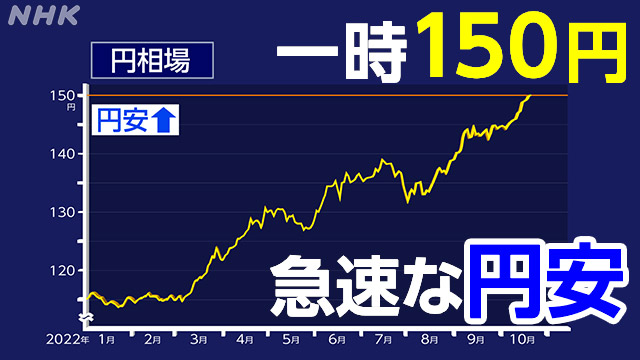

The yen exchange rate on the Tokyo foreign exchange market on the 20th, when the price fell to the 150 yen level to the dollar at one point, marking the first time in 32 years since August 1990 that the yen was depreciating.

What lies behind the unstoppable depreciation of the yen?

Keiichiro Kobayashi, a professor of economics at Keio University who specializes in macroeconomics, points out that Japan's competitiveness is declining over the long term.

Yen exchange rate Temporary 1 dollar = 150 yen range Yen depreciation level for the first time in about 32 years since 1990

Click here for more information

Q. What is the underlying reason for the depreciation of the yen?

A. The direct cause is the difference in monetary policy between Japan, which continues to ease monetary policy, and the United States, which continues to raise interest rates, and the resulting widening interest rate differential between Japan and the United States. It can be said that the cost of growth is now appearing.

Japan's economy has been experiencing low growth for a long time. During that time, prices and wages have risen in other countries, and a certain level of growth has been achieved. My skills were also declining.

The disparity in growth that has made Japan a “cheap country” in all respects has now resulted in the depreciation of the yen.

Q.Is it a structural problem?

A. Looking at the past 30 years, prices in the US have more than doubled, but prices in Japan have hardly changed.

Wages couldn't be raised because prices didn't rise, and companies couldn't raise prices because wages didn't rise either.

Because everyone thought that the Japanese economy as a whole would not grow, investment in the country did not progress, and human capital deteriorated and productivity did not increase.

This accumulation has weakened the competitiveness of the Japanese economy, and it is blowing out in the form of a weaker yen.

Q. The trade deficit in the first half of this year is also the largest ever.

A. This is also proof that Japan's competitiveness is declining and the terms of trade are getting worse.

The trade deficit in the first half of this fiscal year exceeded 11 trillion yen, the largest ever in the first half of the year.

Click here for trade statistics

Japan used to be a trading nation, but Japanese companies are moving overseas more and more, and it is no longer possible to earn money from exports.

If the yen weakens, exports will increase and the trade deficit will not widen, or it would not be surprising if the trade deficit were to become a surplus.

As a result, the import deficit has grown, and a structure has been established in which the entire trade balance falls into a large deficit.

Q. How can we overcome this situation?

A. As the international competitiveness of Japanese companies has weakened, the export-led economic model that generates profits through exports is gradually collapsing.

At present, the income balance from overseas assets is somehow holding on.

As symbolized by the overseas investment of Japanese companies, the maturity of the Japanese economy is making a shift from trade to investment.

In the future, we need to improve how we make money from investments.

Q. The special situation that Japan is the only developed country to continue large-scale monetary easing

A. In the short term, it is the right policy to support the economy through monetary easing, but economics does not fully understand whether keeping interest rates low for 10 or 20 years in the long term is good for the economy.

The monetary easing measures that have been taken so far should have been policies for crisis response, not normal times.

In the first place, when monetary easing of a different dimension was started, it was initially a crisis management policy because it was a two-year policy with a promise to achieve 2% inflation in two years.

By continuing monetary easing for too long, Japanese companies have become accustomed to an environment in which they can easily raise funds at low interest rates and do not have to take risks.

Even if you don't take risks, your business performance won't get that bad, so it's difficult for innovation to occur, and it may not lead to skill improvement for workers.

Now is the time to think seriously about the problem that monetary easing has weakened the strength of the Japanese economy.

Q.Isn't it painful once you try to make a change?

A: There will certainly be pain.

