 10.1 million in this country; Google, with 6.8 million; Amazon, with 4.4 million; Facebook, with 0.8 million; and Netflix, with 0.3 million in 2018, although in the case of the latter the entire year was not computed. It is, neither more nor less, the world's leading internet searches, e-commerce, social networks and streaming . That half dozen multinationals jointly assumed in Spain a tax for their profits of only 22 million. The groups highlight that they contribute «to the Spanish economy in many ways», respond to this newspaper from Netflix, tenant of a production hub in Tres Cantos (Madrid). Amazon announced this week that it has already invested 2.9 billion in Spain, and that it has 7,000 permanent employees.

According to the criteria of The Trust Project

Know more- Ireland

- Spain

- France

- Netflix

- Holland

- Jeff Bezos

- GDP

- PSOE

- United Kingdom

- Sweden

- European Union

- Uruguay

- Australia

- Chile

- Denmark

- Donald Trump

- Emmanuel Macron

- Europe

- Finland

- Hungary

- India

- Italy

- Microsoft

- NATO

EmpresasFacebook buys its first Spanish company: 70 million for PlayGiga, a video game streaming

ScoopFore charge in the foie gras farm

Commercial war Trump hits France for the 'Google rate' and studies more tariffs against Spain