On Tuesday, February 8, the Russian currency strengthens on the Moscow Exchange.

In the middle of the day, the dollar fell by 0.6% to 74.99 rubles, and the euro by 0.7% to 85.68 rubles.

The values reached were the lowest since 13 January.

The official exchange rates of the Central Bank on February 9 were set at 75.3 rubles per dollar and 85.89 rubles per euro.

The national currency is moderately rising in price against the backdrop of weakening geopolitical risks, Dmitry Babin, an expert on the stock market at BCS World of Investments, believes.

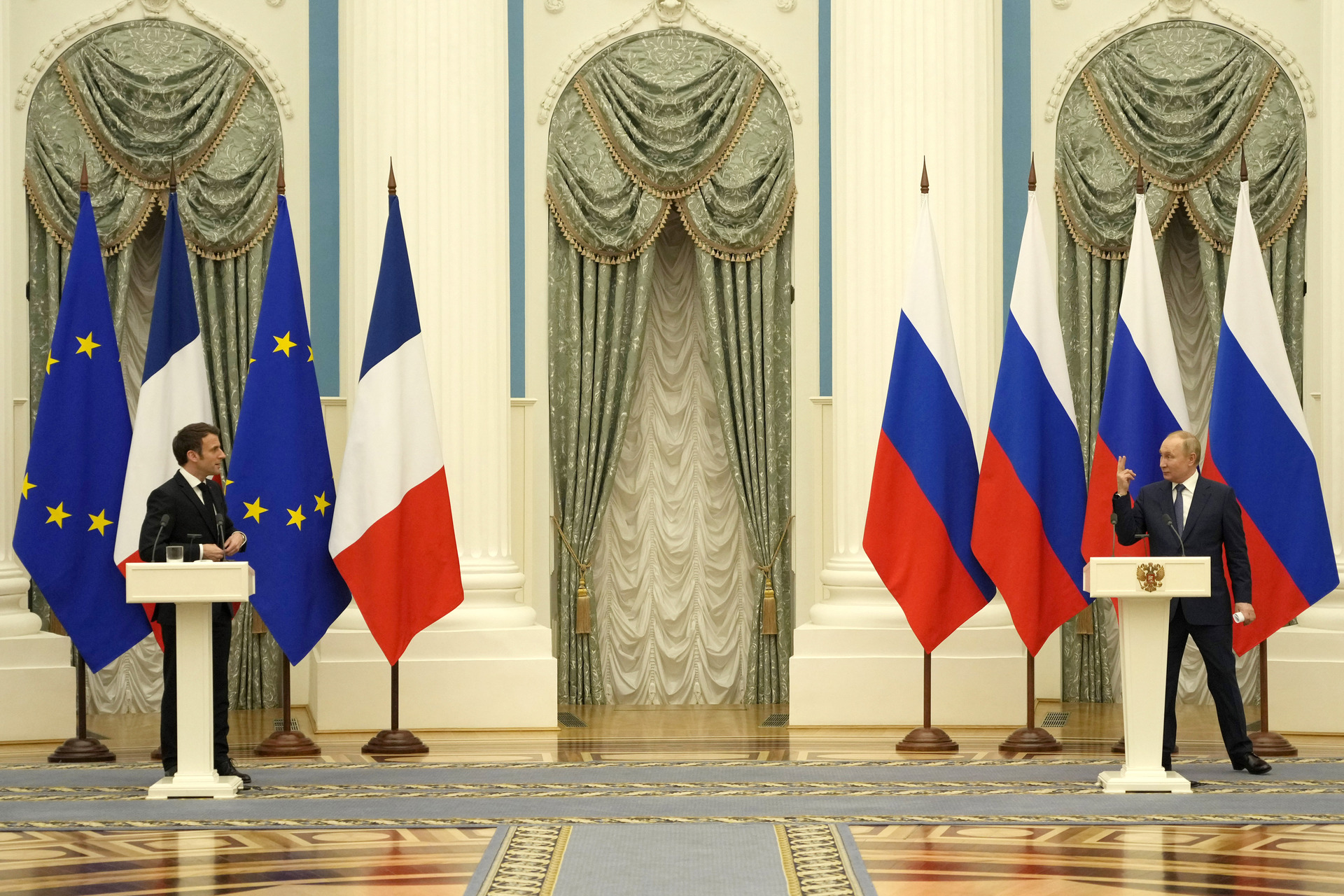

According to him, investors were encouraged by the results of the talks held the day before between the presidents of Russia and France.

