More than 560 listed companies, with a total financing of more than 600 billion yuan-

steadily advancing the comprehensive registration system reform

Our reporter Peng Jiang

The reform of the registration system is a major reform to improve the market-oriented allocation of factor resources, and it is also a key measure for the development of direct financing, especially equity financing.

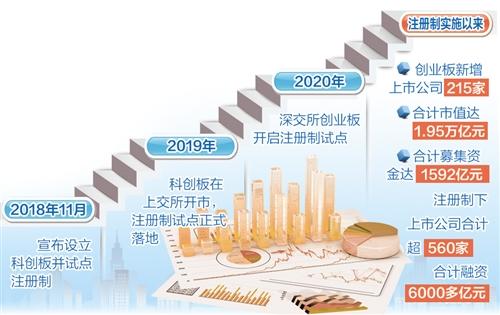

Since the announcement of the establishment of the Science and Technology Innovation Board and the pilot registration system in November 2018, China's stock issuance system has made great strides towards the registration system.

In 2019, the Science and Technology Innovation Board was opened on the Shanghai Stock Exchange, and the pilot registration system was officially launched.

In 2020, the Shenzhen Stock Exchange's Growth Enterprise Market will start a pilot registration system.

The "14th Five-Year Plan" and the outline of long-term goals for 2035 put forward a full implementation of the registration system for stock issuance.

Currently, how to steadily advance the comprehensive registration system reform?

How to consolidate the responsibilities of all parties?

How to administer the city strictly according to law?

These have become issues of general concern both inside and outside the market.

The reform experiment field is vigorous

"This year is the third year of the pilot registration system for China's capital market. With the steady implementation of the pilot registration systems for the Sci-tech Innovation Board and the Growth Enterprise Market, the total number of listed companies under the registration system exceeds 560, with a total financing of more than 600 billion yuan. The reform has achieved the expected goals: the demonstration effect of supporting scientific and technological innovation has initially appeared; the role of the “test field” of institutional reform has been brought into full play; the overall market operation has remained stable." Li Jizun, director of the market department of the China Securities Regulatory Commission, said recently.

"The essence of the registration system reform is to hand over the right to choose to the market, and the way to achieve it is to establish a sound system with information disclosure as the core." Li Jizun said that in this regard, the sci-tech innovation board and the ChiNext registration system have made some breakthroughs. .

The first is to optimize the issuance and listing conditions, transform the substantive threshold as much as possible into strict information disclosure requirements, and increase the inclusiveness of enterprises, especially science and technology enterprises.

The second is to disclose the standards, procedures, content, process, and results of the review and registration to enhance predictability.

Third, there are no administrative restrictions on the price and scale of new stock issuance, and unnecessary intervention is eliminated.

Lu Dabiao, deputy general manager of the Shanghai Stock Exchange, said: "With the deepening of reforms, the sci-tech innovation board market has shown positive changes in terms of investor structure and market pricing efficiency. In the past two years, the Shanghai Stock Exchange has established a sci-tech innovation board and successfully implemented pilot registration reforms. , The leading and demonstrative effect of scientific and technological innovation is gradually released, and it has increasingly become an important platform for the smooth circulation of scientific and technological capital and industry."

The overall R&D intensity of sci-tech innovation boards is relatively prominent, and the quality of hard technology is gradually emerging.

In the first half of this year, the ratio of R&D investment to operating income of sci-tech innovation board companies averaged 14%, and the ratio of R&D personnel to the total number of employees averaged 30%.

On the Sci-tech Innovation Board, each listed company has an average of 106 invention patents, which is higher than that of other sectors.

According to Wang Hong, deputy general manager of the Shenzhen Stock Exchange, 215 companies under the GEM registration system have completed initial public offerings and listed, with a total market value of 1.95 trillion yuan. The reforms have begun to show results, stimulating market vitality and enthusiasm, and improving the allocation of resources in the capital market. efficient.

Compact the responsibilities of all parties

"An important task for the full implementation of the registration system for stock issuance is the reform of the main board." Li Jizun said that compared with the Science and Technology Innovation Board and the Growth Enterprise Market, the main board is more involved and more challenging.

At present, there are more than 3,100 companies listed on the main board of the Shanghai and Shenzhen stock exchanges, accounting for 70% of the A-share market.

