PREMIUM

CÉSAR URRUTIA

@cesarurrutiasj

MADRID

Saturday, 19 September 2020 - 22:48

Share on Facebook

Share on Twitter

Send by email

Comment

"We will come out stronger", the campaign with which last May the President of the Government,

Pedro Sánchez

, encouraged to have faith in a robust recovery once the state of alarm subsided, has turned three months later into a

"fragile

economic recovery

" , incomplete and full of uncertainty "

, as the governor of the Bank of Spain,

Pablo Hernández de Cos

, warned last Wednesday

.

The organization has drastically changed its opinion about the capacity of the Spanish economy to resume in the short term the levels of activity that it presented last February.

In June it was already known that

the first impact of the crisis in March (-5.2%) had been harsher than expected,

but the hope was widespread that the opening of the airports would allow millions of international travelers to enter and allow a summer to make up for the previous three months of hibernation.

The first outbreaks at the end of July and the quarantines decreed in the United Kingdom and other countries for travelers from Spain ended up truncating the recovery.

With tourism sunk, which according to Funcas drags 28% of Spanish economic activity due to its own and related activities,

2020 has been considered lost and it is also assumed that the hangover will last for years

.

According to the Bank of Spain, in 2021

GDP could grow between 7.3% and 4.1%,

a rebound much lower than the one expected in summer and which in any case barely manages to recover half of the lost ground .

Unemployment could reach between 19.4% and 22.1%;

Debt, which had already climbed to its historical maximum of 110% of GDP in July, growing by 89,500 million euros, still has a long way to go that will lead to a range of 118% of GDP and 128% in 2022. And inflation would not reach 1% until 2022.

Economists and research services these days contain their forecasts or build alternative scenarios to try to anticipate the depth of the damage caused by the measures to stop a pandemic that has hardly breathed.

What was a very tough but transitory crisis is now a very tough but persistent crisis with no clear end.

In the short term, economists wait to know the affiliation of workers to Social Security in this month of September to try to get a clearer idea of the situation of the labor market, one of their biggest concerns.

"This third quarter is a period of economic recovery but as much as we want to grow, the truth is that

we are only recovering part of the decline, it is a very incomplete recovery," explains Rafael Doménech

, head of economic analysis at BBVA's Research Service .

Doménech cautions that one must be cautious in the conclusions that can be drawn from the economic data, especially regarding whether the recovery has stopped or whether it continues to progress.

In any case, it does point out that indicators such as spending on cards suggest that the rebound has lost strength as it goes from more to less, mainly due to the "health front".

His colleague at Funcas,

Raymond Torres

, agrees that Spanish households have lost confidence in a quick and robust exit from the coronavirus crisis, which is already looming longer than in May.

