<Anchor> It

's friendly economy time.

Reporter Han Ji-yeon is here.

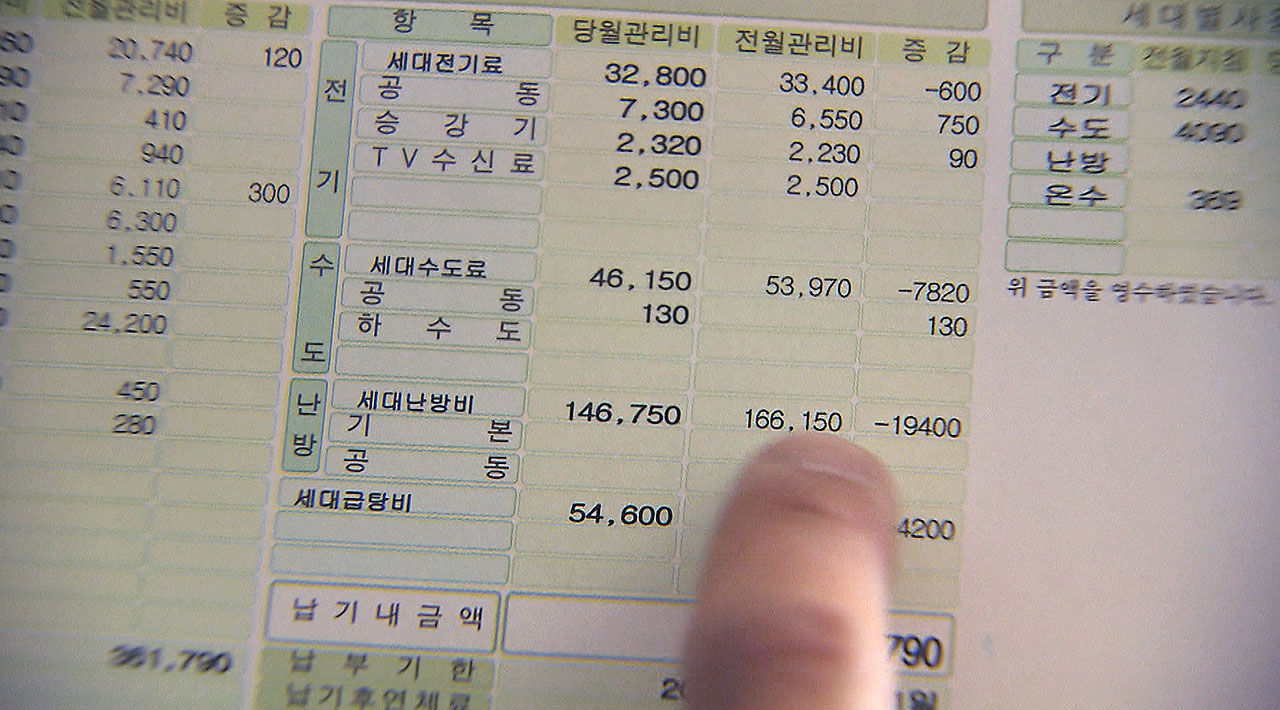

The number of apartments that are now obligatory to disclose apartment management fees will increase in the future.

<Reporter>

Yes, under the current law, only apartments with 100 or more households are obligated to disclose the details of the management fee, so small apartment residents had no way to check how the management fee I paid was being used.

In the future, more apartments will need to disclose this information transparently.

Last year, Koreans spent a total of 23 trillion won in administrative expenses, and although the average monthly maintenance fee is 180,000 won per household, related information is still insufficient.

Therefore, the government has decided to lower the standard of mandatory disclosure of administrative expenses in the first half of next year from the existing 100 households to 50 households or more.

In this way, 6,100 complexes, or about 420,000 households, will be newly included in the subject of disclosure, increasing by about 4%.

In addition, new obligations are imposed on the creation, storage, and disclosure of management fee accounting books for apartments of 50 or more and less than 150 households.

<Anchor>

Then, in the end, I still don't know how the management fee I paid is being used for apartments with less than 50 households or small officetels, and why I paid the maintenance fee like this.

Do you have any supplements?

<Reporter>

Yes, there is no obligation to disclose the details of the maintenance fee, but the government has decided to provide a supplementary measure.

In small officetels and studios, there are many cases where young people or beginners in society live.

To them, the management fee is inevitably a bigger burden to the extent that it is recognized as the second monthly rent.

However, there have been quite a few cases in which 'blinking' management fees have been imposed by taking advantage of institutional loopholes.

To prevent this kind of damage, we plan to add a maintenance fee item to the form used when signing a one-room contract so that landlords will be informed in advance of how much maintenance fee will be charged.

<Anchor>

Are you saying that recently it is difficult to access the website of the Korea Savings Bank Federation?

<Reporter>

Yes, it's like an offline 'open run' is happening these days, but as more and more people are searching for where they can get a higher interest rate, the homepage of the Korea Savings Bank Federation is running out.

If you go to 'View consumer portal interest rates', the phrase 'Waiting for service access' appears with a waiting time of 1 hour and 50 minutes and more than 6,500 people waiting.

This connection delay has occurred since the 19th.

On the 19th, it is five trading days after the base rate was raised.

On the day savings banks raised interest rates on receiving products, inquiries about high-interest products surged.

Currently, the maximum interest rate for savings bank deposit products is 6.5% per annum.

Commercial banks are now at 5.1% per annum, which is more than 1 percentage point.

The Savings Bank Federation's 'SB Talk Talk Plus' app, which allows you to view 67 savings banks at once, has also increased five times compared to weekdays. .

<Anchor>

But you say that some savings banks cut interest rates again in one day?

<Reporter>

Yes, the 6% level is often lowered to the 5% level in one day, but since a lot of subscribers are flocking, the interest rate is lowered again due to concerns about 'reverse margin'.

Reverse margin is a situation in which the bank loses money when the bank has to pay more interest on savings and savings than it will receive on loan interest.

In a situation where it is impossible to increase loans aggressively due to regulations on the total amount of loans, etc., if interest rate deposits and savings accounts increase rapidly, a reverse margin will inevitably occur. .

Through the SB Talk Talk Plus app, you can open an account by verifying your real name through a mobile phone without visiting a branch.

It would be good to give it a try.