Forecasts The OECD lowers its growth forecast for Spain by 1.4 points and raises its average inflation forecast by 5 points

Another lowering of growth forecasts.

The second in just two months and the third since December.

And an inflation that, although it will be slightly contained this year by the cap on gas, will be "

more intense and persistent

".

The Bank of Spain has updated its macroeconomic forecasts this Friday, and has shown that the crisis is deepening, that the Spanish economy continues to accumulate problems and delays in its return to the level of Gross Domestic Product (GDP).

That will not be achieved, pointed out the general director of Economy and Statistics, Ángel Gavilán,

until the third quarter of 2023

.

Many later, obviously, than the end of 2021 in which the Government came to locate that point.

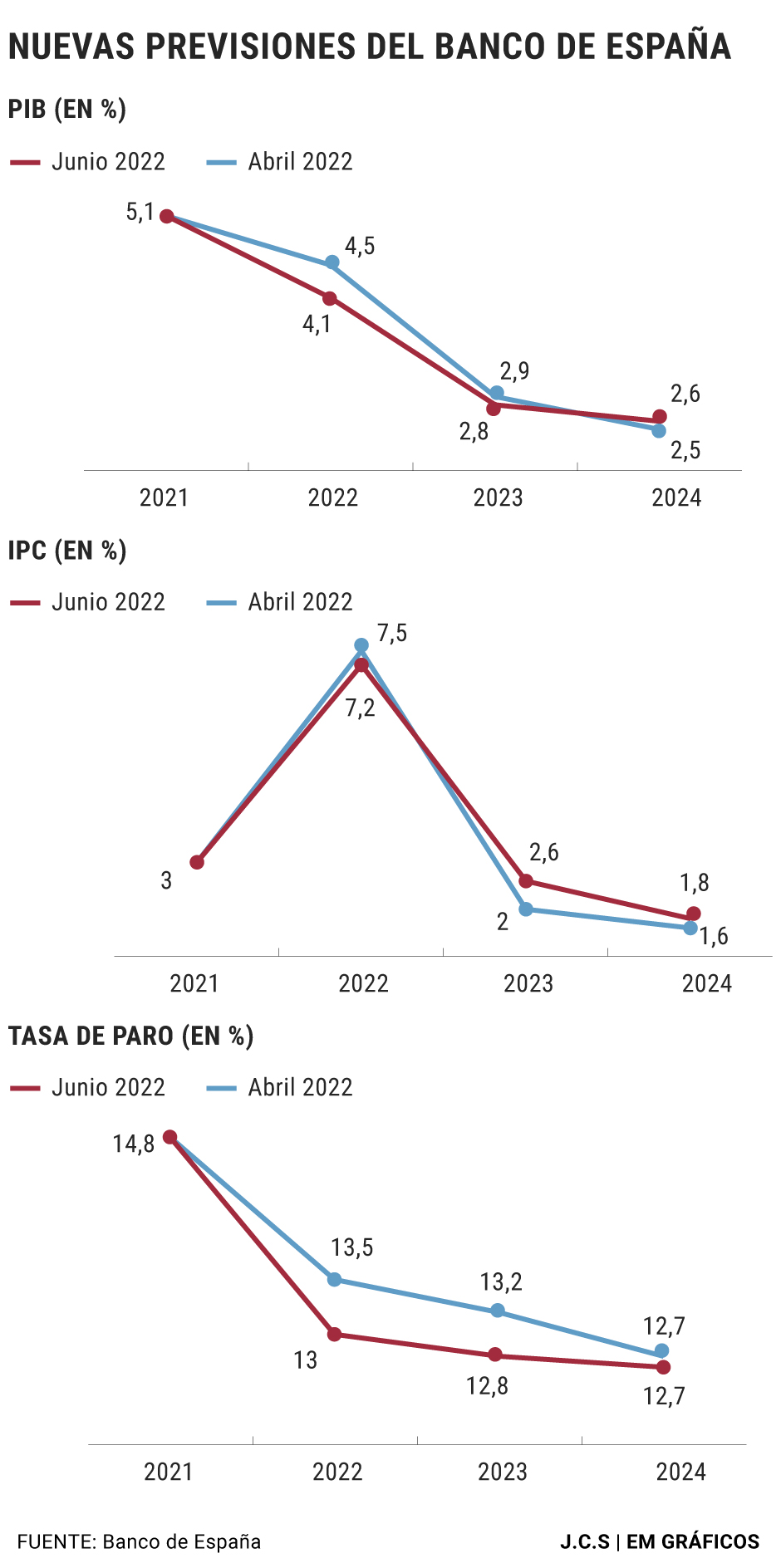

Going into the specific figures,

the rise in GDP in 2022 will be 4.1%

, below the 4.5% that it pointed out in April and very far from the 5.4% that it estimated in December.

The data is also lower than the 4.3% estimated by the Executive, and the estimated rebound for 2023 is also lowered.

The main reason offered by the BdE is that during the first quarter of the year the slowdown was "more pronounced than expected" due to the impact of the

omicron variant, the transport strike and the start of the war

in Ukraine.

The organism, yes, highlights that in the second quarter the activity is accelerating "partly due to the greater dynamism of the branches that require a greater degree of social interaction once practically all the restrictions have been relaxed."

On inflation, the organism does a double exercise.

On the one hand, it lowers the estimated figure for this year as a direct consequence of the Iberian mechanism to limit the price of gas introduced by the Government.

This measure will lower inflation by 0.5 points, with which the average CPI for 2022 will be 7.2% compared to the 7.5% previously estimated.

"However", points out the Bank of Spain, "the

inflation paths of food and the core component

are significantly revised upwards during the 2022-2024 period, which induces an upward revision of the general inflation rate forecast for 2023 and 2023".

Specifically, 2.6% in 2023 and 1.8% in 2024. An inflationary episode, Gavilán has summed up, "

more intense and persistent

".

Algeria and the disturbances

Gavilán has remarked that all these estimates can change if "additional disturbances" occur, and in fact he has remarked that "

every week we have an additional disturbance

".

The last one, the crisis between Spain and Algeria, of which he has not yet wanted to offer a specific impact estimate but in the face of which he has issued a clear warning.

"It could have an

appreciable impact on growth and inflation,

fundamentally in the short term," he pointed out, while recalling that "Spain imports around 30% of Algeria's gas."

That is, the crisis unleashed by the Algiers government will be a new problem for the limping Spanish economy.

Conforms to The Trust Project criteria

Know more