In 2021, the property market sales will exceed 17 trillion yuan

Our reporter Wang Lixin

In 2021, the real estate industry will not be easy.

After a year of fierce battle, the "ambition" of completing the annual scale KPI is no longer, and "surviving" is the new goal.

This year, new policies such as the inventory of operating loans, centralized land supply, mortgage queuing, and RRR cuts followed one after another. More than 600 regulatory policies were launched across the country; debt defaults, reduced profits, difficulties in collecting payments, balance sheets, profit statements, and cash There are three tables in the flow table, Zhang and Zhang can keep the real estate company at the helm of the night; difficult financing, cold sales, weak land acquisition, layoffs and salary reduction, and shrinking market value, forcing developers to make a fuss on refined management ...

Although it has gone through the bumpy road of "hard to find a house in the first quarter, concentrated land grabs in the second quarter, a sudden cold in sales in the third quarter, and a thaw in financing in the fourth quarter", it is foreseeable that the sales area of commercial housing across the country is expected to exceed 17 in 2021. 100 million square meters, the sales amount will once again exceed 17 trillion yuan.

Looking back on the past year, hidden in cyclical fluctuations, various irregular business models have gradually been "broken", and industry risks are clearly "established". It seems that the night is cold and long. However, there is still room for urbanization in China, and the industry still has room for urbanization. Opportunities, after the real estate developers are in pain, the future where the scale and ROE (return on equity) are positively correlated has arrived.

The virtual fire in the property market fades and the toughness is not lost

The main theme of property market regulation and control of "housing and living is not speculation" and "policy by city" has not changed. Centralized land supply, rectification of "school district housing" speculation, inventory of operating loans, second-hand housing guidance prices, drop limit orders, standardized leasing market construction, and real estate tax pilots launched ...Various New Deals guide the development of the industry.

When the new "three red lines" financing regulations set out in August 2020 are implemented, standing at the turning point of the real estate cycle, real estate companies that attach importance to "rules" dare not gamble anymore and immediately adjust the withdrawal of funds as the first priority.

"At the beginning of the year, the group required projects that meet the requirements for pre-sale certificates to enter the market as soon as possible, and no longer compete with relevant departments to raise the pre-sale price, and lose money quickly." A dealer in the northwest region of a real estate company reported to the "Securities Daily" reporter Said that the marketing line reports sales data to the group every day, and the KPI assessment is no longer just about sales, but is tighter on the payment node.

What followed was that it was hard to find a room in the school districts of Shenzhen, Hangzhou, Xi'an and other cities, and there were frequent phenomena of "10,000 people shaking" and hitting new enthusiasm.

In this window period, the housing companies with flexible supply systems are busy grabbing back the money to "save the bag for security" and take the lead in stocking "grain and straw."

"In the first half of the year, home buyers actively boarded cars, and the popularity of transactions in hot cities continued to increase." Savills North China market research department head and assistant director Li Xiang introduced to the "Securities Daily" reporter, but since July, Regulations have continued to increase. Tightening policies such as continued credit tightening, rising mortgage interest rates, and prolonged bank lending time have frequently been tightened. The market seems to be "winter in one day", and the "Golden, Nine, and Silver Ten" have also ended dismal. By November, the property market has basically been over. Reached the bottom of the valley.

On April 27 this year, Guangzhou fired the first shot of centralized land supply in first-tier cities. For the first time, the revenue from water sales reached 90 billion yuan. Since then, the centralized land supply in 22 cities has been sold three times a year.

After 3 months, the first round of centralized land supply came to an end. The land price totaled 1.05 trillion yuan, and the comprehensive premium rate was 14.7%.

Real estate companies busy with land grabbing began to regret it.

In mid-May, Binjiang Group Chairman Qi Jinxing once said, “Recently, in the centralized land transfer in Hangzhou, a total of 5 pieces of land were acquired. Under the lean and efficient management of the Binjiang team, the company has strong financing capabilities, low financing costs, and large brand influence. Achieve a net profit level of 1% to 2%."

Qi Jinxing's words broke the dilemma that some real estate developers were caught in grabbing land in the first round of centralized land supply. Under the trend of declining gross profit margin in the industry, the profit from such land acquisition was too thin.

When the second round of centralized land supply started, the housing market had turned cold, and the market environment had changed drastically.

As a result, 22 cities have concentrated on supplying land for the second time, 30% of the land parcels are unsold, and the average land premium rate is only 4%. State-owned enterprises and local platform companies have become the main force in acquiring land. Private housing companies have reduced their investment and have rarely made gains in the land market. .

