Chinese consumers are becoming increasingly important to Lululemon.

In the past two years, Canada-based sportswear brand Lululemon has grown at a compound growth rate far outpacing other countries in China, and its market with the largest number of new store openings is also China.

This helped Lululemon surpass Adidas in market value.

Through brick-and-mortar stores and online platforms, Lululemeng's products are increasingly connected with Chinese consumers.

Made in China is becoming less and less important to Lululemon.

The production link of Lululemon is increasingly distant from China.

A reporter from China Business News recently visited Lululemeng’s Xintiandi store in Shanghai. Most of the products on display are from Vietnam, Cambodia and other countries, and less than 10 are made in China.

Disappearing Made in China

"There used to be some products made in China, but now there are fewer and fewer." At the Shanghai Xintiandi store of Lululemeng, a shopping guide told Yicai.com reporters.

Lululemeng's Shanghai Xintiandi store is an independent Chinese-style building.

The exterior walls of the three-storey building are made of blue bricks with Shikumen elements.

It is Lululemeng's largest store in East China. The first and second floors display men's and women's clothing respectively, and the third floor is dedicated to members' activities.

When the reporter visited this store, he checked the many categories of product tags on the shelves.

Lululemeng’s famous yoga clothes and winter down jackets for men and women are mainly from Southeast Asian countries, such as Vietnam, the Philippines or Bangladesh. Only a few products such as backpacks and hats are marked with “Made in China” on the labels.

According to Lululemon’s 2020 financial report, the company cooperates with about 40 suppliers in the manufacturing process. The top five suppliers manufacture about 60% of Lululemon’s products, and the largest manufacturer produces Lululemon. Mongolia 17% of the product.

Lululemon did not disclose who is its largest manufacturer, but it is certain that the manufacturer's main production plant is not in China, because China (including Hong Kong, Macao and Taiwan) generally only produces about 9% of Lulu's Lemon products.

Vietnam is the largest production base for Lululemon products.

Lululemon disclosed in its third quarterly report this year that about 33% of its products are produced in Vietnam, 20% are produced in Cambodia, and 12% are produced in Sri Lanka.

This trend is similar to that of sports brand Nike. According to the reporter’s financial report, more than half of Nike’s sports shoes are currently produced in Vietnam, about 25% are produced in Indonesia, and the proportion of production in China has dropped to 21%.

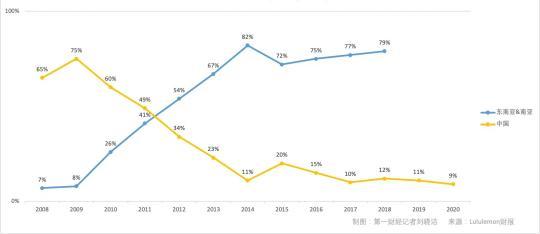

The proportion of Lululemon's products made in China used to be unusually high, especially in the first decade of this century.

2005 was a turning point for the export of China's textile and apparel products. In this year, in accordance with WTO regulations, the United States and other countries removed export quotas for China's textile and apparel products. That year, China's exports of Lululemon products to the United States surged.

Lululemon's first financial report showed that in fiscal 2007, 60% of the company's products were made in China; in fiscal 2008, China made 65% of Lululemon's products; fiscal 2009 was the peak of the parabola, China made 75% of Lululemon products that year; in 2010 the share made in China dropped to 60%.

In the second decade of this century, the proportion of Chinese-made products has declined unusually fast.

In 2011, the proportion of Lululemon produced in China dropped by 11 percentage points to 49%, while the South/Southeast Asia region rose to 41%; in Lululemon's fiscal year 2012, the proportion of Lululemon made in China dropped further to 34%.

Also missing is Made in Canada.

Canada, the country where Lululemon is headquartered, at one point made more than 18 percent of the company's products.

But Canadian manufacturing has lost ground in the competition with Asian manufacturers.

The company no longer separately disclosed the proportion of production in Canada in 2012, and the overall manufacturing proportion in North America was 3%.

Since then, the balance of manufacturing has continued to tilt towards Southeast Asian countries.

