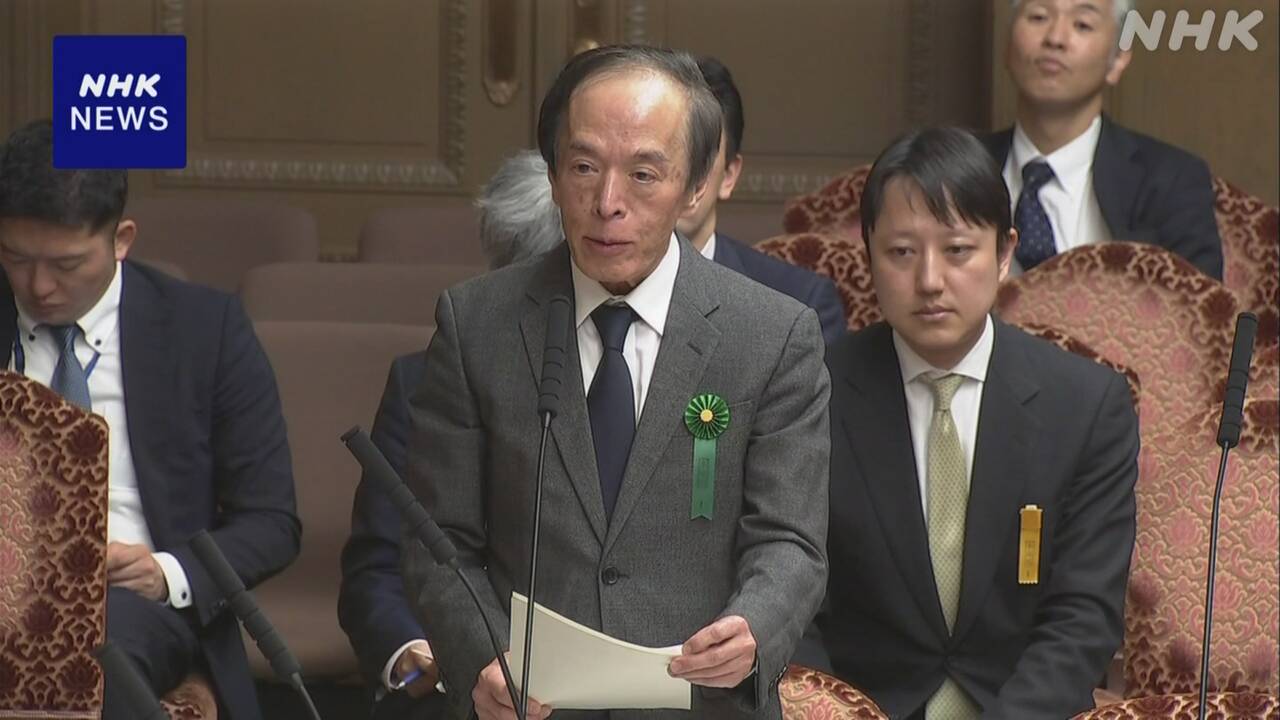

With the market's attention focused on the Bank of Japan's monetary policy meeting to be held next week, Governor Ueda told the House of Councilors' Finance and Financial Affairs Committee that he would once again decide on policy based on the spring labor labor data that will be revealed within the week. I showed it.

In the financial market, there is speculation that the Bank of Japan will soon lift negative interest rates, and interest is gathering in the monetary policy meeting to be held on the 18th of this month.

On the 12th, Governor Ueda attended a meeting of the House of Councilors' Finance and Financial Services Committee and commented on the current state of the economy, saying, ``Personal consumption appears to be showing some weakness in food and daily necessities, which have previously seen large price increases. "The situation is improving moderately, partly due to expectations of a rise in wages."

He added, ``We have been examining the virtuous cycle between wages and prices, and a variety of data has come out since the January meeting, and additional data will be received this week, so we will make a comprehensive judgment based on such information. '', he reiterated his intention to make policy decisions at next week's monetary policy meeting, taking into consideration data from the spring labor union.

On the other hand, the details and procedures for changing policy will depend on the economic and price situation, but regarding the case where negative interest rates are lifted and interest rates on some current account deposits held with financial institutions are raised from negative, I believe that it is possible to control short-term interest rates to an appropriate level by utilizing interest rates on current account deposits at the Bank of Japan."