Today, the third round of centralized land supply is underway. Except for Hangzhou showing signs of recovery, real estate companies are still not in the mood to acquire land in other cities.

Statistics from the Centaline Real Estate Research Center show that as of the end of November, the amount of land sold in 100 cities across the country will be 4.05 trillion yuan in 2021, a year-on-year decrease of 7.4%.

Since the wait-and-see sentiment of home buyers in the third quarter became stronger and the property market sales took a sharp turn, the "downturn" has also become the main theme of the land market.

In this "fire to ice" reversal drama, after several rounds of adjustments, the false fire of China's real estate market has faded, but the resilience has not been lost.

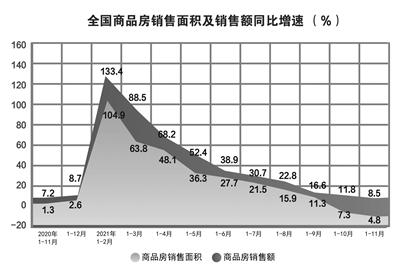

On December 15, the National Bureau of Statistics released data showing that in the first 11 months of 2021, national commercial housing sales exceeded 16,166.7 billion yuan, an increase of 8.5% year-on-year; the sales area was 1,581.31 million square meters, an increase of 4.8% year-on-year.

Industry insiders predict that based on the national commercial housing sales area of 1.760.8 million square meters in 2020, sales of 17.361.3 billion yuan, this year will not only break the "Double 17", and may even set a new high.

Zhang Dawei, chief analyst of Centaline Real Estate, predicts that if the year-on-year increase of 2.5% is maintained, China's real estate market sales and sales area is expected to hit a record high of "Double 18" in the whole year of 2021, that is, sales area is expected to reach 1.8 billion square meters. , Sales are expected to reach 18 trillion yuan.

However, Chen Zhi, secretary general of the Beijing Real Estate Association, has a different opinion.

He believes that the annual sales of commercial housing can hardly exceed 18 trillion yuan.

Chen Zhixiang to the "Securities Daily" reporter said that due to the long real estate transaction cycle, sales data generally lag behind the market performance, and the current rate of decentralization of the property market is still relatively slow.

However, the property market is returning to normal, and market entities are being "relaxed". It is expected that the new housing market will gradually stabilize from bottoming out.

Real estate companies accelerate the process of shrinking the table

The market with an average annual growth rate of one trillion yuan has inspired real estate developers to race their fields.

At that time, most real estate companies relied on the "three high model" of "high turnover, high debt, and high leverage" to instigate scale expansion, and the leverage ratio almost determined the scale of seats.

Under such rules, both shareholders and investors will inevitably pursue the maximization of returns, increase leverage, and expand scale.

In 2021, everything is different.

Since the second half of 2020, new policies such as the “three red lines” and centralized loan management have been launched, and financial institutions have reduced the financial resources invested in the real estate industry. This year has become a year in which the financial side of the real estate industry has fully demonstrated the power of supply reform.

In response to mid- to long-term sustainable development and short-term refinancing requirements, real estate companies have generally accelerated the process of shrinking their balance sheets, and real estate has shifted into a risk clearing cycle.

A leading real estate company that continues to be immersed in the dream of expanding the table and blindfolded, misunderstood the trend and did not realize the huge changes in "policy + market". It is a top-down break from the developer's dependence on high-leverage expansion model and guide real estate A grand chess game for the healthy development of the industry.

Today, the real estate developer, which holds 300 billion yuan in cash and claims to have no financial problems, has been unable to fulfill its guarantee obligations.

The more direct manifestation of balance sheet reduction is debt reduction, leverage control, and definancialization.

Tahoe Group was the first to feel the pain on the skin.

As the first person at the helm of a real estate company with a market value of over 100 billion yuan with a public debt default, Huang Qisen has been deeply moved since he was included in the list of untrustworthy persons to be enforced on April 26, 2020.

"Objectively speaking, in the expansion process, the pace has been increased and management has not been able to keep up." Huang Qisen reflected in an interview with a reporter from the Securities Daily that as the real estate industry's systemic risks are gradually exposed, financial institutions are reducing It is expected that "different projects will adopt different solutions, although it is more difficult, take it step by step."

Under the dilemma of "difficult financing and cold sales", followers of the Tahoe Group will appear one after another in 2021.

