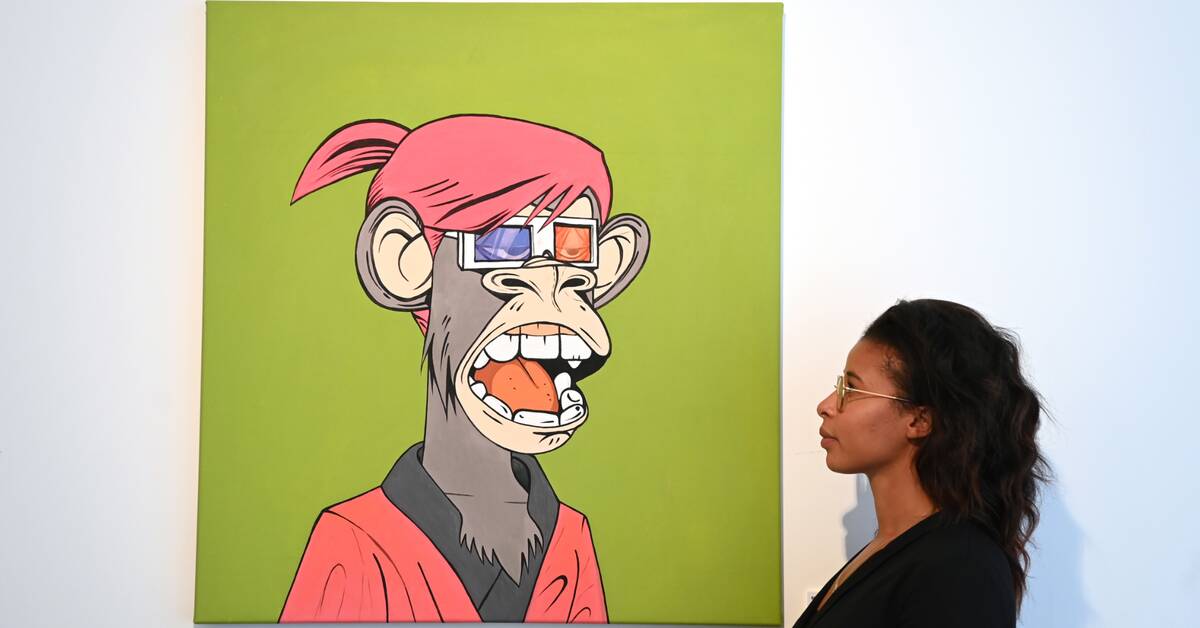

NFTs, Non Fungible Tokens, are for some one of the most mysterious phenomena of our time and for others a billion dollar industry in the crypto market.

Now, however, NFT investors do not seem to be as happy to buy as the number of works sold has gone from 225,000 per day to 19,000 per day since September last year.

A total decrease of 92 percent, according to Wall Street Journal quoted data from NonFungible.

The number of active digital cryptocurrencies in the NFT market must also have decreased by 88 percent since November.

Raised interest rates reduce risk-taking

According to the Wall Street Jorunal, the reason for the market's downward curve may be due to higher interest rates, which has led to fewer people choosing to make speculative investments with high risk.

Sina Estavi, who bought an NFT of the first tweet for $ 2.9 million in March 2021, for example, did not receive a bid of more than $ 14,000 when he wanted to resell it a year later.

The reduced sales can also be a natural transition from the market's hot trend status to a more normal situation, writes the Wall Street Journal.