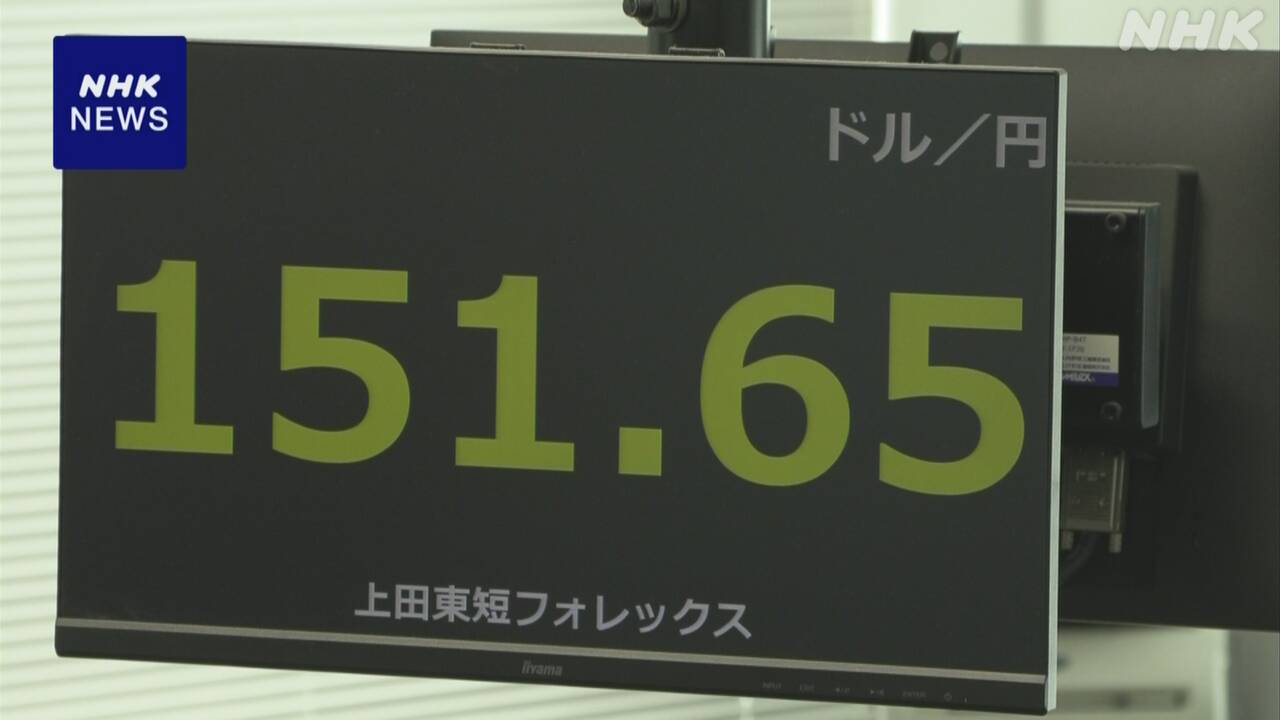

In the Tokyo foreign exchange market on the 22nd, the yen depreciated due to economic indicators announced in the United States on the 21st that exceeded market expectations, and the yen exchange rate was trading in the high 151 yen range to the dollar.

While the results of economic indicators such as housing sales announced in the United States on the 21st exceeded market expectations, leading to the view that the American economy is strong, there are concerns that the Bank of Japan will continue to maintain an accommodative financial environment even after lifting negative interest rates. This suggests that the interest rate differential between Japan and the United States will continue to be large, and people continue to sell yen and buy dollars.

A market source said, ``The yen is approaching its lowest level in 33 years, and there is a sense of caution about market intervention by the government and the Bank of Japan.''

Finance Minister Suzuki: ``We are watching market trends with a high degree of nervousness''

Regarding the continuing depreciation of the yen in the foreign exchange market even after the Bank of Japan changed its monetary policy, including lifting negative interest rates, Minister of Finance Suzuki said at a press conference after the cabinet meeting on the 22nd, ``Foreign exchange rates basically depend on the market. Market participants participate after conducting various analyzes of economic trends.I will refrain from commenting on how this decision will affect the market.The government is feeling very nervous. "We are monitoring market trends with this in mind."

When asked about the possibility of market intervention, he said, ``Market intervention is one of the things I cannot comment on as Minister of Finance, so I will refrain from commenting.''