"Deteriorating financial conditions and financial risks continue to erupt. Among the real estate companies that have defaulted, there are many top-ranking or regional leading companies in the national industry." Li Xiang said that the fundamentals of the industry and some real estate companies are experiencing a "dark moment."

"In the past, many people believed that the real estate industry's trend would go up unilaterally for a long time. For real estate companies, if they expand their scale and speed up their development, they will continue to grow stronger. But the real estate industry in 2021 is going through more than 20 years. The big changes that have not occurred, this kind of changes have broken the old perceptions of real estate one by one." Li Xiang said.

In order to survive, developers have to make changes.

According to the semi-annual report of listed real estate companies, as of the end of June 2021, the scale of interest-bearing liabilities of the top 100 listed real estate companies totaled 4.2 trillion yuan, and the year-on-year growth rate turned positive to negative, reaching -0.9%, ending the radical expansion of leverage from 2018 to 2020 Era.

During the same period, among the top 100 listed real estate companies, there were an increase of 7 green companies, 4 yellow companies, and 3 red companies.

In the process of deleveraging, the asset side will inevitably change, investment and start-up will drop, and the situation of high land prices in the previous period will lead to major impacts on the short-term performance of the industry.

But shrinking the table does not mean that it will be able to survive the winter immediately.

In early October, since Evergrande defaulted on debt, Fantasia and other real estate companies successively announced USD debt defaults. The credit ratings of some domestic real estate companies were continuously downgraded. In the face of the credit crisis, whether short-term liquidity difficulties can be resolved is the survival of real estate developers. The key battle.

Since November, repurchases of bonds, major shareholders’ increase in stocks, shareholder borrowings, allotment financing, asset sales, and debt extensions...Listed real estate companies have taken multiple measures to raise funds to ease the short- and medium-term debt pressure and operational difficulties.

“The positive phenomena currently seen on the enterprise side are more concentrated in the financially sound companies in the early stage, and companies with exposed or higher risks are still facing higher financial pressure.” Pan Hao, senior analyst at Shell Research Institute, told the Securities Daily "The reporter said that even with the recent adjustments in financial policies and some real estate companies’ financing began to unfreeze, the clearing of risks is still in progress.

In this regard, Chen Zhi also believes that high-quality real estate companies will give green light, high-risk real estate companies will be banned from red light, and the risk will be cleared throughout the whole year of next year.

The worst has passed?

Shortening the clearing cycle or shrinking financial statements is still a challenge facing some real estate companies that are caught in financial risks.

"The'dark moment' of these real estate companies is still going on. It will take time for these real estate companies to get out of the predicament." Li Xiang said, of course this kind of great change will be accompanied by pain, but after the pain, it will be healthier. A solid industry future.

At the "2021 Business Exchange Meeting" held not long ago, Yu Liang, the chairman of the Vanke Group's board of directors, who was the first to shout "live", has expressed his views on the real estate industry.

He has repeatedly mentioned that it is necessary to "cherish money" and "make small money" to survive the industry's painful period.

The reverberation still exists, and the turning point seems to be approaching.

In early November, after the China Interbank Market Dealers Association held a symposium with representatives of real estate companies, China Merchants Shekou, Poly Development, Country Garden, Longfor Group, Midea Real Estate and other real estate companies all stated that they plan to register and issue debt financing instruments in the interbank market in the near future.

On December 5, Country Garden’s official WeChat account disclosed that it intends to apply to the exchange for the issuance of supply chain ABS products; on the same day, Gemdale Group’s “Great Wall Securities-Gemdale Group 2021 Phase 1 Asset Supported Special Plan No. 2” was approved for issuance, and it is planned to be issued in 2022. Listed at the beginning of the year.

On December 6, Logan Group announced that it will launch the issuance of asset-backed securitization products such as CMBS and supply chain ABS in the near future.

The "Securities Daily" reporter noticed that since December, a number of private housing companies have released financing plans within 7 days. At the same time, multiple ABS financing applications by housing companies have received regulatory responses.

The closed financing door seems to be opening, and Silk Ribbon has a warm signal, giving some real estate companies a respite.

Immediately afterwards, the central bank lowered the RRR and released 1.2 trillion yuan, which meant an increase in bank loan quotas for the real estate industry, and the property market in first- and second-tier cities is expected to stop falling and stabilize.

