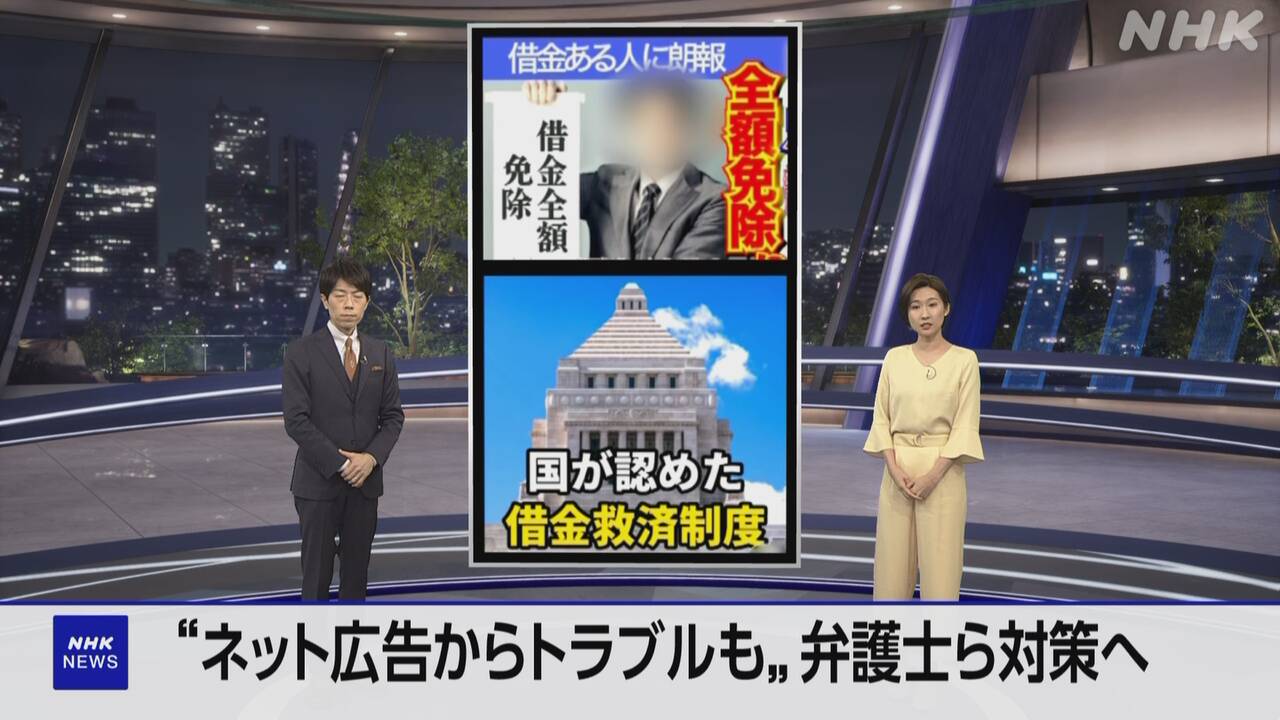

Lawyers are offering countermeasures and support, saying that there are a number of cases in which people with multiple debts are being led to inappropriate debt consolidation and suffering financial damage due to exaggerated online advertisements that promise that their debts will definitely go down. It was decided to set up an organization to carry out the project, and a preparatory meeting was held on the 17th.

Approximately 20 people, including lawyers and supporters who are familiar with the issue of multiple debts, participated in the launch preparation meeting for the ``National Conference on Countermeasures for Secondary Damage due to Debt Consolidation Due to Massive Advertising Agencies,'' which was held online.

At the meeting, a man in his 30s who had requested debt consolidation from two law firms based on online advertisements said, ``In the end, the debt did not decrease, and as a result, they asked for more than 500,000 yen in expenses, which was more than the amount of the debt.'' "My life became difficult, and I ended up taking on new debts from loan sharks," he said of his own experience.

