The central bank’s new formulation of monetary policy has aroused strong market attention.

The Monetary Policy Committee of the People's Bank of China held its fourth quarter 2021 regular meeting in Beijing on December 24. The meeting mentioned structural monetary policy, market liquidity, and real estate.

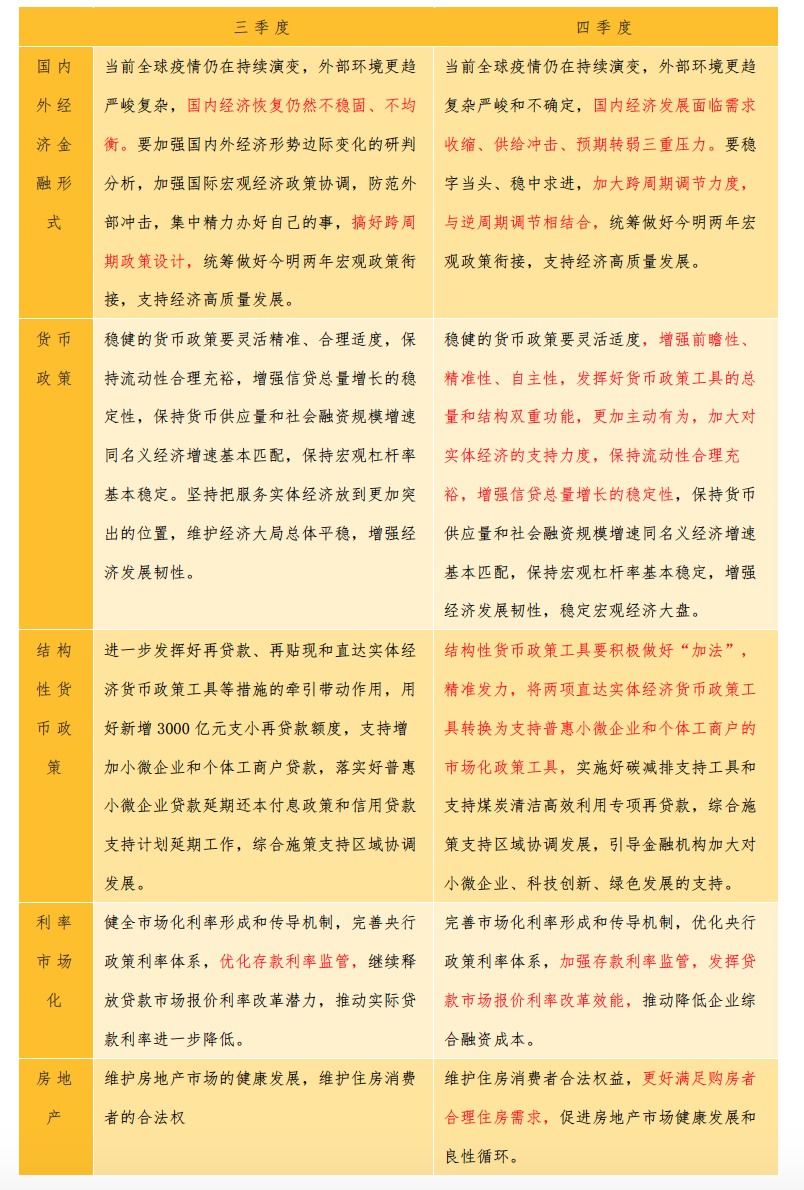

Compared with the content of the third quarter regular meeting, the content of the fourth quarter regular meeting has many adjustments.

For example, the meeting emphasized that it should be more forward-looking, precise, and autonomous, and give full play to the dual functions of monetary policy tools in terms of total volume and structure, and be more proactive. At the same time, it was proposed that structural monetary policy tools should be actively "additive" and precise. Make effort and so on.

More emphasis on the structural role of monetary policy

Compared with the content of the third quarter regular meeting, in terms of the expression of the domestic and foreign economic and financial situation, the fourth quarter regular meeting added "uncertainty" on the basis of the "severe and complicated" internal and external environment, and added "domestic economic development facing shrinking demand." , Supply shocks, and expected weakening triple pressures".

In terms of policy response, it has also been adjusted from "doing a good job in cross-cyclical policy design" to "intensifying cross-cyclical adjustments and combining them with counter-cyclical adjustments."

In terms of monetary policy, the fourth quarter regular meeting still emphasized that “prudent monetary policy should be flexible and precise”, but at the same time, “enhance forward-looking, precise, and autonomous, play the dual functions of monetary policy tools in aggregate and structure, and be more proactive. Promisingly, increase support for the real economy".

Specifically, in terms of structural monetary policy, the fourth quarter regular meeting emphasized that "structural monetary policy tools should be actively added, and the two direct real economy monetary policy tools should be converted into support for inclusive small and micro enterprises and individuals. Market-oriented policy tools for industrial and commercial households" "Implement carbon emission reduction support tools and support special reloans for the clean and efficient use of coal".

