There were more than 500 IPOs throughout the year. Which brokerage and investment banks have “earned in”?

2021 is about to come to an end. During this year, the sci-tech innovation board registration system has been implemented steadily, and the pilot reform of the ChiNext registration system has progressed steadily. Partially move towards the whole market.

The number of newly listed companies in the past year exceeded 500, which also ushered the sponsors in an IPO feast.

According to statistics from China Business News, as of December 26, a total of 515 new A shares were listed during the year, with a total fundraising of 532.567 billion yuan, which is a further increase from the approximately 430 new shares in 2020 and nearly 470 billion yuan in fundraising. .

Of the 515 new shares, more than 70% were issued through the registration system, including 157 new sci-tech innovation board companies, 196 ChiNext stocks, and 41 Beijing Stock Exchange.

Incremental investment banking business emerged from this.

Wind data shows

that in terms of

independent sponsorship, 19 brokerage companies have sponsored more than 10 companies so far this year.

59 sponsors of CITIC Securities ranked first, and China Securities (39), Haitong Securities (33), Minsheng Securities (29), and Huatai United (26) entered the top ten.

Around the IPO, "withdrawal as soon as possible" and "withdrawal in batches" have also become the focus of the year.

The termination and withdrawal of counseling companies may cause some small and medium-sized brokerage investment banks to "no revenue."

The leading advantage remains, and the cutting-edge breaks into the top ten

With 515 IPO sponsors, leading brokerage firms still have an absolute advantage.

The 59 sponsors of CITIC Securities ranked first, 39 CITIC Construction Investment and 33 Haitong Securities ranked the top three.

The above-mentioned three brokerages have accumulatively sponsored 131 companies, and won 25% of the market share.

The number of sponsors is followed by: Minsheng Securities (29), Huatai United (26), Essence Securities (20), China Merchants Securities (18), China International Finance Securities (18), CICC (17) Companies), Yangtze River underwriting sponsors (17 companies), Guotai Junan (17 companies), Guosen Securities (17 companies).

The number of IPO sponsors is 10-15: Guoyuan Securities (14), Shenwan Hongyuan underwriting sponsor (11), Zhongyuan Securities (11), Dongxing Securities (11), Everbright Securities (11), Industrial Development Securities (10 companies), Oriental Investment Bank (10 companies).

In addition, Zheshang Securities, Zhongtai Securities, Western Securities, Northeast Securities and other sponsors have more than five sponsors.

In terms of "large IPO orders", CITIC Securities and CICC have outstanding advantages.

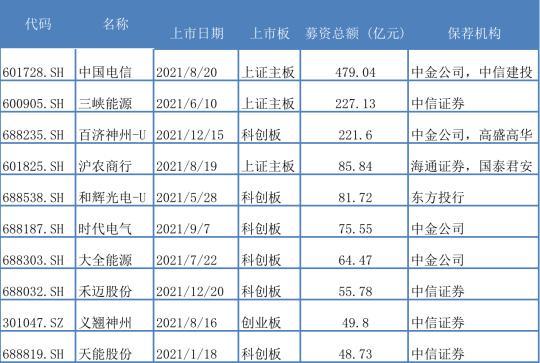

As of December 26, China Telecom, Three Gorges Energy, and BeiGene were among the top three in terms of total funds raised during the year.

Among them, China Telecom’s total fundraising amounted to 47.904 billion yuan, which was jointly sponsored by CICC and CITIC Construction Investment; Three Gorges Energy was sponsored by CITIC Securities; BeiGene was jointly sponsored by CICC and Goldman Sachs Gaohua.

The total amount of funds raised by Shanghai Rural Commercial Bank, Hehui Optoelectronics, Times Electric, and Daquan Energy also entered the top ten this year.

Overall, for the top ten IPOs, 4 CITIC Securities independently sponsored, 2 CICC independently sponsored, 2 joint sponsors, and 1 Oriental Investment Bank independently sponsored.

In addition, China Securities, Haitong Securities, Guotai Junan, and Goldman Sachs Gaohua have all won a joint sponsorship.

From the perspective of initial underwriting revenue, according to Wind data, as of December 26, 69 brokerages with statistical data have achieved a total of 26.984 billion yuan in initial underwriting revenue.

"Three in one China" is a big moneymaker. CITIC Securities' initial underwriting income was 3.625 billion yuan, and it was the only securities firm that earned more than 3 billion yuan in this year.

CITIC Construction Investment and CICC recorded initial underwriting revenue of 2.044 billion yuan and 2.028 billion yuan respectively.

The initial underwriting revenue of Huatai United, Haitong Securities, Minsheng Securities, Guotai Junan, China Merchants Securities, and China National Finance Securities also exceeded 1 billion yuan.

In terms of market share, CITIC Securities alone won 13.43% of the market. Including it, the above-mentioned nine brokerages took up nearly 60% of the total market share.

After the above-mentioned head institutions, there are 8 companies with initial underwriting income in the range of 500 million to 900 million yuan, including Guosen Securities (861 million yuan), Essence Securities (788 million yuan), and Guoyuan Securities (703 million yuan).

