Is the decline in the meeting rate incidental or inevitable?

Maintained at a high level throughout the year, reaching 92.89%

Text/Table Yangcheng Evening News reporter Ding Ling

For a company to enter the A-share market, from the acceptance of listing materials to the successful issuance, it can be described as a "practice".

For companies that applied for an IPO meeting in November, the road to practice has been a bit twisted.

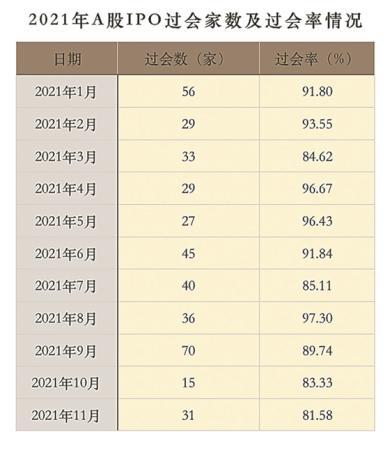

According to data from Yi Dong, 31 of the 38 proposed listing companies that attended the meeting in November passed the review, and the meeting rate was only 81.58%. This is also the third consecutive month of decline in the meeting rate.

As the main position of the November IPO, among the 31 companies that are going to go public, the Sci-tech Innovation Board has 21 companies, accounting for nearly 70%; followed by the Growth Enterprise Market and the Shanghai Stock Exchange Main Board, with 7 and 2 companies respectively; The Beijing Stock Exchange, which opened its doors for business, also ushered in Weibo Hydraulics, the first company to pass the meeting. If the registration is approved, Weibo Hydraulics will become the 83rd listed company on the Beijing Stock Exchange.

The reasons for the IPO rejection of the company vary

Under the situation of strict supervision of IPO issuance, problem companies have become the key "care" objects of supervision. Under this background, IPO "failures" in November have also occurred from time to time.

In terms of reasons, one is that the company voluntarily withdraws the materials, and the other is that the IPO is denied.

Regarding the rejection of the IPO, on the evening of November 11, the CSRC announced that the first issue of Caifu Glass had not been approved.

Behind the two "folded" IPOs are the industry's environmental protection pressure, performance decline, multiple supplier problems, and the necessity of fundraising projects that need to be resolved. On November 18, Zhenghe Technology's IPO was rejected. Mainly related to problems such as high customer concentration, declining utilization rate of final assembly capacity, and gross profit margin significantly higher than peers.

Fiss Technology failed to break through on November 24, mainly due to the company’s high customer concentration in the new energy vehicle business segment, low gross profit margin, net profit loss, and poor profitability; on November 25, the Shenzhen Stock Exchange Huatai Yongchuang’s IPO application "bright red card", the announcement mentioned several major doubts about Huatai Yongchuang, including interest-free borrowing by the actual controller, breach of trust by large customers, surprise shareholding, related fund lending, and core executives who have worked in the industry. Wait.

On the same day, Mengjinyuan bid farewell to Chong A, which was the third case in which an IPO was denied within two days.

The main business income mainly comes from the franchise model. The trade-in business accounts for a relatively high proportion of the main business income of related products in the current period. The book value of inventory is large, the proportion of total assets is relatively high, and the inventory turnover rate is decreasing year by year.

In this regard, some people in the industry said that the higher rate of rejection in a single month is more likely to be due to poor quality, fish in troubled waters, or too many applications in advance of the time window. "The majority of companies that are rejected are The problem may be business, financial or regulatory."

The annual meeting rate is as high as 92.89%

It is worth mentioning that just last week (November 29-December 3), a total of 12 companies were scheduled to attend the meeting, of which 11 successfully passed the meeting, and the weekly meeting rate jumped to 91.67%.

This week, 5 companies will also usher in the first conference.

Looking at the situation of this year's meeting, the A-share IPO issuance rate has generally remained at a high level, with the annual meeting rate reaching 92.89%.

In the first half of the year, except for the drop to 84.62% in March, the meeting pass rate can reach more than 90%.

In the second half of the year, the situation was just the opposite. The meeting rate in August exceeded 90%. In addition, the IPO meeting rate in the second half of the year went out of a "roller coaster" trend. After reaching a peak of 97.3% in August, it turned around and fell to the bottom of November.

Some brokerage and investment bankers said that they have clearly felt that the meeting rate has gradually declined recently.

However, there is no inevitable relationship between the changes in the monthly meeting rate. It is more of an accidental factor. Whether there are more IPOs in a certain period of time is not a significant change in the audit scale, but may be just a coincidence in time.

Statistics show that from January to November this year, the number of A-share listed companies reached 438, surpassing 396 for the whole year of 2020, tying the previous record in 2017.

In terms of sub-sectors, the Beijing Stock Exchange had the highest meeting rate of 97.06%, and the listed company on the selected floor before the meeting was Yangtze Flooring.

On September 11, Yangzi Flooring issued a material withdrawal announcement. The company stated that the company’s continued operation and profitability were severely affected because the commercial acceptance bill of its largest customer was overdue, and the company decided to terminate its application for listing on the select floor.

The IPO issuance enthusiasm for the Sci-tech Innovation Board and ChiNext this year is not diminishing. This year there are 190 companies to be listed on the ChiNext, with a meeting rate of 96.32%; the companies that "break through the barriers" on the Sci-tech Innovation Board are the next most popular, with 138 companies. The meeting rate also reached 92.03%; in contrast, the Shanghai and Shenzhen main board IPO meeting rate was relatively low, both were 83.33%.

57 brokerages favored the event

There were a total of 442 IPO projects at the conference this year, which were "escorted" by 61 brokerages. Among them, 57 brokerages favored the conference, and 4 brokerages had no gains for the time being.

From the perspective of the number of meeting houses, the top brokerages CITIC Securities and China Securities Investment are far ahead, harvesting 54 and 40 meeting projects respectively; the second echelon Zhongtai United (27), Minsheng Securities (25), Haitong Securities (24), CICC (23) and Guotai Junan (21) are basically evenly matched, with more than 20 projects.

As the dark horse of investment banking, Minsheng Securities ranks among the top five, putting a group of established brokerages behind.

Regarding the meeting rate, all 40 sponsors have maintained a zero-error "record", and many of them are big sponsors such as CITIC Securities and Minsheng Securities.

At the same time, there are 21 sponsors with a meeting rate of less than 100%, accounting for more than 30%.

Among them, Guotai Junan's 4 bills were rejected, namely Haihe Pharmaceutical, Inovance Technology, Linhua Medical and Petrol; Huatai United 3 bills were rejected, and CICC and Guosen Securities also failed to pass 2 bills each.

Four investment banks, GF Securities, Hualong Securities, Horizon Securities, and Credit Suisse Securities (China), have not yet "opened orders" this year.

It is worth noting that after GF Securities restarted its sponsorship business, it ushered in its first meeting project. On November 18, the Baihe shares IPO sponsored by it suffered a suspension of voting, which may be related to Baihe shares suspected of not disclosing the content of horizontal competition.

Brokers with lower meeting rates include Northeast Securities (66.67%), Huaan Securities (66.67%), Galaxy Securities (50%) and Huachuang Securities (50%).