The Central Bank proposed to amend Russian legislation to limit operations with cryptocurrencies in the country.

On Thursday, January 20, the Central Bank presented the relevant initiatives in a report for public consultations.

“The spread of cryptocurrencies poses significant threats to the well-being of Russian citizens, the stability of the financial system and the threats associated with servicing illegal activities with cryptocurrencies,” the regulator’s report says.

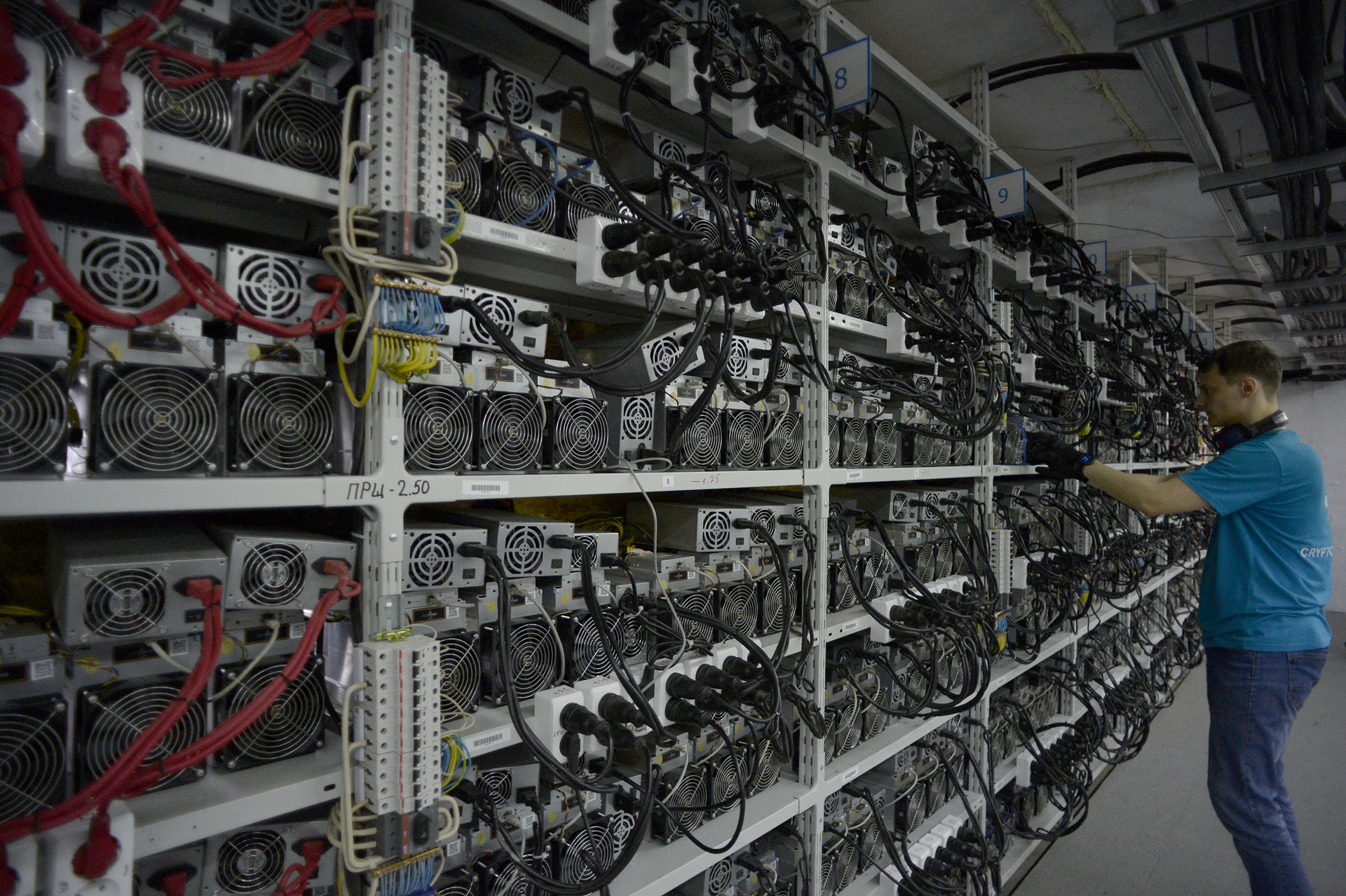

To reduce such threats, the Bank of Russia advocates the introduction of a complete ban on mining, issuance, organization of circulation and exchange of cryptocurrencies in the country.

At the same time, the regulator proposes to ban banks from investing their funds in cryptocurrency, stop any transactions with digital coins using the infrastructure of the Russian financial market, and also block transactions for the sale and purchase of cryptocurrency for real money.

