More than 30 million mu of cotton in the main production area have been successively purchased——

Steady quality of cotton increases, cotton yields increase

Our reporter Liu Jin

In the recent period, more than 30 million mu of cotton in Xinjiang Uygur Autonomous Region has been successively purchased by processing plants.

The cotton farmer, who has been busy for more than half a year, has a happy harvest on his face.

"At present, the cotton purchase has come to an end." Wang Jianhong, vice president and secretary general of the China Cotton Association, introduced in an interview with the Economic Daily reporter that as of December 19, 2021, the cumulative processing volume of lint nationwide was about 4.4863 million tons, a year-on-year decrease of 2.8% , the quality has improved significantly compared with the previous year.

The recent changes in the international trade situation have brought new challenges to the development of the cotton industry. Wang Jianhong said that China's cotton will continue to adhere to opening up and cooperation, and changes in external factors will not hinder the high-quality and sustainable development of China's cotton industry in the future.

Steady planting: the income is getting better and better

In Inbostan Village, Kumish Town, Toksun County, Turpan City, Xinjiang, Keremu Aihemat, a 38-year-old major cotton grower, has been dealing with cotton for seven years.

Beginning in 2018, all cotton fields in Keremu have been mechanized planting, making cotton planting easier and more efficient, with better returns.

"There is Beidou navigation for planting, automatic drip irrigation for watering, and mechanization of cotton picking." Keremu said that in recent years, the scale of his cotton planting has increased year by year, and now it has reached more than 600 mu, with a net income of more than 600,000 yuan a year. Yuan.

In recent years, with the country's implementation of the cotton target price subsidy policy, agricultural machinery subsidies and land transfer and other policies to support Xinjiang, the income of cotton planting has continued to increase, and the cotton planting area and cotton output in Xinjiang have grown rapidly. The proportion is increasing.

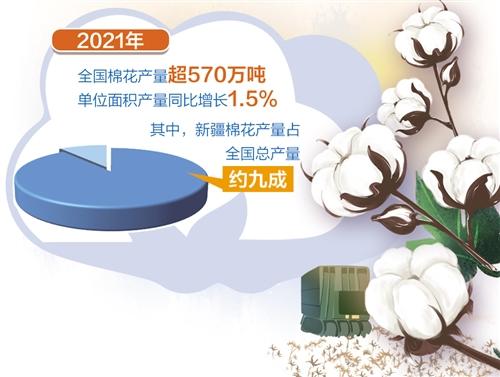

"Now Xinjiang's cotton production accounts for more than 90% of the country's total output." Wang Jianhong introduced that Xinjiang's total cotton production, unit yield, planting area, and commodity allocation have ranked first in the country for more than 20 consecutive years.

Compared with Xinjiang, other provinces have been affected by factors such as planting efficiency and planting structure adjustment, and the cotton planting area has declined year by year.

Liu Shuang, general manager of Hubei Yinfeng Cotton Co., Ltd., who is checking the processing progress in Xinjiang, told reporters that Yinfeng used to carry out business across the country, but now the entire acquisition and processing business is located in Xinjiang.

In order to stabilize cotton production, various departments of the national cotton trading market cooperate closely, and promote the implementation of "professional storage supervision + notarization inspection in warehouse" in Gansu Province.

As of November 30, 2021, the reserved storage volume of cotton is 13,800 tons, and the annual storage volume is expected to exceed 20,000 tons.

Stable quality: fine management pays off

In 2021, Xinjiang cotton was affected by cold air in the early stage of growth, and its growth and development was later than that in 2020, and the growth was weak; the weather was good from June to August, and the growth changed from weak to strong or even better than in 2020. The picking basically ended at the end of November, and the unit yield was worse than expected.

Judging from the survey results of the China Cotton Association on the national cotton production situation at the end of November 2021, since the unit yield was lower than previously expected, the total output was slightly lower than the previous period.

Liu Shuang revealed that from the statistics of the National Cotton Quality Monitoring Center, the output of Xinjiang cotton in 2021 will be lower than that of the previous year.

Although the weather has affected the output, it has not lowered the quality. The quality of Xinjiang cotton in 2021 will be significantly improved compared with the previous year.

According to statistics from the China Fiber Quality Monitoring Center, the color grade, length, breaking strength, micronaire value, length uniformity and other indicators of Xinjiang cotton have increased significantly compared with the same period in 2020.

Liu Shuang said that Xinjiang's better light and heat conditions, coupled with the improvement of the cotton subsidy policy, and the meticulous management of water and fertilizer from seeds to planting, have all contributed to the improvement of Xinjiang's cotton quality.

The degree of mechanization of cotton cultivation in Xinjiang continues to increase.

Wang Jianhong introduced that in 2021, the proportion of machine-picked cotton in northern Xinjiang will exceed 90%, and the proportion of machine-picked cotton in southern Xinjiang will also be close to 80%.

The equipment owners who are on the front line of cotton harvesting have made a lot of money.

Abuduwaili Hujiamaiti, a villager in Imberstein Village who bought two forklifts, can earn 80,000 yuan a month by loading and unloading cotton during the harvest season alone.

Stabilizing the price: the expectation of processing enterprises

In 2021, the purchase price of seed cotton will open up and go up, and then the price will start to fall.

On November 18, China's cotton price index reached a maximum of 22,713 yuan / ton. After that, as new cotton came into the market in large quantities, reserve cotton continued to be put in, and enterprises had more resources to choose from, and cotton prices showed a downward trend.

"In the early stage of the acquisition, cotton prices at home and abroad accelerated, and spot prices in futures hit a new high in nearly 10 years." Wang Jianhong recalled that on December 23, 2021, China's cotton price index was 21,947 yuan / ton, still higher than the price of imported cotton.

If the average purchase price of seed cotton in Xinjiang is 10.5 yuan/kg, the price of folded lint cotton is 22,893 yuan/ton, and the market price is already lower than the processing cost, causing greater operational risks to processing enterprises.

Liu Shuang told reporters: "The acquisition cost in 2021 should be more than 50% higher than the previous year." He believes that in addition to overcapacity, there is also a reduction in cotton production, a phenomenon of rush to harvest during acquisition, coupled with the impact of commodity prices, and many factors push up the purchase price.

On the one hand, the high cotton price may cause the ginners to purchase high-priced cotton and make losses difficult to sell, and on the other hand, it will lay a risk for the downstream production and export of cotton, textiles, and clothing in the later period.

According to feedback from many cotton manufacturers, the production cost of lint cotton in 2021 is mostly around 23,000 yuan/ton, but the current acceptable raw material prices for spinning enterprises are mostly in the range of 21,000 yuan/ton to 21,500 yuan/ton.

In previous years, most production companies were able to unwind their spot inventories after the futures price gave a hedging opportunity. However, the 2021 spot price was seriously inverted, making the ginners lose the hedging opportunity.

Wang Jianhong suggested that suspending the release of reserve cotton and increasing the import quota will help ease the pressure of spot inversion in the cotton price period, narrow the price difference between domestic cotton and imported cotton, and boost the sales of domestic cotton.