“The continuation of the dialogue between Moscow and the West on acute geopolitical contradictions strengthens the hope that the worst scenarios for the development of the current situation are not realized.

The comments of Putin and Macron only added optimism on this issue, as a result of which the appreciation of ruble assets accelerated, ”Babin said in a conversation with RT.

The meeting of the heads of the two states took place on the evening of February 7 in Moscow and lasted almost six hours.

During the final press conference, Vladimir Putin announced Russia's readiness to continue the dialogue and "seek answers to key questions" on security guarantees.

Emmanuel Macron, in turn, expressed the hope that these negotiations could help de-escalate tensions.

AP

© Thibault Camus

Recall that on December 17, 2021, the Russian Foreign Ministry published draft treaties with the United States and agreements with NATO.

The documents speak, in particular, of mutual security guarantees in Europe and the refusal to further expand the alliance, including at the expense of the former republics of the USSR, including Ukraine.

After discussing these initiatives during a series of talks in January, the US and NATO handed over their written responses to Russia's proposals.

However, as Vladimir Putin noted, Moscow's fundamental concerns were ignored.

“The impression is that we did not even raise these questions, they were simply bypassed.

We see there political clichés and proposals on some minor issues.

I do not think that our dialogue is over here.

Now we will formulate an answer, our vision, and send it to Washington and Brussels,” the Russian leader said.

At the same time, a number of representatives of the United States, Great Britain and EU countries continue to accuse Moscow of preparing a "military invasion" of Ukraine.

Moreover, a number of Western politicians again came up with proposals for the introduction of new anti-Russian sanctions.

The deterioration of the foreign policy situation led to a noticeable weakening of the Russian currency in January.

So, in the first month of 2022, the dollar and euro exchange rates on the Moscow Exchange grew by about 3% and at the moment rose above 80 and 90 rubles, respectively.

However, already in February the situation on the foreign exchange market began to gradually stabilize, Dmitry Babin noted.

“If subsequent meetings of Russian representatives with foreign colleagues continue to reduce the degree of geopolitical tension, this will continue to spur interest in the ruble, Russian stocks and bonds, especially from foreign investors,” the analyst emphasized.

Currency support

Some support for the national currency is provided by the growth of oil prices, experts say.

Thus, in early February, the cost of raw materials of the Russian brand Urals at auction in Europe rose above $95 per barrel.

The last time a similar indicator could be observed was in September 2014.

“High prices for oil and other raw materials, of course, play in favor of the Russian currency.

I note that at the current cost of oil, the dollar should be no more than 66 rubles.

The observed difference with the current exchange rate suggests that the ruble is now greatly undervalued due to geopolitical risks,” Babin said.

The actions of the Central Bank also have a positive impact on the dynamics of the ruble, Andrey Maslov, an analyst at FG Finam, is sure.

As the specialist recalled, at the end of January, against the backdrop of a sharp increase in the dollar and euro, the Central Bank suspended the purchase of foreign currency on the domestic market as part of the budget rule.

“It is also worth noting that the Bank of Russia continues to tighten its monetary policy to fight inflation.

Most likely, at a meeting on February 11, the Board of Directors of the Central Bank will again raise the key rate from the current 8.5% to 9% or 9.5% per annum, which could further support the ruble," Maslov suggested.

globallookpress.com

© Konstantin Kokoshkin

Note that the increase in the interest rate of the Central Bank makes investing money in ruble assets more attractive to investors.

In particular, due to the actions of the regulator, the yield of federal loan bonds (OFZ) is increasing.

As a result, an additional influx of investments into the OFZ market has a positive effect on the dynamics of the ruble.

“At the same time, it is geopolitics that remains the key factor for the Russian currency now.

Despite the fact that the peak of the crisis seems to have already been passed, the ruble is still under pressure,” Andrey Maslov stressed.

The expert does not rule out the possibility of further strengthening of the national currency in the event of an improvement in the foreign policy background.

According to the specialist, in the coming weeks, the dollar and euro rates may drop to 74 and 84 rubles, respectively.

Dmitry Babin adheres to a similar assessment.

“If the situation on world markets does not deteriorate significantly, and the geopolitical situation at least remains stable, the dollar exchange rate in February will be in the corridor of 74-76 rubles, and the euro exchange rate will be at the level of 84.4-86.7 rubles.

In March, it is possible to consolidate rates under the lower boundaries of these ranges if the geopolitical factor improves,” he concluded.