The proportion of Chinese-made products in Lululemon dropped to 23% in 2013, only 11% in fiscal 2014, 15% in fiscal 2016, 10% in fiscal 2017, 12% in fiscal 2018, and 11% in 2019 (including Taiwan 2% of the region).

In 2020, only 9% of Lululemon's products come from China (including 2% in Taiwan).

Lululemeng said in an official reply to the first financial interview that the company is committed to building a supply chain on a global scale, and its "standard operating method is to regularly evaluate and adjust the relevant layout."

China's manufacturing sector, especially the manufacturing industry along the southeast coast, has faced labor shortages for not a year or two.

In Southeast Asia, such as Vietnam, the labor force advantage is obvious.

Lululemeng stated in its 2010 financial report that the potential pressure faced by Chinese manufacturing at that time came from "the possibility of a significant appreciation of the RMB, labor shortages and rising labor costs."

Vietnam's appeal lies in its cheap labor costs and lower tariff rates for international markets.

However, in building a complete textile and garment industry chain, Vietnam still has a lot of shortcomings.

For example, 45% of the textile materials required for Lululemon products come from Taiwan, China, 18% from mainland China, and 16% from Sri Lanka.

"A lot of the raw materials and products we use come from China," Lululemon's official told Yicai.com: "In fact, two-thirds of the raw materials used by Lululemon come from mainland China and Taiwan, which are used in the global market. make our products."

Lululemon’s financial report shows that 45% of the textile materials needed for its current products come from Taiwan, China, 18% from mainland China, and 16% from Sri Lanka.

Booming Chinese market

During the epidemic, the number of Lululemon stores in China has exceeded the number of stores in Canada.

As of October 31, 2021, the number of Lululemon stores in China (including Hong Kong, Macau and Taiwan) has reached 71, an increase of 16 stores from the beginning of the year.

In the same period, Lululemon's U.S. stores increased by seven to 322, while the number of Canadian stores remained at 62.

In 2021, China will be the country with the most new stores for Lululemeng.

Thanks to China's strong containment of the new crown epidemic, consumers' social and shopping needs have recovered.

According to Lululemeng’s third-quarter quarterly report this year, its sales in both online and physical stores in China are very strong, and it has achieved a compound growth rate of 70% in the past two years, significantly exceeding the overall growth rate of the international market.

Taking the European market as an example, the compound growth rate of Lululemon in the past two years is only 20%.

"We are very satisfied with the 70% compound growth in the Chinese market. The company continues to invest in new stores in China and the China headquarters in Shanghai." Calvin McDonald, CEO of Lululemon, on the results of the third quarter of 2021 communicated at the meeting.

The growth in the number of Lululemont stores in China is a continuation of past trends.

In 2020, the epidemic caused Lululemon to temporarily close all its stores in China.

Those stores quickly reopened as the outbreak was brought under control, and the company hasn't stopped opening new stores in China.

In 2020, Lululemen opened 17 new stores in China, more than any other country.

As of the end of 2020, Lululemon operates 521 stores in 17 countries, the vast majority of which are in the United States and Canada, with China having the third-highest number of stores (55).

This strong growth in store numbers has only occurred in two countries: China and the United States.

In terms of global comparison, the number of stores in Canada, where Lululemon is headquartered, has basically remained at around 60, which has basically not increased since 2017; the number of stores in the United States has increased from 274 in 2017 to 315. , but only 10 new stores will be opened in 2020.

It only took six years for China to become Lululemeng's second largest country with the number of storefronts.

And Lululemeng controls the distribution channels herself.

An employee of Lululemeng told China Business News that all its 71 stores in China are self-operated, and there are no third-party franchise stores.

Lululemeng only opened its first store in China in 2016.

Its yoga clothes and other products are expensive, and Chinese consumers are in high demand.

The growth of China's middle-class population and the desire for healthy living have contributed to a booming sportswear market.

Lululemon and its competitors Nike, Adidas, etc. have benefited greatly from this rapidly growing cake.

Take Nike and Adidas for example. These two companies have been in China for a long time and have long been the largest market share holders of sportswear in China.

Lululemeng seems to have the momentum of latecomers.

The sportswear dark horse company currently has a market value of about $48 billion, surpassing Adidas and ranking behind Nike.

(Our reporter Liu Xiaojie also contributed to this article)