The main board has 190 million investors, which is 22 times that of the Science and Technology Innovation Board and 4 times that of the ChiNext. It involves large-scale investment products and has a significant impact on the benchmark index.

The full implementation of the registration system for stock issuance is inseparable from further consolidating the responsibilities of all parties in the market and promoting the transformation of the capital market from a seller's market to a buyer's market.

"We must fully consider our country’s largest reality, which is dominated by small and medium investors. Individual investors hold more than 30% of the shares and account for about 70% of transactions; small and medium investors often have the ability to independently identify market risks and professional judgments. Obviously weak; the foundation of market integrity culture is still relatively weak. Therefore, we always emphasize that the registration system does not mean relaxing review requirements. We must strictly control the truthfulness, accuracy and completeness of information disclosure, and improve the quality of listed companies from the source.” Chairman of the China Securities Regulatory Commission Yi Huiman said.

Under the registration system, information is required to be more open and accurate. As an intermediary agency, it needs to uphold the concept of registration system reform and uphold the responsibility of capital market gatekeepers.

Intermediary agencies should use information-based service methods to fully grasp the distribution of project risks, further refine and improve due diligence standards, refine and stage review process requirements, and continuously improve practice and service capabilities.

"With the deepening of the reform of the registration system, sponsor institutions must strengthen the construction of their professional capabilities. Under the registration system, the practice requirements for intermediaries have increased significantly. Intermediaries must continue to cultivate their internal skills, optimize internal management, and improve the level of practice of sponsors." Said Zhang Youjun, chairman of CITIC Securities.

Wang Hong said that the stock exchange should strive to be "transparent and trustworthy" and strictly control the "entry gate" of the capital market.

According to reports, the Shenzhen Stock Exchange insists on building a "transparent exchange", implements "sunshine audit", vigorously promotes the "four disclosures" of audit standards, audit processes, audit opinions, and audit supervision, formulates and releases audit key points, and regularly compiles issuance and listing audit dynamics. Multi-channel diversification strengthens communication and interaction with the market, continuously improves audit transparency, strives to eliminate "pocket policies", and enhances market predictability.

Strictly administer the city according to law

Steady progress in the reform of the registration system requires the full implementation of the "zero tolerance" policy, adherence to strict supervision in accordance with the law, and strengthen the crackdown on serious illegal acts such as fraudulent issuance and financial fraud, so as to ensure the smooth progress of the registration system reform.

Yi Huiman said that with the successive implementation of the new Securities Law, the Criminal Law Amendment (11), and the opinions on cracking down on illegal securities activities in accordance with the law, the legal environment of the capital market has been fundamentally improved.

With the registration reform as the leader, basic systems such as issuance, listing, trading, delisting, and continuous supervision have been systematically improved. The high-standard and three-dimensional punishment of administrative penalties, civil compensation, and criminal accountability has been a good start, the first case The civil compensation litigation of the special representative in securities disputes is about to land. The clear orientation of punishing evil and promoting good, supporting the advantages and limiting the disadvantages has been continuously strengthened, and the awe of all parties in the market has gradually increased.

Wang Hong said that the investor structure of the ChiNext market has continued to improve, the proportion of institutional investors has steadily increased, the scale of overseas investment has continued to expand, and the concept of value investment has been further popularized and deepened.

The rule of law environment is becoming more and more perfect. The Securities Law and the Criminal Law have been revised successively, and the cost of violations of laws and regulations has been greatly increased. Judicial safeguard measures concerning the registration system for the Growth Enterprise Market have gradually come into effect.

During the reform period, the Shenzhen Stock Exchange strictly controlled the entrance of audits, terminated audits of 122 IPO projects, conducted on-site supervision of 55 project sponsors or independent financial consultants, and issued regulatory warnings for issuers, intermediaries and related personnel 23 times. Disciplinary actions were taken 4 times, and supervision and deterrence were continuously strengthened.

"The registration system reform is really in place depends on effective market constraints, including the relocation of market entities and the formation of a'buyer's market', etc., and it also requires stronger legal protection. At present, market entities' regulatory awareness is increasing." Li Jizun said, The China Securities Regulatory Commission will resolutely implement the Party Central Committee's deployment of the full implementation of the registration system for stock issuance, maintain the strength of reform, and carry out the reform step by step to the end.

Our reporter Peng Jiang