It is worth mentioning that several brokerage (underwriting sponsors) subsidiaries ranked top in first-issue underwriting income. Shenwan Hongyuan’s underwriting sponsorship attracted 574 million yuan, the Oriental Investment Bank was 522 million yuan, and the Yangtze River underwriting sponsorship was 484 million yuan.

However, a group of small and medium investment banks are at a disadvantage in initial underwriting income.

During the above-mentioned period, 19 brokerages had revenues of less than 100 million yuan, including Galaxy Securities, Pacific Securities, and Cinda Securities.

Medium-sized brokerages borrow the registration system

With the help of the registration system, a number of medium-sized brokerages and underwriting sponsor subsidiaries of brokerages broke out of the siege, and the number of sponsoring companies increased significantly.

Minsheng Securities won 29 IPO sponsorship qualifications, ranking fourth, ahead of Huatai United and Essence Securities.

Among them, 14 on the ChiNext, 11 on the Science and Technology Innovation Board, and 1 on the Beijing Stock Exchange, a total of 26, accounting for 89% of their sponsors.

In addition, there are 1 Shanghai Stock Exchange Main Board and 2 Shenzhen Stock Exchange Main Board.

The total fund-raising amounted to more than 1 billion yuan for the three orders of Xinrui shares, Haoyuan Pharmaceutical, and Anxu Biological.

Nearly 90% of the 17 companies that Yangtze River underwrites and sponsors serve as intermediary agencies have landed in the registration system.

Among them, 10 are on the Growth Enterprise Market, 4 on the Science and Technology Innovation Board, and 1 on the Beijing Stock Exchange.

On the whole, most of the 17 companies have raised funds of less than 600 million yuan, and the total amount of funds raised by Huayang Variable-speed listed on the Beijing Stock Exchange is only 143 million yuan.

For brokerage investment banks, another major business opportunity this year comes from the Beijing Stock Exchange.

According to data, as of now, there are 82 listed companies on the Beijing Stock Exchange, and 41 of them were listed within the year.

From the perspective of the first batch of listed companies, according to the statistics of the Beijing Stock Exchange website, the first batch of 81 companies (including 71 from the NEEQ selection layer) were sponsored by 37 brokerage investment banks (subsidiaries).

CITIC Construction Investment ranked first with 12 orders, involving projects such as Keda Automation and Jinhao Medical; Essence Securities (7 companies), Shenwan Hongyuan underwriting sponsors (6 companies), Kaiyuan Securities (5 companies), CITIC Securities (4 companies) ), Northeast Securities (4 companies), Yangtze River Securities underwriting sponsors (3 companies), and Zhongtai Securities (3 companies) are also major business players.

The above-mentioned 8 securities companies have a total of 43 sponsors, accounting for more than 50%.

In addition, Soochow Securities, Tianfeng Securities, and Galaxy Securities have all participated in the sponsorship of the first batch of companies.

"Remove material" as a key word

As the issuance of new shares advances to the era of the registration system and is engaged in investment banking business, securities firms must truly "return to their positions and conscientiously."

During the year, the withdrawal of IPO materials and "passing through barriers with illness" became the focus of supervision.

Judging from the situation of the GEM registration system, the reporter, according to statistics from the Shenzhen Stock Exchange website, found that 96 IPO companies have terminated their review due to "withdrawal" during the year so far.

What are the sponsors behind the companies that withdraw materials?

CITIC Securities, Minsheng Securities, and Guosen Securities each have 7 orders, Huatai United and China Merchants Securities each have 6 orders, China National Finance Securities, China Securities Investment Co., Ltd. have 5 orders, and Dongxing Securities and Soochow Securities both have 4 orders.

During the year, Wanhe Securities had 5 GEM registration projects and 3 withdrawal materials.

According to the Shenzhen Stock Exchange website, its sponsored Zhenmei shares, Le Demei, and Runke Biology, three proposed GEM companies, all withdrew their listing applications during the year.

Jiaqi Technology terminated its registration in October due to the expiry of the IPO financial information.

During the year, Donghai Securities sponsored 3 GEM IPO projects and 2 withdrew materials.

Counseling companies to withdraw materials may also make some brokerages' IPO business on the Growth Enterprise Market this year "no revenue."

According to data, during the year, Echo Bid sponsored by Guosheng Securities, Zhongheng New Materials sponsored by Hongta Securities, and Zhongcheng Development sponsored by Huajin Securities were all terminated (withdrawn), and these projects were the only GEM IPO projects of the aforementioned institutions during the year.

In response to the high rejection rate of investment banking projects, this year, strict supervision of intermediary agencies has been upgraded.

On July 9th, the China Securities Regulatory Commission issued the “Guiding Opinions on Supervising Securities Companies to Engage in Investment Banking Business under the Registration System to Relocate and Responsible” and stated that it will have a high rejection rate for investment banking projects, a high corporate bond default rate, low practice quality, and market reporting problems. Many securities companies carry out special inspections; establish a quality evaluation mechanism for business personnel by the internal control department, and it is strictly forbidden to directly link the remuneration of business personnel with project income.

"Expand on-site inspection and supervision, and adhere to the principle of'reporting responsibility'. For items withdrawn after receiving on-site inspection or supervision notice, inspections should be organized in accordance with the law to resolutely put an end to the behavior of entering the customs with illness." The above-mentioned guidance mentioned. .

(Author: Zhou Nan)