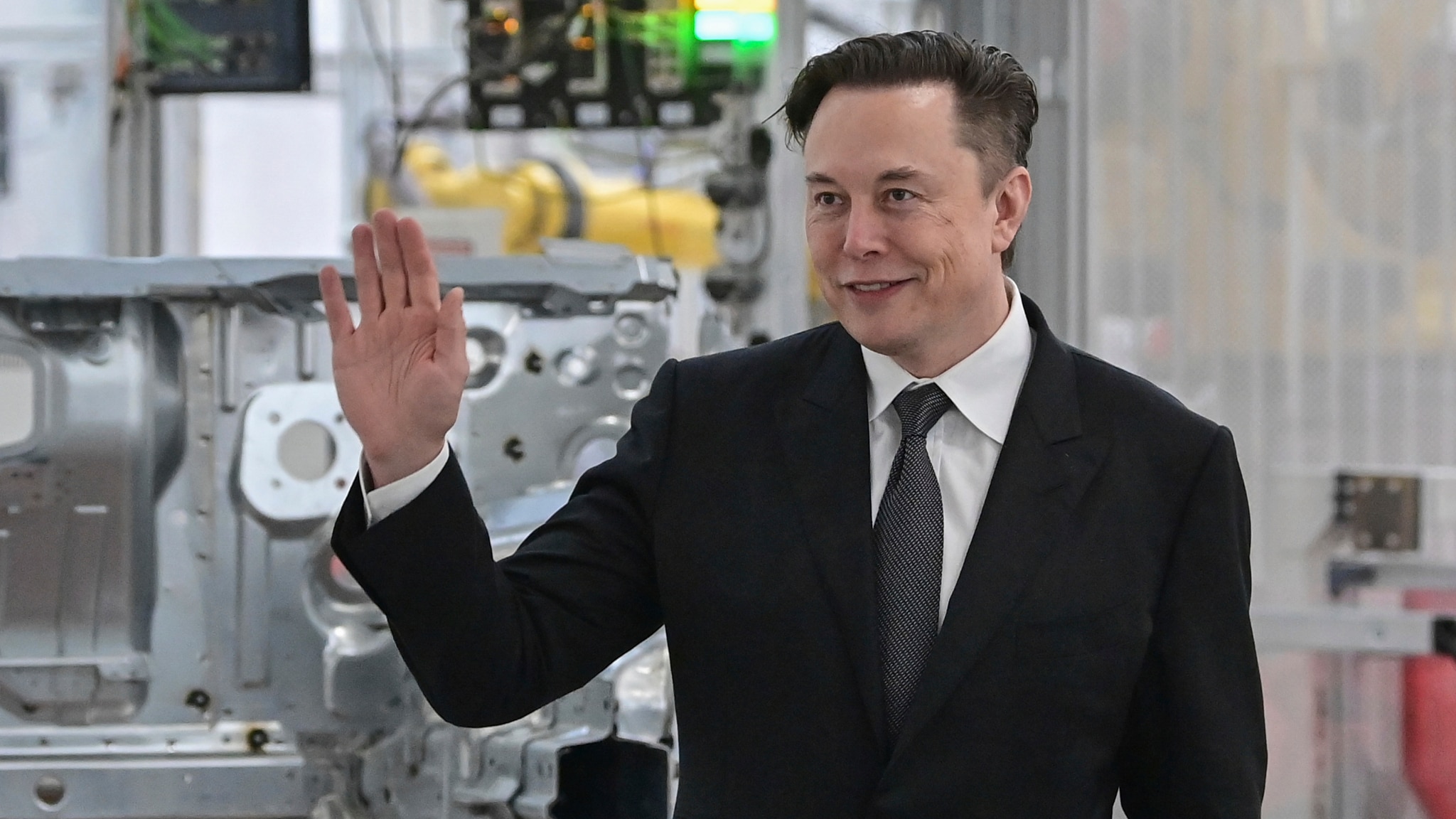

The American billionaire Elon Musk - with an estimated net worth of $ 264 billion in 2022 - evaluates the launch of a takeover bid - a takeover bid - for Twitter shares.

The patron of Tesla and the SpaceX aerospace company has secured "commitments" for $ 46.5 billion from various banks, ie the funds to finance the operation at a price of $ 54.20 per share.

This is what emerges from the communications to the Sec (the control commission for securities and exchanges of the American market).

Days ago the company defended itself from Musk's attempt to take over, with a "poison pill": in financial jargon, preferred shares that allow shareholders to activate "barriers" when an interested party intends to take control,

accumulating shares on the free market.

Today the counter-move of the Tesla patron.

Musk, however, specified "that he has not yet decided on the matter".

In the same communication, made to the American Consob, Musk affirms that he has secured the necessary funds to buy Twitter "

having obtained commitments from various banks to finance the operation"

.

As soon as the offer was submitted for Twitter, many observers had raised doubts about the possibility that Musk had the necessary resources to carry out the transaction: despite being the richest man in the world, the billionaire has most of his wealth tied to Tesla. .

But according to the rules decided by the board of directors of the electric car giant, he "can use Tesla securities only partially as collateral to obtain financing".

In short, bound by decision of the Board only for financial activities related to Tesla itself (and Twitter is not).

In recent days, however, Elon Musk has set to work to obtain the loans, and has achieved his goal: the banks have assured him of commitments for 46.5 billion, a figure even higher than that put on the plate for Twitter.

Who guarantees him the huge funds:

Musk announced that he obtained a $ 25.5 billion loan - including a $ 12.5 billion loan with a pledge on his Tesla stock -

from a banking syndicate

led by his financial adviser, Morgan Stanley.

In addition, the entrepreneur will personally provide securities for $ 21 billion, according to the documents filed with the Sec.