The depreciation of the yen is accelerating due to the dollar-yen exchange rate in the foreign exchange market.

On the 16th, the US Federal Reserve Board decided to raise interest rates.

The yen's exchange rate temporarily dropped to the 119 yen level per dollar.

(As of 7:00 pm on March 18) There are complicated factors in the background, but I can see the reason why I am worried.

(Hidetoshi Inomata, Reporter, Ministry of Economic Affairs)

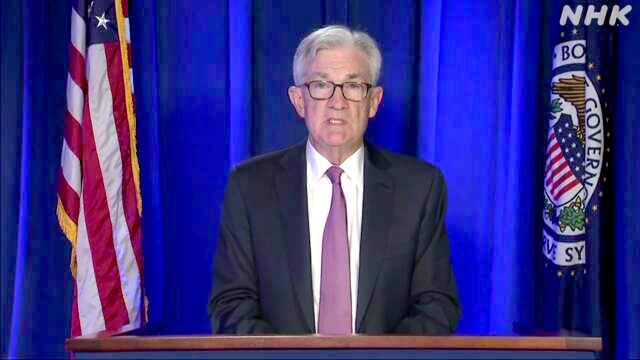

"We understand that high inflation ... will put a lot of hardship on people. The best we can do to support a strong labor market is to encourage long-term economic expansion,"

the Fed, 16th. Powell said at a press conference that he clarified his stance on raising interest rates.

What surprised market participants was the expected number of rate hikes.

He said he expects to raise rates six more times this year.

There are six remaining meetings in 2022, and if this is the case, we will raise interest rates each time.

The United States, where interest rates are rising, and Japan, where large-scale easing is maintained.

From the view that the interest rate differential will widen, the dollar will be bought and the yen will be sold. At one point, the yen was depreciated for the first time in about 6 years and 1 month with 1 dollar = 119.13 yen.

(As of 7:00 pm on the 18th)

Looking back at the yen exchange rate, we can see that the depreciation of the yen has gradually progressed.

The transaction at the beginning of last year started at around 103 yen per dollar.

After that, when expectations increased that the US economy would recover from the corona disaster and the delay in vaccination in Japan was transmitted to the market, dollar buying and yen selling would accelerate.

The price dropped to the 110 yen level in March last year.

Then, when the Fed became aware of a policy shift called "tapering," which would reduce the scale of quantitative easing, the view that the interest rate differential between Japan and the United States would widen became influential, and the yen depreciated rapidly.

Last November, it hit the 115 yen level for the first time in 4 years and 8 months.

The depreciation of the yen, which is currently progressing, is a combination of multiple factors.

In addition to the widening interest rate differential between Japan and the United States, Russia's invasion of Ukraine has made it easier for buy orders to gather in the dollar, which is said to be strong in an emergency.

However, there are some questions from market participants.

Among the currencies, the yen has been proud of its high credit as a relatively safe currency.

In such an emergency, I was skeptical that the power of the yen was weakened, although it was no wonder that an "emergency yen buying" occurred.

Please see this graph.

In fact, on February 24, when Russia's military invasion took place, the yen depreciated, but it seems that it has been fighting against the dollar since then.

Some market players analyze that investors who buy strong dollars and investors who buy yen were separated.

Why did the yen depreciate sharply in March?

One of the answers is the balance of payments.

Economic statistics showing how much Japan has earned through trade and investment.

Announced on March 8, January's current account is in the red for the second straight month.

The deficit has expanded to the second highest level in the past.

The main factor was that the "trade balance" became a deficit due to the rise in crude oil prices.

Market official 1

"The yen is no longer being bought. I expected that the movement to buy the yen would become stronger as the tension in the situation in Ukraine increased, but it is quite sluggish and limited. I also feel afraid that if it is not good, it will lead to "selling in Japan" and it will be a risk of speculation progressing spirally. "Marketer

2

" Originally, if the yen depreciates, inbound from overseas can be expected, but now Corona In the meantime, the structure has changed to a structure that tends to be in the red. Also, although it was once a major exporter, companies have moved their production facilities overseas, and as a result, the merit of yen depreciation has become difficult to take advantage of. ”

Japan As the world's leading current account surplus country, it has been evaluated in the financial market for many years.

Since the 1980s, the manufacturing industry has improved its external competitiveness, and in the 2000s, it has maintained a stable surplus due to the increase in investment income accompanying the overseas expansion of companies.

Is that figure about to change?

It seems that more attention is needed to what is behind the message sent by the current depreciation of the yen.

Next week, priority measures such as spread prevention that have been issued in 18 prefectures on the 21st will be lifted.

For the first time in about two and a half months, priority measures will not be issued to any region, and it is expected that business performance will recover in tourism and eating and drinking.

In addition, at Toshiba's extraordinary general meeting of shareholders on the 24th, attention will be focused on the whereabouts of the agenda, as so-called "shareholders who say things" investment funds oppose Toshiba's policy of splitting the company into two.