Two Bankers: The aim of the banks is to protect customer accounts and prevent their misuse

Banks give the customer a grace period to update his data before stopping their services

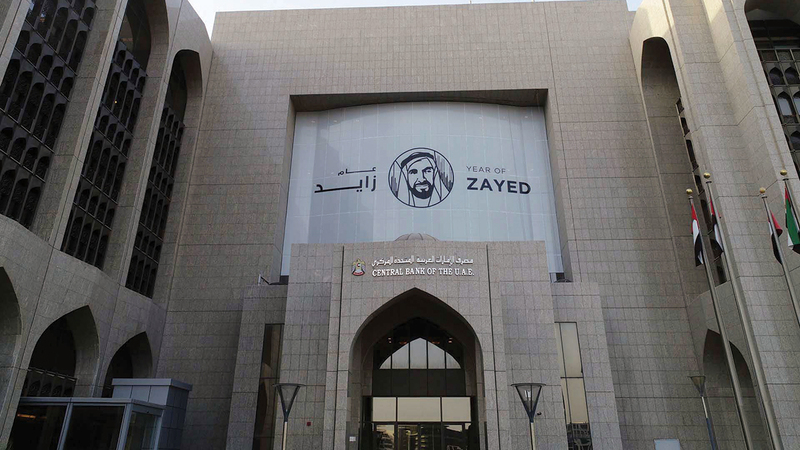

The Central Bank's instructions stressed the need to update customer data within the "know your customer" initiative.

À archival

picture

Two bankers confirmed that the banks suspend all their banking services on the accounts of customers whose identification papers have expired, including travel, residence, and identity cards, after exhausting all means to communicate with them, and urging them to update them in the bank’s records.

And they told "Emirates Today" that the banks take into account a period of "a month" after the expiry of the date of residence, or identity, a grace period for renewal, noting that before and during this period, text messages and e-mails are sent, to inform the customer that his account is subject to stopping transactions on him, from Withdrawal, deposit, and purchase through points of sale, if he does not update his data.

They explained that the Central Bank's instructions stress the need for banks to adhere to the "know your customer" initiative, which requires updating all customers' data on a timely basis, in addition to the fact that these procedures are considered protection and a guarantee for the customer himself from misusing his bank accounts.

This came in response to customers' objection to text messages they received from the banks they deal with, warning them not to cut off banking services if they did not update their expired identification documents.

They confirmed to "Emirates Today" that these messages reached them within a month, the deadline for renewing their documents.

The banker, Awatef Al-Harmoudi, said that the Central Bank’s instructions to banks stressed the need to update the data of customers within its initiative known as “Know Your Customer.” Therefore, banks initiate contact with the customer whose identity papers have expired, such as a passport, residence, or identity card.

She added: "Usually several text messages are sent, as well as the email address registered with the bank, a month before the expiry date of these documents."

Al-Harmoudi continued: “Banks do not usually stop all banking services during the grace month that follows the expiry date of the customer’s documents, as they often wait for the expiry of this period, after which they start applying stopping services gradually, such as stopping withdrawals or deposits from ATMs using a direct debit card, Followed by stopping payment through points of sale, and all this to urge the customer to visit the branch of the bank he deals with and update his data.”

For his part, the banking expert, Mustafa Al-Rikabi, said that the banks try with the customer more than once to update his data, and make it easier for him to send a link that can easily download his expired identification papers on him, without bearing the burden of visiting the branch, but those who do not respond more than a month after the expiry date The renewal period and grace month, the banks start taking steps to get him to update his data.

Al-Rikabi explained that these are strict instructions by the Central Bank of all banks, to ensure that customer data is updated within the “know your customer” initiative, which aims primarily to protect customer accounts and prevent their misuse by any party.

He stressed that the banks understand that the customer is given enough time to renew his papers, but the customer himself must take the initiative to update his data.

Follow our latest local and sports news and the latest political and economic developments via Google news