At the Tokyo foreign exchange market on the 29th, which marked the end of the fiscal year, the yen exchange rate was at the 151 yen level to the dollar, a depreciation of more than 18 yen against the dollar since the end of last fiscal year. Amid continuing monetary tightening in the United States against the backdrop of a strong economy, the yen has continued to weaken against the dollar for a year, with the yen dropping to its lowest level in 33 years and eight months this month.

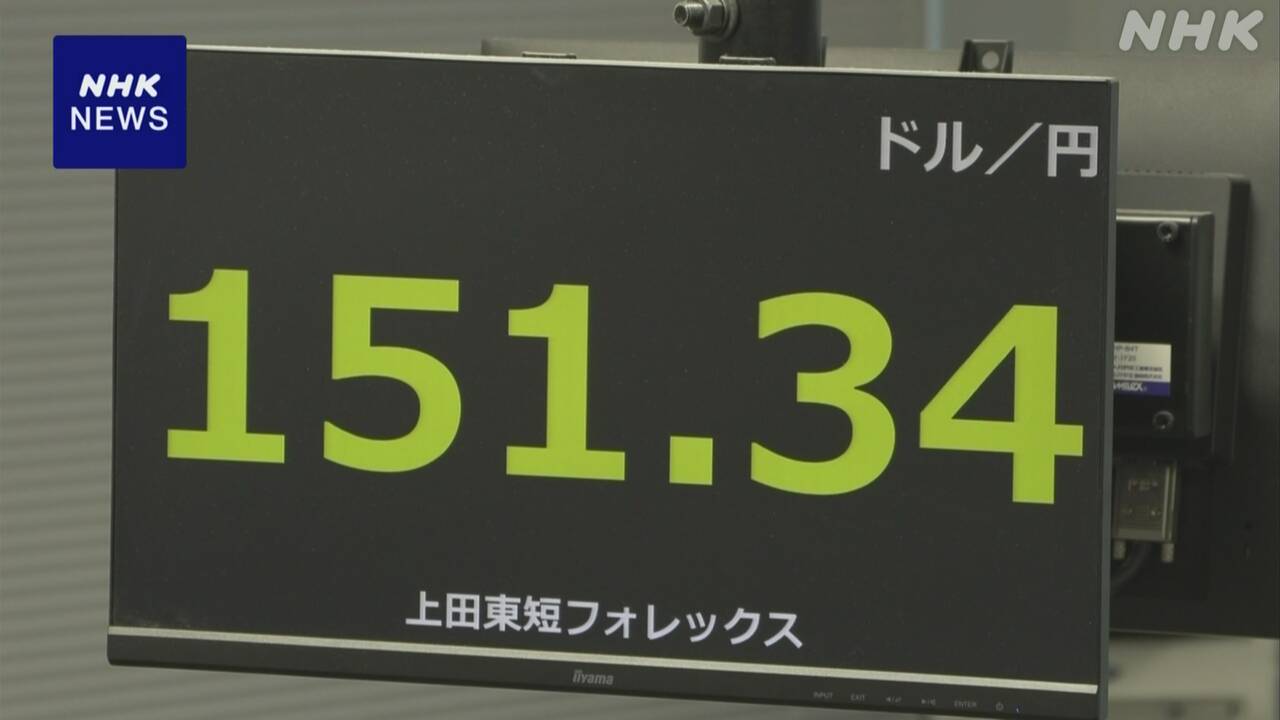

At the Tokyo foreign exchange market on the 29th, the yen exchange rate as of 5 p.m. was 151 yen to 34 yen to the dollar, and compared to the end of last year, the yen has weakened by more than 18 yen against the dollar over the past year. Ta.

Against the backdrop of a strong economy, inflation in the United States has been prolonged and monetary tightening continues, while the Bank of Japan has continued to implement large-scale monetary easing measures, leading to awareness of the difference in interest rates between Japan and the United States, and the yen's depreciation against the dollar continued. .

On the 19th of this month, the Bank of Japan decided to take a large-scale shift in its easing measures, including lifting its negative interest rate policy, but by not rushing to raise interest rates further and showing a stance of continuing to maintain an accommodative financial environment, the yen has further weakened. The depreciation continued, and on the 27th of this month, the yen hit 151.97 yen to the dollar, the first weaker yen to dollar value in 33 years and 8 months since July 1990.

There is a growing view that the interest rate differential between Japan and the United States will remain difficult to narrow, leading to a depreciation of the yen.

A market source said, ``As the yen continues to weaken, there have been a number of statements from government officials strongly restraining market movements recently, and the market is wondering at what level of yen depreciation the government and the Bank of Japan will decide to intervene in the market. We are closely monitoring the future outlook for monetary policy in Japan and the United States."