As a result of the Covid-19 virus pandemic, the world witnessed an economic shock in light of the shortage of supplies and the succession of closings that began in February 2020. With the development of vaccines against this virus, the launch of vaccination campaigns, and the return of countries to open their borders;

The global economy has begun to recover, especially after the supply and production chain crisis that afflicted Asian countries.

In the past, Turkey used to follow the policy of low exchange rate and high interest rates also approved by IMF programs;

But the large deficit in the trade balance as a result of these policies has been a permanent problem for our country's economy for years.

The global demand crisis - which was manifested by the rise in freight and fuel prices following a sudden increase in demand - exposed the weaknesses of supply chains in almost all countries, especially advanced economies.

Baladna is considered a strategic base in the global supply chain, given its geographical location, close to the markets in Europe, the Middle East and North Africa, and the competitive prices it offers.

Currently, many Western companies are rethinking their production units in China and the Far East and the supply options from these countries, which gives Turkey the opportunity to become a global center in the global supply chain.

In order for Turkey to make the most of the emerging opportunities on a global scale, it is necessary to make some adjustments to the basic policies implemented in our country.

In the past, Turkey used to follow the policy of low exchange rate and high interest rates also approved by IMF programs;

But the large deficit in the trade balance as a result of these policies has been a permanent problem for our country's economy for years.

Turkey's trade deficit was particularly recorded during the periods when the low exchange rate policy and high interest rates were applied.

The chronic deficit in the trade balance and the depletion of the country's foreign currency reserves have increased the demand for foreign exchange;

Which put pressure on the Turkish lira and affected its value.

Added to this is the continued dependence of our country's economy on external debt.

In addition to the problems arising from the trade balance deficit, the method of filling this deficit represents a problem no less dangerous for our country's economy, because this is mostly through the so-called "hot money" - capital that circulates for a short period and responds very quickly to changes in the interest rate - Which further weakens the economy.

The new economic model being implemented is based on supporting investments, creating an environment conducive to employment growth and sustainability, imposing low interest rates and balancing the demand for foreign exchange by reducing imports and increasing exports, benefiting from a competitive exchange rate and increasing investments.

In this way, it is possible to achieve a surplus in the trade balance and reduce dependence on external debt.

Upon success in reducing the trade balance deficit and reducing the country's dependence on external debt, the economy will become less fragile and an economic structure capable of resisting external shocks will be formed by attracting foreign direct investment to our country instead of hot money.

During the early stages of implementing these economic policies, negative effects appeared, represented in the excessive fluctuations in exchange rates and the depreciation of the Turkish lira on December 20.

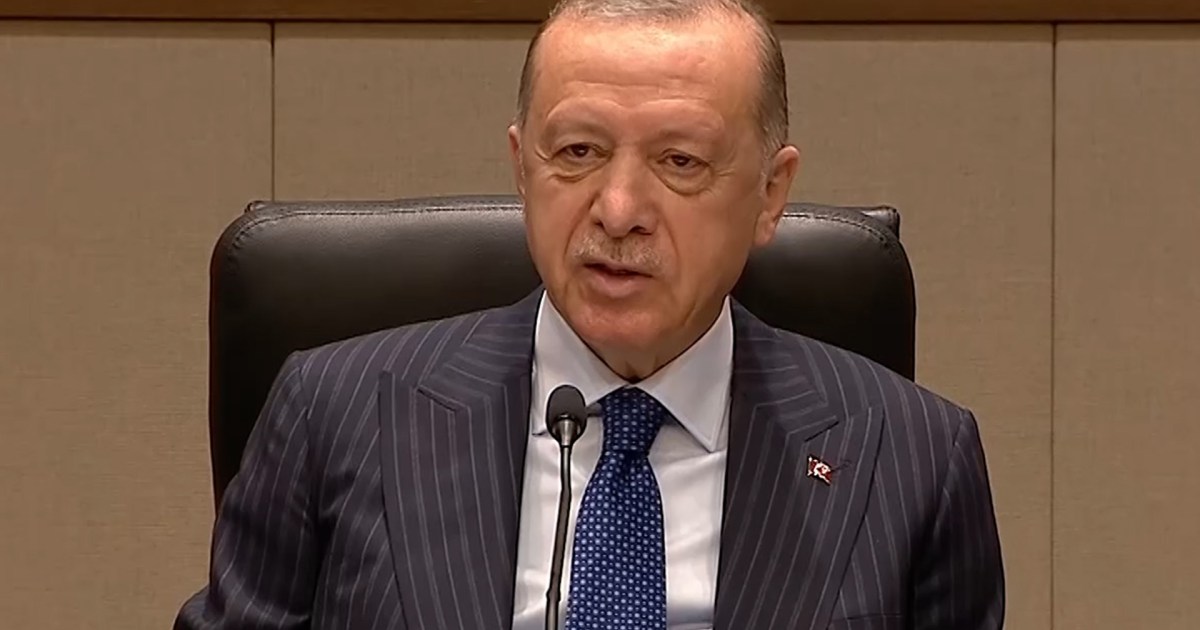

The country has weathered these disturbances thanks to the implementation of the set of measures announced by our President (Recep Tayyip Erdogan).

We believe that the effectiveness of this new economic plan will be wide-ranging and its positive results will appear in a short time.