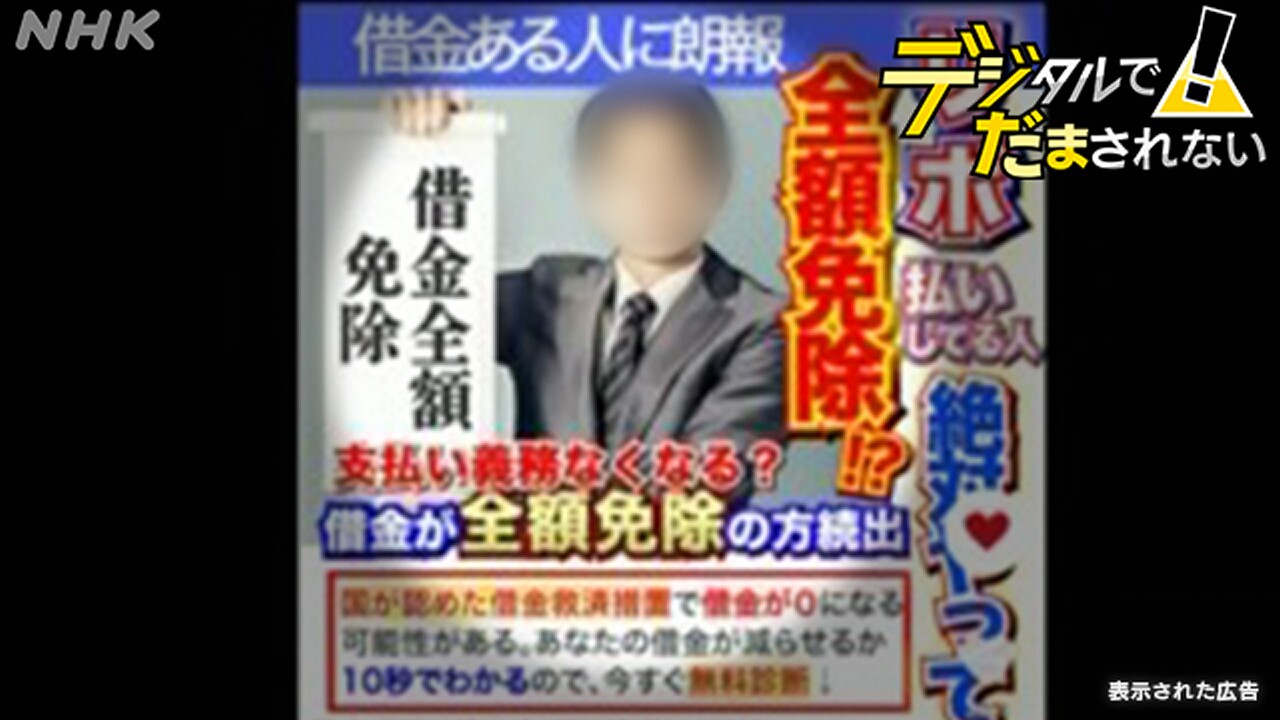

“All debts waived! ? ” ``Debt Relief System Recognized by the Government''

Many people have seen advertisements that give the impression that anyone can reduce their debt, although they are not sure what system they are referring to. I think so.

“Debt consolidation” is a way to rebuild the lives of people with multiple debts. Just when you thought everything would be okay now that lawyers and judicial scriveners arrived, people are saying that their lives have become more difficult.

(Research team that won't be fooled by digital / Chiharu Kinukawa, Ministry of Science and Culture)

If you're interested in a video ad and tap on it...

A woman in her 40s contacted a law firm after seeing an online advertisement that promised to "reduce debt."

The woman had borrowed 650,000 yen from a consumer loan for her living expenses and was struggling to pay it back.

In March 2023, she was watching a video streaming site on her smartphone when she heard the words, ``My debt has decreased!'' ” A video ad appeared that talked about the experience, and he was intrigued and tapped it.

Then, I was directed to a website where I could get a free diagnosis to see if I could reduce my debt. After entering my debt amount and contact information, I was contacted by a law firm in Tokyo.

As a result of communicating with the clerk at the law firm via LINE and email, I was told to transfer the reserve funds every month.

The amount was about 1,000 yen cheaper than his previous monthly repayments, so he decided to request it and ended up paying about 130,000 yen in eight months. However, in December, it was said that a settlement was reached with Consumer Finance, and the repayment amount, including late interest, was 760,000 yen.

When I was concerned that my debt had not been reduced, I consulted the local government's consumer affairs center, and was told that I should have proceeded with bankruptcy proceedings.

I canceled my contract with a law firm through a judicial scrivener at a support organization, but the money I paid, which I was told was a reserve fund, was not returned to me because it was a deposit.

Female in her 40s

: ``I believed the video ad that sounded like people were happy about having reduced their debt, and I only received a very simple explanation about the payment, but I thought that's what the lawyer said.'' I really wanted to reduce my debt as quickly as possible..."

