Two bankers: Banks have monitoring tools and can stop any suspicious activities

Banks refuse to open bank accounts for small businesses

Two bankers emphasized that banks must adhere to the Central Bank’s controls to facilitate the work of small companies.

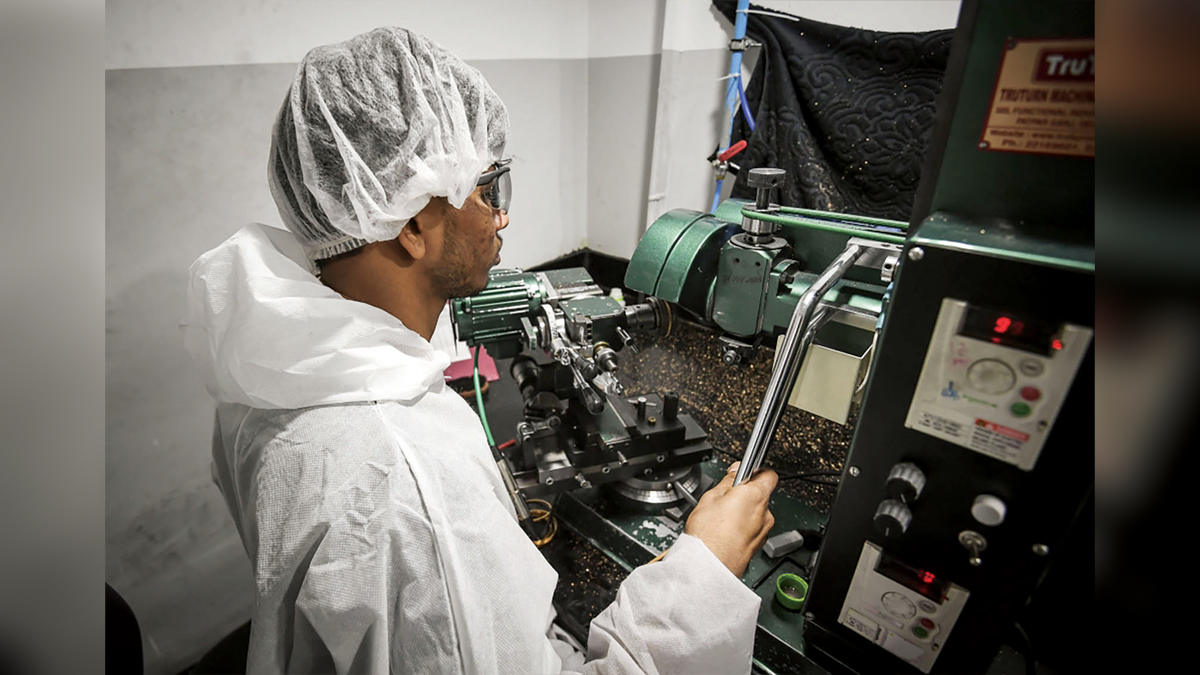

Photography: Eric Arazas

Owners of small companies reported that they are facing great difficulty in opening bank accounts in the name of their newly established companies, due to the reluctance of a large number of banks and their employees informing them that they are not interested in this type of account because of the risks it entails.

While two bankers emphasized that banks must adhere to the Central Bank’s controls regarding facilitating the work of small and medium-sized companies, in line with the state’s supportive approach, indicating that banks have mechanisms and tools to monitor bank accounts, and they can at any time stop dealing with them, if they feel the presence of movement Suspicious of funds, contrary to what the account holder provided of expectations of cash flows through his account.

In detail, small business owners told "Emirates Today" that the banks asked them for many requirements, which they do not believe that the Central Bank approves or requests, such as: "CV, housing lease contract or ownership contract, and a water and electricity bill," along with key documents such as: "Passport, Emirates ID, phone numbers, trade license" and others, and in the end they are refused, noting that one of the requirements for the continuation of the company and dealing in the market is the existence of a bank account designated for it, through which checks can be deposited and money transferred, away from the personal account.

And they indicated that no less than 90% of the entities that are dealt with, whether governmental or private companies, require a bank account for transferring payments or paying purchases, etc., and it must be in the name of the company, which means that their business may stop in the future.

They added that all companies are required, according to the instructions of the Central Bank, to open a bank account within a period of six months from the incorporation, otherwise this will not be approved later, indicating that the bank’s refusal to open the account, upon incorporation, may prevent the company from opening the account later. for years.

On the other hand, the banking expert, Amjad Nasr, said, “Banks have a mechanism and tools that allow them to track the movement of funds on different accounts, and they can at any time stop dealing with them or seize the account, if they suspect any illegal transactions, which means that the banks’ concerns There is no justification for opening accounts for small companies upon incorporation, especially in light of the government’s supportive approach to this type of company.

Nasr added, "Companies' accounts can be classified sectorally, and unified standards and requirements can be set, which the owner of the company is bound to, and if there are any, no obstacles or delays are put in place, which facilitates the tasks of business owners."

He pointed out that if banks facilitate the account opening process for small companies, there is no doubt that they will benefit from the fees, opening letters of credit, letters of guarantee, etc., since all these services carry fees, so banks must reconsider their reluctance to provide this important service.

For her part, the banking expert, Awatef Al-Harmoudi, said, “All banks aim to attract new bank accounts, but each bank sets its own policy and controls that it adheres to,” noting that “sometimes there is a shortage of documents, or reservations about some of them.” nationalities, or fears of something specific, so the matter is subject to the discretion of the management of each bank.

And she added, “Yes, there is a reservation about opening bank accounts for companies that are established in some free zones, for reasons related to ensuring the continuity of the company and not leaving the country, and other logical reasons that guarantee the preservation of the funds of depositors and shareholders.”

Follow our latest local and sports news and the latest political and economic developments via Google news