In addition, the Central Bank considers it necessary to introduce liability for Russians and Russian legal entities for purchases in cryptocurrency and for violation of other prohibitions.

As Elizaveta Danilova, director of the financial stability department of the Bank of Russia, clarified during a press conference, we can talk about fines.

At the same time, according to her, it is too early to talk about criminal liability.

“Naturally, specific measures need to be discussed, and we will continue to discuss them with departments and the market.

As for the timing and changes, then, naturally, changes in federal legislation will be required.

Proposals for these changes are under development and will be ready in the coming months,” Danilova emphasized.

It is noteworthy that the initiatives of the Bank of Russia do not imply the introduction of a ban on the possession of cryptocurrencies.

According to Elizaveta Danilova, Russians will still be able to conduct transactions with electronic money in foreign jurisdictions.

According to the Central Bank, the volume of cryptocurrency transactions made by Russians annually is about $5 billion. At the same time, the share of Russian users on various crypto exchanges varies from 7 to 14.5%.

As Anatoly Aksakov, chairman of the State Duma Committee on the Financial Market, noted in an interview with RT, the Bank of Russia took a rather tough stance on cryptocurrencies.

Nevertheless, the actions of the regulator are necessary to protect the finances of the population, the deputy is sure.

“We were waiting for such a report from the Central Bank and treat it with understanding.

Investment in cryptocurrencies has skyrocketed during the pandemic.

Millions of Russians have invested in various cryptocurrency instruments that have all the signs of financial pyramids.

Such assets are not backed by anything, and their owners may face a very sad prospect of irretrievable loss of money,” Aksakov noted.

In his opinion, the ban on mining is also important, since the mining of cryptocurrencies puts a serious burden on local power networks and can cause power outages.

As a result, as Aksakov emphasized, ordinary consumers suffer.

“Moreover, miners buy energy at a price for the population, although they use it for business.

At the same time, they do not pay taxes,” the deputy added.

AFP

© OLGA MALTSEVA

Note that cryptocurrencies exist on the basis of blockchain technology - a single database that contains information about all transactions performed.

The issue of new digital coins occurs due to mining - solving complex mathematical problems and the appearance of a new block in the blockchain network.

Each such block is a data array, which contains information about transactions carried out after the creation of the previous block.

As a reward for solving the problem, miners receive cryptocurrency.

According to the Central Bank, in August 2021, Russia ranked third in the world in terms of bitcoin mining.

The share of the country today accounts for 11.23% of computing power.

“Against the background of the actions of the Central Bank, miners will probably have to move to other countries.

This could put significant pressure on the global cryptocurrency market.

As for ordinary users, their life will become much more complicated.

The Central Bank will in every way prevent the exchange of cryptocurrencies for real money and vice versa.

However, the regulator cannot influence the funds that have already been invested in cryptocurrencies, but it is not going to, ”said Vladimir Ananiev, EXANTE analyst, in a conversation with RT.

Beijing example

It is curious that the Central Bank in its actions to regulate the cryptocurrency market can follow the example of China.

Valery Romanyuk, First Vice President of the Russian Association for Cryptoeconomics, Artificial Intelligence and Blockchain (RACIB), shared this opinion with RT.

In 2021, the PRC authorities banned financial institutions and companies in the country from accepting cryptocurrencies as a means of payment and from providing services related to digital assets. Later, the People's Bank of China demanded that credit institutions and payment operators tighten control over customer transactions in order to prevent transactions and transactions with bitcoin and its analogues. At the same time, the country's leadership also began to fight against mining.

“China has effectively banned all types of cryptocurrencies ahead of the launch of the digital yuan.

Beijing is already testing its e-currency, and its large-scale implementation is planned to begin in time for the Olympics.

Russia is also now developing a digital ruble, and the public hearings initiated by the Central Bank are a kind of signal to the market.

Tough decisions regarding cryptocurrencies are being discussed in order for the digital ruble to be widely accepted later, ”Romanyuk suggested.

The Bank of Russia announced the development of an electronic national currency back in 2020.

As expected in the Central Bank and the Ministry of Finance, over the next ten years, the digital ruble will be actively used along with cash and non-cash money.

Note that the Central Bank issues cash in the form of banknotes, each of which has a unique number, and non-cash rubles are entries in commercial bank accounts.

In turn, the Central Bank will assign the form of a unique code to the digital ruble, which will be stored in a special electronic wallet.

According to the Central Bank, keeping money in digital rubles will ensure a “high level of safety and security of funds.”

At the same time, the emergence of an electronic currency will make it possible to develop the country's payment infrastructure, control the spending of budgetary funds and simplify cross-border payments.