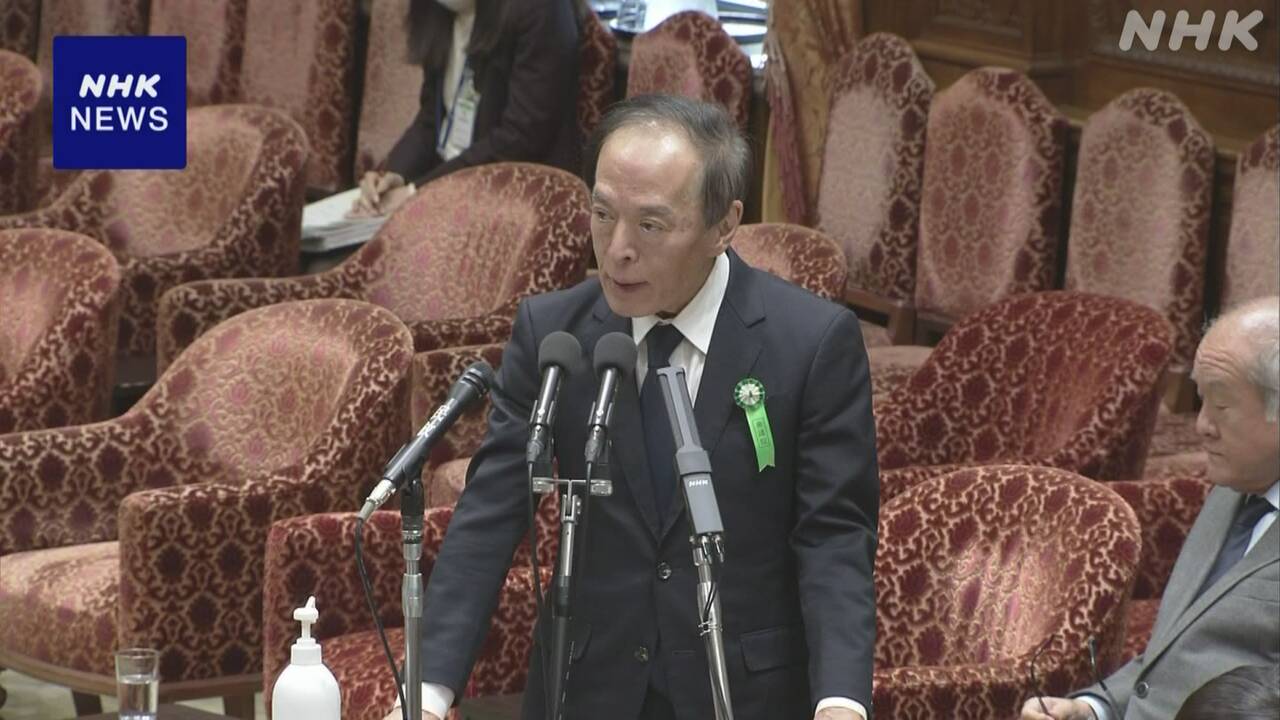

Bank of Japan Governor Ueda attended the House of Representatives Budget Committee on the 9th and reiterated the idea that the accommodative financial environment will be maintained even if the negative interest rate policy is lifted.

Regarding monetary policy management, Governor Ueda stated, ``If we can see the sustainable and stable achievement of the 2% inflation target, we will consider the pros and cons of continuing various large-scale easing measures, including negative interest rates.'' ” he said.

He then stated, ``Based on the current outlook for economic price movements, even if negative interest rates are lifted, it is likely that accommodative financial conditions will continue for the time being.'' Ta.

Deputy Governor Uchida gave a similar explanation on the 8th regarding the management after the policy change, and this is a form of re-emphasizing this content.

On the other hand, it has been pointed out that in the exit phase of large-scale monetary easing measures, interest rates would rise in the bond market and the prices of government bonds held by the Bank of Japan would fall, which would have an impact on the Bank of Japan's finances. Masu.

Regarding this, Governor Ueda said, ``I believe there is a possibility that the Bank's financial situation may deteriorate temporarily.The Bank of Japan will strive to implement appropriate policies while paying attention to financial soundness.''