Revenue jumped by 60.4%, supported by acquisitions and strong performance by Freight Services

3.2 billion dirhams, net profit of "DB World" in the first half

Container revenue per 20-foot equivalent container increased by 9.2%.

From the source

Sultan bin Sulayem: “The strong performance in the first half puts us in a good position to deliver an improved performance for the whole year.”

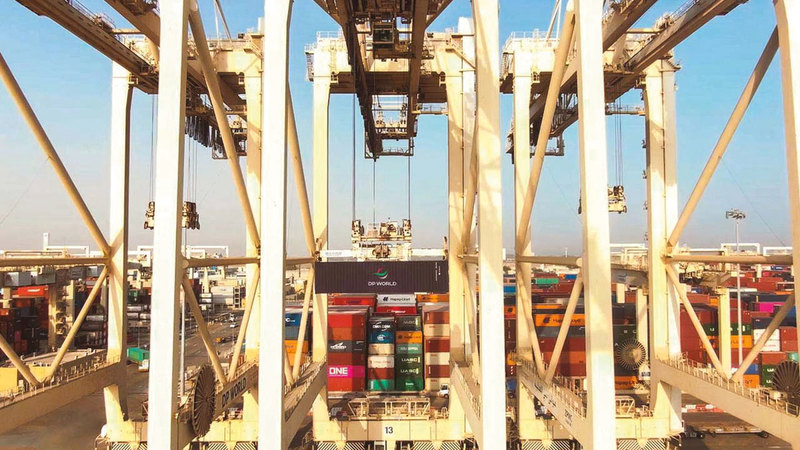

picture

DB World Limited announced yesterday that it recorded strong financial results for the six months ending June 30, 2022, with a record net profit of $884 million (AED 3.244 billion), an increase of 51.2% compared to the same period last year. The company also recorded revenues of $7,932 billion (AED 29.1 billion), a growth of 60.4% on an annualized basis, while revenues grew by 20.1% on a like-for-like basis.

The company explained, in a statement, that the increase in revenues was supported by acquisitions, the strong performance of short and medium-distance freight services, and the growth of volumes of goods with high profit margins.

It added that container revenue per 20-foot equivalent container increased by 9.2%, driven by increased demand for warehousing.

profits

Adjusted EBITDA margin was $2.441 billion, while adjusted EBITDA margin was 30.8%.

Adjusted earnings before interest, tax, depreciation and amortization increased to $628 million, while the adjusted earnings margin reached 30.8% during the first half of this year.

The like-for-like adjusted EBITDA margin was 38.2%.

Profits for the period attributable to company owners increased to $721 million, while profits attributable to company owners - before separately disclosed items - increased by 51.8% according to announced reports, and also increased by 39.2% on a like-for-like basis.

Liquidity

Cash flow from operations increased by 29.6%, reaching $1.931 billion during the first half of 2022, compared to $1.490 billion during the same period in 2021.

Consolidated debt ratio, including PPZW guarantee (net debt to EBITDA-adjusted ratio on an annual basis) has been reduced to 3.8 times (before the implementation of IFRS 16), compared to By 5.9 times in the fiscal year 2021, while the net debt ratio, after the adoption of IFRS 16, reached 4.1 times, compared to six times in the 2021 fiscal year.

Classification and Partnerships

DB World's credit rating improved, as Fitch upgraded the company's rating to the investment category (BBB-), with a positive future outlook, while Moody's maintained its rating at Baa3.

The company expanded its strategic partnerships to strengthen the company's balance sheet, as this leads to long-term value

It also expanded the scope of partnerships and monetization to raise nearly $9 billion to significantly enhance the company's balance sheet and provide long-term flexibility.

Standard results

Sultan Ahmed bin Sulayem, Chairman and CEO of DB World Group, said: “We are pleased to announce record results in the first half of the year, with EBITDA-adjusted growth of 34.6%, and an increase in profits attributable to shareholders by 34%. 51.8%».

"This significant growth demonstrates that our strategy of focusing on high-margin merchandise, and providing customized supply chain solutions, will deliver sustainable returns in the long term," he added.

Bin Sulayem indicated that “it is encouraging that cargo owners continue to respond positively to the integrated group’s product offerings.” He continued: “We are currently focusing on integrating acquisitions in the logistics field that we have made, finally, to enhance returns, and we continue to invest in sectors and markets with High growth, to provide more attractive solutions in supply chains.”

deals

Bin Sulayem said: “In recent months, we have announced several deals that will contribute to raising nearly nine billion dollars.”

The new capital will provide the company with the flexibility to accelerate investment in key growth markets, while maintaining a strong investment rating.

good location

Bin Sulayem emphasized, “Overall, the strong performance in the first half puts us in a good position to deliver an improved performance for the full year.”

selective investment

The directives for capital expenditures for DB World for the current year amount to $1.4 billion, and include the implementation of planned investments in the UAE, Jeddah, Saudi Arabia, London Gateway (UK), the Port of Sokhna in Egypt, in addition to Senegal, and the port of « Callao” in Peru.

• The company's liquidity resulting from its operations increased by 29.6% to 7 billion dirhams.

• AED 29.1 billion in revenues from DB World during the first six months of 2022.

Follow our latest local and sports news and the latest political and economic developments via Google news