Statistics from the Shell Research Institute show that the lending cycle of second-hand housing banks in key cities has been shortened by five days in November, and the housing loan problem on the residential side is being solved. This will undoubtedly help real estate companies accelerate the return of funds.

Positive signals followed one after another.

In mid-to-late December, the Central Bank and the China Banking and Insurance Regulatory Commission issued the "Notice on Doing a Good Job in the M&A Financial Services for Key Real Estate Enterprise Risk Disposal Projects" to encourage banks to conduct M&A loan business in a stable and orderly manner, and focus on supporting high-quality real estate companies in the merger and acquisition of large-scale real estates that are in danger and in difficulties High-quality projects for enterprises.

In the opinion of the Zhongzhi Research Institute, the "Notice" will speed up the clearance of risks for real estate companies.

When a real estate company encounters a risk event or is on the verge of a liquidity crisis, timely disposal of project assets is an important risk mitigation method, which can play a role of three birds with one stone: First, it helps companies in danger to quickly withdraw funds and reduce debt pressure ; The second is to ensure the smooth completion of the project’s subsequent construction and delivery on schedule; the third is that the acquirer can obtain high-quality projects at preferential prices to improve asset quality and profitability.

In Pan Hao’s view, the statement in the “Notice” that “develop real estate M&A loans in a stable and orderly manner” is helpful for stable housing companies to intervene in solving the problems of risky housing companies. Risky housing companies have the opportunity to use financial institutions, dispose of assets, and Introduce investment, accelerate sales and other means to jointly solve the risks faced and prevent the further expansion of risks.

"Recently, with the obvious adjustments and transitions in policies, I personally believe that the worst moment of the real estate industry has passed, the liquidity crisis will be effectively controlled, and the real estate industry can largely avoid the hard landing that everyone had previously worried about. Gao Shanwen, chief economist of Essence Securities, stated at Essence Securities’ 2022 Investment Strategy Conference that with the continuous advancement of deleveraging measures, the high turnover model of the real estate industry has come to an end. Under the current regulatory conditions, the original model Unsustainable.

Make a fuss on refined management

“The future real estate market is likely to face a third adjustment, which is marked by a forced decline in inventory turnover and leverage.” Gao Shanwen further stated that in the next stage, the real estate industry’s business model will shift to high-quality growth and fine control.

Cao Zhounan, chairman of the Blue and Green Twins, told the "Securities Daily" reporter that the continued compression of the profit level of real estate companies will lead to major changes in the land market, showing a state of coexistence of variables, increments and stock markets.

Does the future sales scale matter?

"It is also important, but not the most important. Scale and ROE have to be positively correlated. If ROE does not reach the required level, blindly pursuing the so-called scale is the opposite."

Tianfeng Securities also stated in a research report that only by breaking the radical and extensive model can a stable and healthy development concept be established.

Perhaps 2021 will become a turning point for the replacement of new and old development momentum in the real estate industry. 2022 is expected to become the starting point of a new real estate cycle. After industry structural adjustments, production capacity clearance and policy guidance, the arrival of the new year may bring opportunities for the real estate industry.

In this regard, Tianfeng Securities stated that the new cycle is characterized by reduced volatility, lengthened time, and urban differentiation.

Judging from the current policy statement, demand and supply side support has increased to underpin the fundamentals of "stalls". However, considering that the digestion of risk events and the restoration of confidence in home buyers will take time, the recovery of sales is more than in the past. It will be longer and is expected to stabilize in the second quarter of next year.

"The trading volume of new houses will not change drastically in a short time. The growth rate of the traditional track will shrink, but the uneven development between regions still gives the real estate industry a certain amount of room for development." Pan Hao said, urban renewal, asset operation, There is still a lot of room for exploration in business models such as leasing security and retirement real estate. After bidding farewell to high growth expectations and letting go of the burden, the industry will enter a new stage of development.

As Zhang Dawei said, in addition to increasing revenue and reducing expenditure, maintaining liquidity, and making small money with peace of mind, real estate developers must also change their thinking and focus on polishing product quality.

Next is the time for real estate companies to reshuffle. Only those with better quality can attract users, share a piece of the pie in the shrinking real estate market, and win tickets for the second half of the competition.

After 2021, whether the size of the new housing market can continue to rise in the future is still a question mark.

But it has to be said that in the post-real estate era, scale will no longer be the magic weapon to win. Financial supply-side reforms will change industry rules and development models. What is in front of real estate companies is to recognize the situation and accelerate changes. Opportunity to survive the winter.

(Securities Daily)