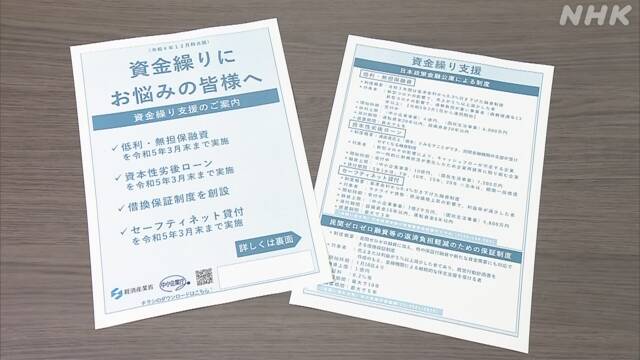

Before the full-scale repayment of so-called "zero zero loans", in which small and medium-sized enterprises affected by the new coronavirus receive real interest-free and unsecured loans, the Ministry of Economy, Trade and Industry will establish a new refinancing guarantee system on the 10th. I'm going to start with

The real interest-free and unsecured “Zero Zero Loan”, which supports the cash flow of companies whose sales have decreased due to the corona crisis, began in March 2020, and the total amount of loans so far has reached 42 trillion yen.

Since the repayment of companies that have received loans from private banks and credit unions for three years will be in full swing from July this year, the Ministry of Economy, Trade and Industry will start a system to guarantee new refinancing of companies from the 10th. , the policy is to continue to support financing.

However, with regard to zero-zero loans, it has been pointed out that easy borrowing could lead to excess debt, as even companies with no prospects of improving earnings could receive loans.

Under these circumstances, the new system requires that sales have decreased by 5% or more from the previous year, and that the creation of a plan to strengthen profitability is a condition for guarantee.

On top of that, the government will virtually guarantee financing for 10 years up to 100 million yen for small and medium-sized enterprises, and will also guarantee new funding needs such as investment in new businesses.

Tadahiko Kanzaki, head of the Finance Division of the Small and Medium Enterprise Agency, said, "In addition to reducing the burden of repayment on companies, we also want to improve profitability by having financial institutions provide follow-up support."