Zhou Maohua, an analyst at the Financial Markets Department of China Everbright Bank, told CBN that in response to the more complex and severe domestic and international economic environment next year, the country mainly focuses on the “big article” of promoting domestic demand, emphasizing that a prudent and slightly loose monetary policy is related to deepening reform and opening up. Combining, emphasizing the coordination of financial, fiscal, and industrial policies to effectively stabilize short-term economic growth while promoting healthy and sustainable development of the medium and long-term economy.

In Zhou Maohua's view, the fourth quarter regular meeting puts more emphasis on the structural role of monetary policy.

"Structural monetary policy tools must be actively'additive'" expressions have released the signal of a prudent and slightly looser domestic monetary policy, paying more attention to precise policy support and efficiency, and relying on the conditions of maintaining reasonable and adequate liquidity and reasonable and moderate growth in credit Structural tools guide finance to increase support for the real economy, relieve difficulties for enterprises, and accelerate the recovery of domestic demand.

"Total monetary policy tools ensure reasonable and ample market liquidity, but to improve the efficiency of policy transmission and precision, and prevent the risk of partial accumulation of currency liquidity, structural tools are needed. At present, the domestic economy is facing a complex environment and needs to be balanced. To stabilize growth, promote reforms and prevent risks, and cherish normal policy space, requires the coordination of aggregate and structural monetary policy tools." Zhou Maohua said.

Mingming, deputy director of the CITIC Securities Research Institute, also told reporters, "The formulation of this regular meeting of the Monetary Policy Committee has become more active than in the third quarter. Under the background of triple pressure, monetary policy should be more proactive and forward-looking. The combination of aggregate and structure may be the main feature of monetary policy in the future."

Promote the reduction of corporate comprehensive financing costs

Since the third quarter, the domestic economic climate has declined significantly, the downward pressure has increased significantly, and the importance of stable growth in the short term has increased, and macro-control policies need to be exerted.

In particular, small and medium-sized enterprises and certain industries still face many difficulties in their operations and need to continue to provide policy support.

In terms of supporting small and micro enterprises, the meeting proposed to guide financial institutions to increase support for small and micro enterprises, technological innovation, and green development. It also proposed to deepen the structural reform of the financial supply side, guide the major banks to sink their services, and promote Small and medium-sized banks focus on their main responsibilities and businesses, support banks in replenishing capital, enhance the vitality and resilience of financial markets, and improve a modern financial system that is highly adaptable, competitive, and inclusive; improve market-based interest rate formation and transmission mechanisms, and optimize central bank policies Interest rate system, strengthen the supervision of deposit interest rates, give full play to the effectiveness of the reform of quoted interest rates in the loan market, and promote the reduction of comprehensive financing costs for enterprises.

Recently, the financial management department has repeatedly proposed to "promote the reduction of the comprehensive financing costs of enterprises."

Previously, the Central Bank's Business Management Department held a credit work conference for major banks within its jurisdiction to redeploy the implementation of carbon emission reduction support tools and special re-lending policies for the clean and efficient use of coal.

The meeting requested that all banks should fully understand the importance and urgency of green finance work, take financial support for green and low-carbon transformation as an important political task, take the above two policy tools as an important starting point, accelerate project reserves and docking, and make every effort to advance .

At the same time, after a lapse of 20 months, the 1-year LPR quotation was lowered by 5BP on December 20, and the counter-cyclical control efforts were increased to better assist the development of the real economy.

Liang Si, a researcher at the Bank of China Research Institute, believes that the LPR reduction will help guide financial institutions to continue to reduce loan interest rates, further reduce corporate financing costs, and help companies operate steadily and speed up recovery.

The counter-cyclical adjustment of macro-control policies has begun to exert full force, and it may continue to increase in the future.

Lian Ping, chief economist and dean of the research institute of Zhixin Investment, predicts that in 2022, in order to better support the real economy and reduce corporate financing costs, there is still a possibility of a small RRR cut in the first half of the year, and LPR may also continue to decline slightly.

Better meet the reasonable housing needs of buyers

It is worth noting that, compared with the third quarter regular meeting, the content of the fourth quarter regular meeting involves the real estate aspect, and the statement "better meet the reasonable housing needs of buyers" has been added.

The meeting emphasized that to safeguard the legitimate rights and interests of housing consumers, better meet the reasonable housing needs of buyers, and promote the healthy development and virtuous circle of the real estate market.

In the past two months, supervision has been blowing frequently, and real estate financing has gradually returned to normal.

At the end of November, the personal housing loan balance of banking financial institutions was 38.1 trillion yuan, an increase of 401.3 billion yuan that month, an increase of 53.2 billion yuan over October; at the end of October, the personal housing loan balance was 37.7 trillion yuan, an increase of 348.1 billion yuan that month. An increase of 101.3 billion yuan in September.

Lian Ping believes that in 2022, the real estate market may gradually stabilize from a comprehensive downward trend.

The development of the real estate market will highlight the new positioning of “better meeting the reasonable housing needs of buyers”, and may show changes in five aspects: one is the slowdown in commercial housing sales; The bottom rebound; fourth, the growth rate of real estate investment will further slow down; fifth, the new pattern of supply and demand may lead to a trend of first decline and then rise in housing prices.