The number of young households owning a home has plummeted.

And ownership not only means that they have finished paying for it and it is completely theirs, but also that they have simply been able to formalize a mortgage and pay a down payment.

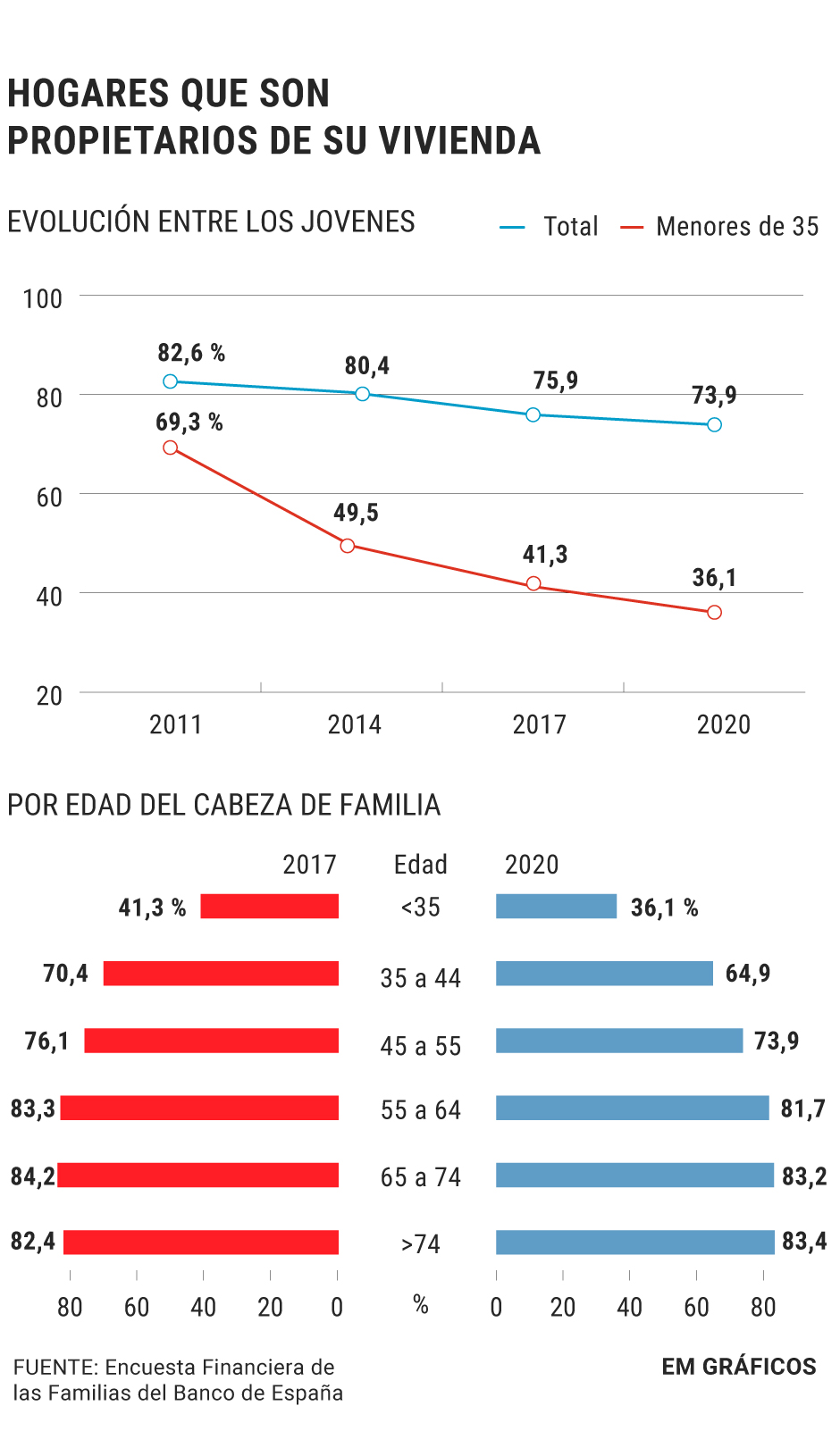

Specifically, and according to the latest Family Financial Survey of the Bank of Spain that refers to 2020,

only 36% of households under 35 years of age are now owners

.

The data, moreover, contrasts sharply with that of just 10 years ago: in the same BdE work but with reference to

2011, the figure was almost 70%

.

That is, young people can no longer access a home they own or, at least, they do so with much more difficulty than just a few years ago.

"Between the end of 2017 and the end of 2020, the percentage of households that owned their main home continued to decline appreciably, from 75.9% to 73.9%", explains the Bank of Spain in its work, which which shows that there is a

downward trend in society as a whole

.

"Generalized falls are observed in this percentage in almost all groups, which are

especially pronounced among households with heads of households under 35 years old

[5.2 pp] and between 35 and 44 years old [5.6 pp], households whose head of family was self-employed [4.9 pp] and those who were unemployed or in another type of inactivity [5.6 pp]", they continue.

And they underline: "It should be noted that, in the nine years between the end of 2011 and the end of 2020,

the ownership rate of the youngest households fell 33 percentage points

, and went from 69.3% to 36.1%" .

Consulted for the reasons for this special drop among young people, sources from the Bank of Spain refer to a study that was carried out with data from 2017 but that is clearly indicative of what is happening.

Three possible reasons

were raised, they explain

: the evolution of the credit market, the uncertainties of income and the elimination of tax benefits for the purchase of a first home.

And according to this work, the reasons that explain why young people have serious difficulties in accessing their own home are the first two.

That is, the fact that mortgages

no longer offer 100% financing

and that it is necessary to advance 20% of the price of the house as well as the expenses associated with the mortgage process, and that the

employment situation of those under 35 years of age has significantly

worsened

as well as their financial security.

Data from the Bank of Spain also show that there is

an obvious carry-over effect towards the following

age brackets, and in the last three years alone the drop in households between 34 and 44 years of age who are owners has fallen by almost six percentage points.

And that, as they explain from the organization directed by Pablo Hernández de Cos, will be accentuated in the coming years.

Among older households, on the other hand, they have barely occurred and among those over 74 years of age, there has even been an increase.

The net wealth of families increased by 4.6% in the year of the pandemic

The work of the Bank of Spain also shows that the median net wealth of families in Spain increased by 4.6% in 2020, up to 122,000 euros, compared to 116,600 in 2017, while the median household income rose by 14.1%, from 23,300 euros in 2016 to 25,600 euros in 2019.

The agency points out that this rebound "breaks the downward trend" shown in the 2011-2017 period, in which a 27% drop was accumulated, although this increase "hides" "very disparate" variations by age groups, reports Europe Press.

Conforms to The Trust Project criteria

Know more

living place