behind the economy

Why did China cut interest rates?

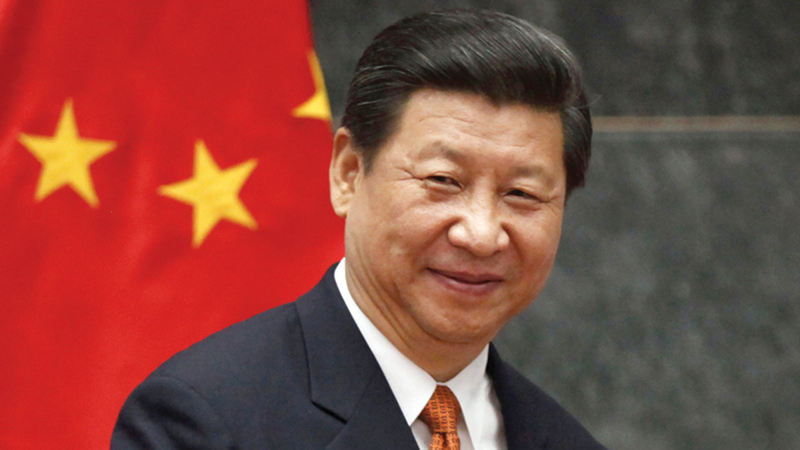

Chinese President Xi Jinping.

archival

Chinese banks have reduced interest rates on loans granted to individuals and companies, in an attempt to revive growth in an economy suffering from a real estate crisis, as well as reversing the "zero Covid" policy adopted by the Chinese government to combat the outbreak of the "Corona" pandemic in the country.

Last week, the People's Bank of China unexpectedly cut its rates to deal with slowing economic growth and weak demand for credit.

Economists said cutting interest rates likely won't do much to revive growth in the economy.

Economists expect monetary policymakers will need to make more small rate cuts this year, but Chinese officials have signaled their refusal to respond to massive stimulus launched earlier when faced with past periods of slow growth, citing concerns including: the risk of faster inflation, An increase in debt.

The data released recently showed a slowdown in economic activity in July in all areas, including factory production, investment, consumer spending, youth employment and the real estate sector, highlighting the broadening of the economic challenge facing China in a politically sensitive year for Chinese President Xi Jinping. Who is expected to seek a third term in office.

China posted its weakest annual growth in two years in the second quarter, with GDP growing just 0.4% from a year earlier, as factories closed, transportation and shipping operations were disrupted, and millions were left stranded at home.

The data showed retail sales, industrial production and public and private investment slowed in July, while youth unemployment was at a high level, with nearly a fifth of people aged 16-24 looking for work.

The People's Bank of China said the basic interest rate for a one-year loan offered by banks was reduced to 3.65% from the previous rate of 3.7%, while the five-year interest rate was lowered to 4.3% from 4.45%.

Although the real estate sector was a major driver of growth in the world's second largest economy, it is now shrinking as developers suffer from heavy debt, which has led to a broader downturn in the economy.

Julian Evans-Pritchard, chief economist at Capital Economics in Singapore, said the interest rate cut would not be felt by existing borrowers immediately, and demand for loans would be affected by a loss of confidence in the real estate market.

Follow our latest local and sports news and the latest political and economic developments via Google news