The largest number of public fund investors in Guangdong

From the perspective of the total scale of financial assets, nearly 70% are less than 500,000 yuan

Text/Biao Yangcheng Evening News reporter Ding Ling

Since 2019, the concept of "it is better to buy funds than to invest in stocks" has become more and more popular.

Which region has the largest number of individual investors, and which types of public offering funds are more favored by individual investors. Under the background of the erratic market, whether Christians will also have anxiety... The Asset Management Association of China recently released " National Public Fund Market Investor Status Survey Report (2020)" (hereinafter referred to as the "Report"), the "Report" survey collected 84,807 questionnaires from individual investors and 409 institutional investors, outlining the 2020 annual public fund investors. portrait.

Guangdong has the largest proportion of individual investors

How about the income of individual investors who are keen to buy funds?

The "Report" shows that in terms of income, over 90% of individuals have an annual after-tax income of less than 500,000 yuan.

In 2020, the personal after-tax income of the natural person investors surveyed was mostly below 500,000 yuan, accounting for 91.60%, which was basically the same as the 2019 survey data (91.40%).

500,000 yuan has become an obvious watershed, and only 8.40% of the income is more than 500,000 yuan.

Investors with income between RMB 100,000 and RMB 500,000 are the most, accounting for 45.30%; followed by investors between RMB 50,000 and RMB 100,000, accounting for about 30% (31.80%); investors below RMB 50,000 account for The ratio is 14.50%; the proportion of 500,000-3 million yuan is 7.20%; the proportion of more than 3 million yuan is about 1.20%.

In terms of the regions where individual investors are located, Guangdong, Beijing, and Shanghai are home to about one-third of the country's investors.

The natural person investors in this survey cover all provinces, autonomous regions and municipalities directly under the Central Government, and there are natural persons whose permanent residence is in Hong Kong, Macau, Taiwan and overseas.

Among them, Guangdong, Beijing and Shanghai have obvious leading advantages, accounting for more than 9%.

Guangdong is the place with the most concentrated residence of individual investors in this survey, accounting for 13.90%; followed by Beijing, accounting for 11.60%; and finally Shanghai, accounting for 9.90%.

Investors from the three places accounted for a total of 35.40%.

In addition, judging from the total scale of financial assets held by individual investors, nearly 70% of individual investors are less than 500,000 yuan.

The "Report" shows that 5% of individual investors have financial assets with a total scale of more than 3 million yuan; 9.30% have financial assets between 1 million and 3 million yuan, and their financial assets are between 500,000 and 1 million yuan. 17.40% of the total, and 31.70% of individual investors with financial assets above 500,000 yuan.

Over 70% of investors are positive

Which finances are favored by individual investors?

The "Report" shows that the financial products invested by individual investors are characterized by cash management and diversified allocation. Among them, "bank wealth management products" and "deposits" account for more than 50%, 53.2% and 53.0% respectively. %; "stocks", "non-monetary public funds" and "monetary funds" accounted for 45.3%, 41.8%, and 38.2% respectively; "bonds" and "insurance products" accounted for 10%-20%; "private securities" Funds, "futures, options and other financial derivatives", "private equity funds" and "trust products", etc., all accounted for less than 10%.

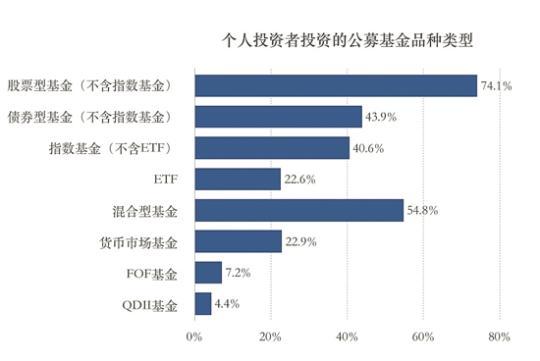

In terms of investment types of public funds, individual investors are more inclined to stock and hybrid funds.

More than 70% of the individual investors surveyed (74.10%) chose stock funds as the main investment varieties of public funds, and 54.80% chose hybrid funds, with stock and hybrid funds performing more prominently.

The selection ratios of other bond funds (excluding index funds), index funds (excluding ETFs) and money market funds are 43.90%, 40.60% and 22.90% respectively.

Another 22.90% and 22.60% of investors choose money market funds and ETFs; the proportion of choosing FOF funds, QDII funds and other funds is less than 10%.

When buying public funds, most investors choose to trust their own judgments, and the proportion of buying public funds is as high as 66.7% when "they find out that a certain fund is performing very well".

It is worth noting that the highest proportion (66.80%) of the timing of buying public funds is "the broader market is falling, there is a chance to hunt for the bottom", while the proportion of "the broader market is rising, optimistic about the market situation" is 44.50%.

It can be seen that individual investors are more inclined to take risks in the market with certain risks to find investment opportunities.

At the same time, over 70% of investors hold a positive attitude towards the fund's scheduled investment.

In general, most natural person investors hold a positive attitude towards the fund's scheduled investment.

71.10% of the respondents believed that fund fixed investment "can diversify investment risks and is an investment method that saves worry and effort".

15.40% of investors hold a neutral attitude, believing that fund fixed investment "is no different from general fund investment".

Only 13.40% of investors held a negative attitude, believing that "fund investment is not as good as general fund investment, and it is better to choose by yourself".

Over 60% of investors focus on long-term gains

The "Report" also shows that over 60% (63.30%) of investors pay more attention to long-term returns after purchasing funds.

Among them, the proportion of "generally not checking account profit and loss" was 23.20%, and the proportion of "occasionally checking account profit and loss" was 40.1%.

In addition, more than 30% of investors said they "frequently check their accounts".

Among them, 25.10% of investors "frequently check the profit and loss of the account but do not trade frequently"; only 11.50% of the investors "frequently check the account and conduct trading operations".

Compared with last year's survey data, the proportion of investors who generally do not check account profit and loss has dropped from 34.60% to 23.20%, and the proportion of investors who occasionally check account profit and loss has dropped from 51.90% to 40.10%, which shows that investors are paying attention to changes in the fund market. degree has increased.

From the data of redemption funds, among the various reasons leading to the redemption of public funds, "they need cash" is the most important factor (65%), and "the stock market performs poorly or may fall" ranks second. , 51.20% of investors take it into consideration.

Fund performance is also an important factor. 46.40% and 45.90% of individual investors will consider whether the fund's performance has reached the expected target when deciding whether to redeem a public fund, and whether the fund's performance is compared with other types of funds. Performance.

In addition, 32% of investors will redeem funds due to changes in fund managers, 21.90% of investors will redeem funds due to major events such as equity and executive changes in the fund management company, and only 9.30% of investors will be due to bank customers. Redemption of the fund on the recommendation of the manager.