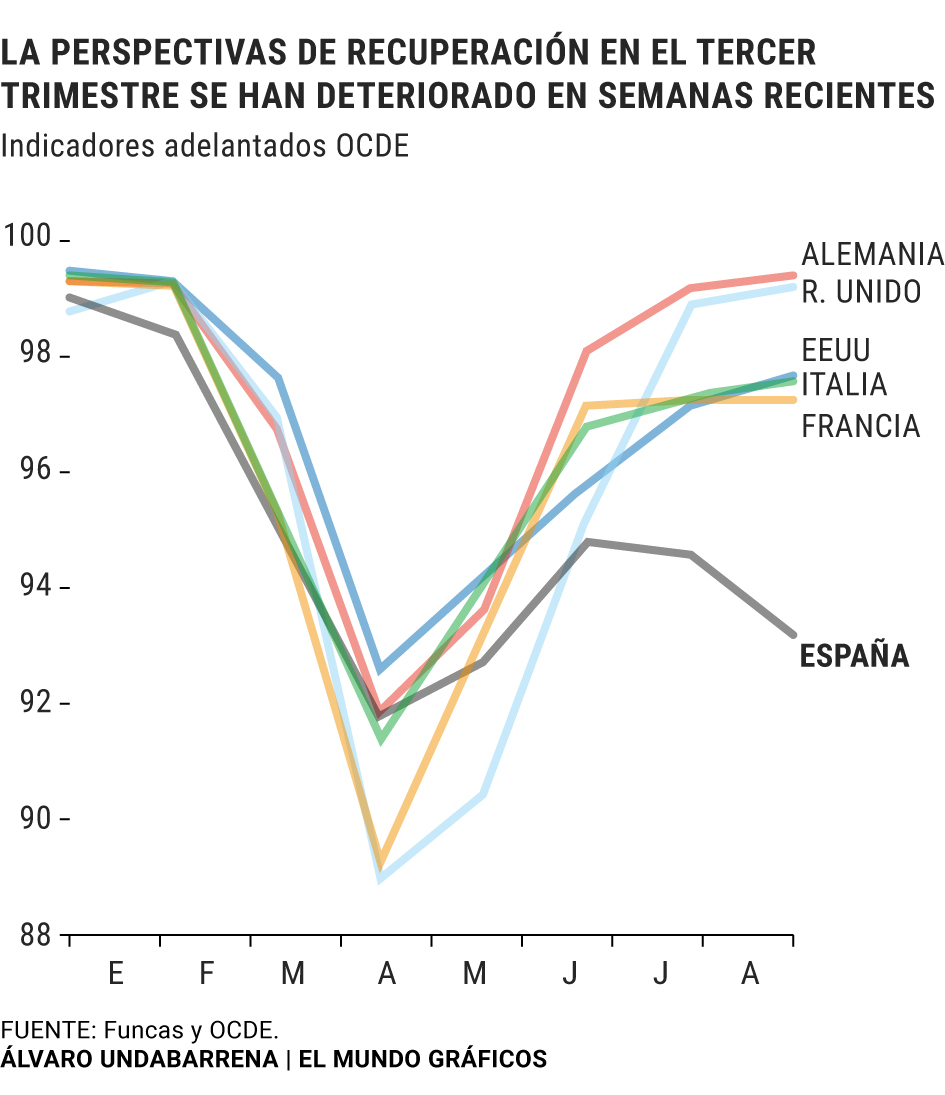

"The outbreaks stunted the recovery in August and

now the indicators are getting worse when compared to other countries like Italy," he

says.

According to Torres, if the specific weight of the factors that have truncated the recovery had to be assessed, two thirds would be due to the worsening of the pandemic at the end of July.

"The remaining third could be attributed to the impact that the above has on the expectations of Spanish consumers," he says, recalling that, as a whole, Spanish households already accumulate a surplus of 70,000 million euros and that their spending last summer has been very lower than a normal summer.

In any case, if there is something that particularly worries the economists of the truncated recovery, it is the

financial health of the Spanish business fabric, the increasing pressure on income protection schemes and ERTEs and the ability of

Spanish

administrations

to efficiently manage the 140,000 million euros in funds agreed with the European Union that will arrive in the coming years to rebuild the economy.

Credits and ERTE

Regarding the companies, Torres warns that there are already many for which the crisis is lasting more than their ability to endure and are on the verge of bankruptcy despite being viable in a period of normality.

"The liquidity aids (provided by the State through financial institutions from the Official Credit Institute) are good but there is a risk of closing these companies and it would be advisable to develop new mechanisms to reinforce their solvency".

For his part, Doménech highlights that, for the moment, the ERTE scheme has been able to break the rule of the Spanish economy whereby a point of loss of GDP means another of job destruction.

Thanks to the massive use of ERTE, this time it has been an effect up to four times less, although there has been a drop in the hours worked.

Of the 3.4 million workers suspended from employment last April, 700,000 remain,

according to the latest figures provided by the Ministry of Labor.

"The unknown is what the companies' endurance capacity is and if a process of job destruction will open, it

is difficult to think that all ERTE will remain and that all those that remain can preserve jobs," he

acknowledges while It assumes that the government's talks with the social agents will lead to an extension agreement beyond September 30 with conditions yet to be seen.

Faith in europe

For those responsible for economic analysis at BBVA and Funcas as well as for the Bank of Spain,

the key that could change the pace of economic recovery is the European Recovery Fund

.

It is a consensual request that the Government rush to the maximum the possibilities offered by the 140,000 million euros as if it were a historical opportunity for the Spanish economy

not only to resume lost activity but to modernize its structure at once

.

The Bank of Spain indicates that the funds could add up to two percentage points to GDP growth.

"We are the country with the highest rate of school failure and our average unemployment rate is above 15% since the 1980s," says Doménech.

"Apart from good projects,

if the use of these funds is successful, their effect will be much greater to solve chronic problems

, and even more so if they are accompanied by the reforms to which they are conditioned," he concludes.

According to the criteria of The Trust Project

Know more

GDP

Social Security

UK

Pedro Sanchez

Spain

Italy

Unemployment

LaboralCEOE demands to extend the ERTE until June 2021 due to the tourism debacle: "The Government does not do its homework"

Policy European Funds: an open, conditional amount that will not arrive before autumn 2021

Crisis Spain's aid to tourism only covers 4.2% of expected losses

See links of interest

Last News

Programming

English translator

Work calendar

Daily horoscope

Movies TV

Topics

Coronavirus

The time trial that will decide the Tour, live: Lure - La Planche des Belles Filles

Villarreal - Eibar

Getafe - Osasuna

Quarterfinals of the Rome Masters, live: Rafael Nadal - Diego Schwartzman

Celta de Vigo - Valencia CF