“Some online advertisements are fraudulent”

Shinkawa Shinkawa, a judicial scrivener and deputy executive director of the National Cresara/Living Credit Problem Victims Liaison Council, a civic group that provides support to people with multiple debts, was consulted by a woman about her household finances. It is said that if they had understood the matter properly, it would have been inappropriate to proceed with the voluntary liquidation.

Judicial scrivener Shinichi Shinkawa

said, ``This firm is thought to have created a business model in which they are forced to settle and pay fees, even though they should know that their debts will not be reduced even if they undergo long-term voluntary liquidation.'' Some of the online advertisements that are used as a tool for offices to attract large numbers of customers are fraudulent, and the entire industry must take action against them.

Launching an organization with “measures against internet advertising”

In response to these voices, a group has been formed to take countermeasures.

The organization is called the ``National Council for Countermeasures for Secondary Damages Due to Debt Consolidation by Mass Advertising Agencies,'' and is scheduled to be formed in March by lawyers, judicial scriveners, and supporters of multiple debtors.

On February 17th, approximately 20 people, including lawyers, judicial scriveners, and supporters of multiple debtors, gathered at a preparatory meeting held online.

A man in his 30s who requested debt consolidation from two law firms based on online advertisements also participated. They talked about their own painful experiences.

Male in his 30s

: ``The cost of each case I hire from a law firm is high, so in the end I have to pay more, and in order to pay the expenses, I end up borrowing money again from a loan shark. , life became difficult.”

What is the method of “debt consolidation” in the first place?

There are several methods of ``debt consolidation'', such as ``

voluntary consolidation'' in which you negotiate with your creditors and pay the removable amount every month, and

``bankruptcy proceedings'' in court to have your debts waived.

Lawyers and judicial scriveners are required to provide support tailored to the debtor's actual living situation.

However, in a survey conducted in 2022 among support groups for people with multiple debts across the country, it was found that when law firms that were directed to them through online advertisements were contacted, they were found to be in situations where they should have filed for bankruptcy proceedings. Recently, 37 people have reported that they were led to ``voluntary reorganization'' regardless of the situation, and that the burden increased.

Of the consultations, there were 18 cases in which the debt did not reduce for the debtor, and 14 cases in which the debtor incurred new debt due to payments to the agency.

Additionally, 30 of the 37 people had their procedures completed online rather than meeting a lawyer or judicial scrivener in person.

A support group to be launched next month will hold free telephone consultation sessions to provide support to people with multiple debts, and will also try to understand the true nature of the damage caused.

Lawyer Osamu Mikami, who held the preparatory meeting, said, ``

I would like to receive counseling from people who requested a lawyer based on an online advertisement, did not receive a proper interview or explanation, and were unable to resolve the situation in the end, or whose situation worsened.'' There are a lot of things that can cause misunderstandings, such as ``a debt relief system recognized by the government'', so I would like to question the nature of online advertising as well.''

Punishment over exaggerated advertising

There have been cases where exaggerated advertising by lawyers has been judged to be disciplinary action.

The Chiba Prefecture Bar Association, in an effort to provide relief for victims of investment fraud and romance fraud, is running online advertisements with the logos of the Consumer Affairs Agency and the Financial Services Agency, saying things like ``If you leave everything to us, we will solve the problem.'' The lawyer, who is in his 70s, was subject to disciplinary action in June 2023 on the grounds that the content of the advertisement may have been ``exaggerated advertisements or advertisements that arouse excessive expectations,'' which is prohibited under the Japan Federation of Bar Associations' regulations. We believe that it is worthy of action, and we are reviewing the details of the punishment.

In addition, according to the Japan Advertising Review Organization (JARO), which collects opinions from consumers about advertising, it has received approximately 200 complaints every year over the three years until 2023 regarding advertisements for consulting services such as law firms. Some of the complaints are related to the content, such as ``the expressions that make it seem like you will get your money back are confusing.''

Where should I consult?

For those who have been in debt, there are legal consultation sites where you can receive free legal advice, as well as free consultation sessions held by local bar associations.

However, it is said that fewer people are coming to these consultation meetings these days.

In interviews, several lawyers expressed concern that ``the number of people who request debt consolidation through online advertisements is increasing and becoming more and more difficult.''

You can consult about multiple debts at the bar association or judicial scrivener's association in each prefecture, the consumer affairs center of your local government, or the Japan Federation of Bar Associations' Himawari Hot Dial.

Japan Federation of Bar Associations Himawari Hot Dial

0570-001-240 (Weekdays 10:00 a.m. to 12:00 p.m., 1:00 p.m. to 4:00 p.m.)

Support organizations recommend that you first consult with these points of contact.

[Looking for experiences etc.] Click here for the submission form

NHK News Post

#Don't be fooled digitally