However, it should be possible to choose whether to continue low growth in a “boiling frog” state with low interest rates, or to return interest rates to normal to some extent and raise the economic growth rate, albeit painfully. .

In order for the Japanese economy to recover over the long term, we hope that interest rates will normalize and that the growth rate will gradually rise, and everyone will have the expectation that companies will take risks, creating a virtuous cycle. I have to

Q. What does the Japanese economy need to overcome the depreciation of the yen?

A: If the dollar's appreciation stops at some point, the yen may appreciate, but fundamentally, we must increase the value of the yen by increasing Japan's economic growth rate.

Now is the age of IT.

It is essential to increase the mobility of workers, who have been rigid for a long time, to encourage them to advance their careers in new fields, and to raise overall productivity.

The most important thing is to increase the productivity and growth rate by improving the skills of Japanese people.

(Interviewer, Economic Department, Daisuke Nogami)

Feed prices soaring, some dairy farmers going out of business

Among dairy farmers, the soaring cost of feed and fuel for cattle imported from overseas is directly hitting the management, and there are cases where the business is closed.

Tetsuji Kusaba, who runs a dairy farm in Asakura City, Fukuoka Prefecture, is facing pressure on profits due to soaring purchase prices and fuel costs.

Due to the depreciation of the yen, which pushes up import prices, and the soaring food and energy prices due to the situation in Ukraine, the purchase price of "mixed feed" using multiple grains such as American corn, which is used for cattle feed, has exceeded 50% since last year. It means that the price of light oil, which is used as fuel, has risen by nearly 20%.

A raw milk sales group made up of dairy farmers in seven prefectures in Kyushu will uniformly raise the price of raw milk for beverages sold to manufacturers by 10 yen per kilogram from next month, but the yen is depreciating in the foreign exchange market. It's progressing step by step.

According to the Fukuoka Prefecture Dairy Farming Cooperative, nine producers closed in the prefecture last year, but this year there are already 10 in half a year, highlighting the harsh reality of dairy farming. .

Mr. Kusaba says, "Producers all feel a sense of crisis and are trying to devise management, but the future is unpredictable and the situation is extremely difficult."

California melon soars

A trading company specializing in fruits located in Ota Ward, Tokyo deals with grapes and oranges imported from the United States and South America.

Among them, melons from California, the United States, which are imported from summer to autumn, are popular because they are cheaper than domestic melons.

However, this melon, which can be said to be the company's main product, is also exposed to headwinds.

Soaring labor costs in the United States and reduced harvests due to drought caused melon prices to soar, and dollar-denominated purchase prices rose 20%.

The rapid depreciation of the yen added to this, and the purchase price converted to yen has risen by about 30% compared to last year.

When the company negotiated the purchase price with a local company, the company took into consideration the level of yen depreciation to the lower 140 yen level to the dollar, but the yen depreciation progressed in a way that exceeded expectations, so the costs that swelled I'm concerned that we won't be able to pass it on to the wholesale price.

Ryusuke Yashiki, manager of Funasho Shoji, said, "We expected production costs to rise to some extent in the United States, but the exchange rate far exceeded our expectations. We are also discussing raising wholesale prices with our business partners. , If the retail price rises, domestic demand may fall, which is the most difficult."

“I can't feel the export benefits of the weaker yen”

Some say that they do not realize the merits of exports due to the weaker yen.

An industrial product manufacturing company in Bizen City, Okayama Prefecture manufactures a product called "clay" that can be mixed with rubber or paint to increase its strength.

We import 60% of the ore used as raw materials from overseas, and we purchase about 2,400 tons annually from China, Indonesia, and India.

According to the company, the purchase price has increased by nearly 40% from last year due to the recent depreciation of the yen, in addition to the soaring raw material prices due to the rise in transportation costs, etc., and the purchase cost is about 1.5 million yen per month.

The company sells clay to more than 100 companies nationwide, including rubber manufacturers, paint companies, and paper companies, and products using this company's clay are exported overseas through major companies.

The company is negotiating with its business partners to raise prices, but only about 30% of them accept price increases.

Koji Takimoto, president of Sanyo Clay Industry, said, "The soaring raw material costs are unprecedented, and management is tough. I would like to request that major exporters and other companies that are enjoying profits promptly pass on the costs to their prices, and I would like the government to send out such a message."