When conducting debt consolidation,

there are methods such as ``

voluntary consolidation'' in which you negotiate with your creditors and pay the payable amount every month, and `

` bankruptcy procedures'' in court to have your debts waived.

Debtors and judicial scriveners are required to provide support tailored to the actual living conditions of debtors.

However, according to the preparatory committee, a survey conducted last year among support groups for people with multiple debts found that when they contacted law firms that had been directed to them through online advertisements, they found that they were not in situations where they should have filed for bankruptcy proceedings. Recently, 37 people have reported that they were led to ``voluntary reorganization'' regardless of the situation, and that the burden increased.

According to the breakdown of the consultations, there were

18 cases in which the debt did not reduce for the debtor

, and 14 cases in which the debtor incurred new debt due to payments to the agency.

Additionally, 30 of the 37 people had their procedures completed online rather than meeting a lawyer or judicial scrivener in person.

Osamu Mikami, a lawyer who serves as chairman of the multiple debt subcommittee of the Japan Federation of Bar Associations' consumer issues committee, which held the preparatory meeting, said, ``Many people hired lawyers based on online advertisements, did not receive proper interviews or explanations, and in the end did not find a solution. I would like to receive advice from people who have not had the opportunity to do so.There are many things that cause misunderstandings, such as ``a debt relief system approved by the government,'' so I would like to question the nature of online advertising.''

This organization was launched in March and plans to hold free telephone consultations.

Victim: “Even though it felt strange, I thought it was something like that.”

We spoke to a woman in her 40s who was lured by an Internet advertisement that offered a way to ``reduce her debts.'' She paid a large fee to a lawyer who hired her, and she complained that her debts did not decrease but instead increased.

The woman had borrowed 650,000 yen from a consumer loan for living expenses, but in March last year, an advertisement she saw on an Internet video distribution site led her to a website that offered a free diagnostic test to see if her debt could be reduced. After entering my contact information, I received a call from a law firm in Tokyo.

She was told to transfer the savings every month, and paid about 130,000 yen in eight months.

After that, as a result of a settlement with her consumer finance company, her debt did not decrease, and I canceled the contract with her law firm, but the money I had paid, which was said to be a reserve fund, was not reduced. That is why it was not returned.

She said she signed a contract with the law firm only through online communication and without meeting in person.

The woman said, ``I believed the video advertisement that seemed to be about people's experiences of reducing debt, and even though it felt strange, I assumed that's what the lawyer said.There are no more deceiving lawyers and advertisements anymore. I want you to do that.''

She is a woman who has decided to proceed with her bankruptcy filing by consulting with another judicial scrivener's office.

Shinkawa Shinkawa, a judicial scrivener and deputy executive director of the National Cresara/Living Debt Problem Victims Liaison Council, a civic group that provides support to people with multiple debts, said, ``The office that the woman requested was a long-term company. It is thought that they have created a business model that forces them to settle even though they should know that their debt will not be reduced even if they voluntarily liquidate the debt.Some of the online advertisements that are used as a tool to attract large numbers of customers are fraudulent. There is something wrong with this, and we have to come together as an industry to take measures."

Lawyers' exaggerated advertising and cases of disciplinary action

There have been cases where exaggerated advertising by lawyers has been determined to constitute disciplinary action.

The Chiba Prefectural Bar Association

has been running online advertisements with the logos of the Consumer Affairs Agency and the Financial Services Agency to

help victims of investment fraud and romance fraud.

In June of last year, the Japan Federation of Bar Associations determined that disciplinary action was taken against a lawyer in his 70s on the grounds that the advertisement may constitute "exaggerated advertising or advertisements that arouse excessive expectations," which is prohibited under the Japan Federation

of Bar Associations' regulations. , we are reviewing the details of the disposition.

According to the Japan Advertising Review Organization (JARO), which collects opinions from consumers about advertising, it has received approximately 200 complaints each year over the three years up to last year regarding advertisements for consulting services such as law firms. Some of the complaints are related to the content, such as ``the expressions that make it seem like money will be returned are confusing.''