On Thursday, May 5, oil prices are steadily rising during international trading.

In the afternoon, the cost of raw materials of the benchmark Brent rose by 3.5% and briefly reached $113.99 per barrel.

The last time a similar figure was recorded on April 19.

The growth of quotations accelerated after the completion of the OPEC + ministerial meeting.

At a meeting on Thursday, representatives of the countries participating in the deal agreed to leave the previously agreed plans unchanged and from June 2022 to increase oil production by a total of 432 thousand barrels per day.

The OPEC+ decision reinforced the market's fears about a possible shortage of oil in Europe.

Artyom Deev, head of the analytical department at AMarkets, spoke about this in an interview with RT.

“The Alliance decided not to increase production beyond the designated quotas, even against the backdrop of growing rhetoric in Europe regarding the prospects for abandoning Russian oil.

This means that if the EU imposes an embargo on the import of raw materials from Russia, there may be difficulties with energy supplies.

Therefore, prices are rising, ”Deev explained.

Recall that since the end of February 2022, the European Union, together with the United States and a number of other states, continues to impose new economic sanctions against Russia.

This is how the West reacts to the conduct of a military special operation in Ukraine.

In total, more than 10.1 thousand restrictions have already been imposed on Moscow, as evidenced by the materials of the global sanctions tracking database Castellum.AI.

At the same time, on May 4, the European Union announced plans to introduce a new package of restrictions.

According to European Commission President Ursula von der Leyen, the measures imply, in particular, the refusal of the EU countries to purchase oil from Russia.

“Let's face it, it won't be easy.

But we just have to work on it.

We will take care of the phase-out of Russian oil,” the head of the EC wrote on Twitter.

At the same time, today there are no free capacities in the world to replace energy raw materials from Russia.

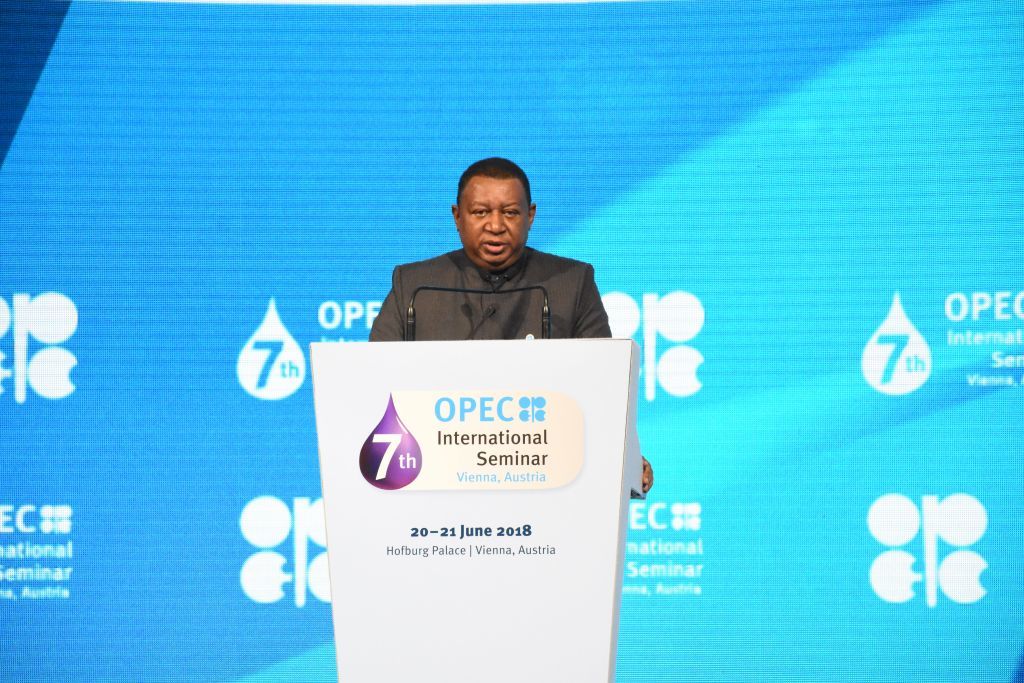

This was stated by OPEC Secretary General Mohammed Barkindo.

“Obviously, the export of Russian oil and oil products in the amount of more than 7 million barrels per day cannot come from somewhere else, there is simply no free capacity.

Its potential loss due to sanctions or voluntary restrictions will definitely be felt by the energy market, ”TASS quoted Barkindo as saying.

OPEC Secretary General Mohammed Barkindo

Gettyimages.ru

Note that Russia remains the largest supplier of oil to Europe.

According to the latest data from Eurostat, in 2020 Moscow provided 37% of the EU's needs for this type of fuel.

At that time, Germany was the most active buyer of Russian oil (34% of supplies came from the Russian Federation), the Czech Republic (49%), Hungary (61%), Poland (72%), Lithuania (73%), Finland (84%) and Slovakia ( 100%).

“So far, there is no unity in the European Union on this issue.

However, in the event of an embargo, the price of Brent will reach at least $125-130 per barrel in a matter of days, ”Natalia Milchakova, a leading analyst at Freedom Finance, suggested in a conversation with RT.

This state of affairs will lead to even greater growth in consumer prices in Europe, experts say.

According to Eurostat's preliminary estimates, in April annual inflation in the Eurozone has already updated its historical record and reached 7.5%.

According to experts, a further increase in the indicator risks turning into a serious challenge for the Europeans and a number of sectors of the EU economy.

“With the rejection of Russian energy resources, the European Union will obviously have to replace them with more expensive ones.

This will increase inflationary pressure in Europe and may lead to a forced reduction in production in the most energy-intensive sectors (metallurgy, chemicals, fertilizers) and stagflation.

The EU does not have much time left to replace Russian oil in the required volumes: it must be done no later than winter, ”Olga Belenkaya, head of the FINAM macroeconomic analysis department, told RT.

If the European Union imposes an embargo on oil imports from Russia, the country will need time to reorient supplies to Asian markets and solve logistical problems, Artyom Deev noted.

As the specialist emphasized, now Moscow provides significant discounts to its Asian partners.

Thus, if the price of Brent oil is above $110 per barrel, Russia sells its Urals crude at about $75 per barrel.

At the same time, the current price level is still comfortable for Russia, experts say.

For 2022, the country's budget was drawn up based on the cost of oil at $44.2 per barrel.

“The Russian budget is now receiving enough money to finance the necessary expenses.

The Urals price discount to Brent is quite wide.

However, even if the price of a barrel of Brent falls below $100, the situation, of course, will be undesirable, but not critical, ”Igor Galaktionov, an expert on the BCS World of Investments stock market, told RT.