In the third quarter, the domestic smart phone market reshapes the new Android camp and "impacts" with Apple

Huawei's lost market share is quickly being divided between the domestic Android camp and Apple, and the mid-to-high-end market has become a "key battlefield" for various manufacturers.

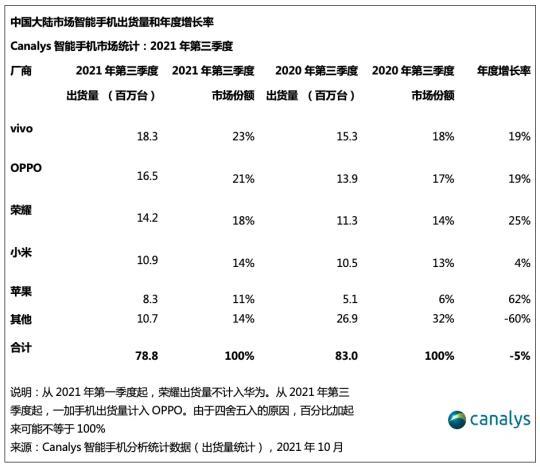

According to the domestic smartphone market analysis report for the third quarter of 2021 released by a number of research institutions, after Huawei was controlled on the chip side, the pattern of the domestic mobile phone market was "completely reshaped", with vivo, OPPO and Honor ranking the top three in the domestic market. , Apple ranked fifth.

"Faced with the radical efforts of Android manufacturers in the configuration and pricing of high-end devices, Apple took advantage of the release of the iPhone 13 and adopted more favorable pricing to further lower the entry barrier of the iPhone, and face the competition with the flagship Android models." October 29, Canalys Analyst Liu Yixuan told CBN reporters that Apple has a place in the high-end market, but it can also be seen that the share of the Android camp is also increasing in the price segment above $600.

"With the global component limitation this year, the Chinese market is expected to be flat or achieve slight growth in 2021 compared with last year." Liu Yixuan said that for the Chinese market, the keywords for product opportunities in the short term are "segmentation" and "high-end". change".

Manufacturers must establish a mechanism to quickly respond to consumer needs and improve the experience of using high-tech and cutting-edge hardware.

Vivo ranks first, glory returns to the list

Two years ago, Huawei's share of the Chinese smartphone market exceeded 50%, and the share of the “head phone manufacturers” ranked in the top five smartphones in China has been solidified.

However, since the end of last year, the share of various domestic mobile phone manufacturers began to fluctuate drastically. By the third quarter report, the manufacturers ranked third to fifth in the list have been rotated many times.

According to data released by Canalys, Strategy Analytics, and Counterpoint Research, the entire smartphone market has been shuffled again due to the comeback of Honor.

"Vivo and OPPO continued to lead the market in the third quarter with 23% and 20% market shares, respectively. Honor’s share rose to third, slightly surpassing Xiaomi. Compared with other major Chinese OEMs, Honor and Xiaomi’s line The upper channel sales account for a relatively high proportion, so it is expected that Xiaomi will be more affected by the return of glory.” Counterpoint Research senior research analyst Ethan Qi said that Apple’s ranking will remain unchanged in the third quarter of 2021, but Apple’s market share is expected to be in the fourth quarter. Rising with the debut of the iPhone 13 series.

In terms of specific sales volume, Liu Yixuan told reporters that among the top five vendors in the third quarter, four vendors had a sales volume of tens of millions.

"Vivo shipped 18.3 million units, OPPO (including OnePlus) shipped 16.5 million units, Honor and Xiaomi had 14.2 million and 10.9 million units respectively. Apple ranked fifth with 8.3 million units. "

According to the data provided by Canalys, the reporter found that from the second quarter of last year to the third quarter of this year, vivo's market share rose the fastest, reaching 7%, while OPPO, Xiaomi and Apple increased by 5%, 4% and 2% respectively.

The most dramatic change was Honor, whose market share fell from 14% in the second quarter of last year to 3% and then rebounded to the current 18%.

"Collision" in the high-end market

"Huawei can account for 43% of the price range above $600 in the first half of 2020, while Huawei accounted for 13% in the first half of 2021, and the shares of vivo, OPPO and Xiaomi have all increased by 6%-8%." Liu Yixuan told reporters .

According to analysts, with the launch of new flagship products of major mobile phone manufacturers in the second half of the year, the most competitive market will be the mid-to-high-end market.

The “downward pressure” of Apple’s new product prices is reaching the “base camp” of domestic Android phones, but from a trend point of view, domestic mobile phone manufacturers are also seeking breakthrough space in the high-end market.

"Ten years ago, most domestic mobile phones used chip companies directly, but in the past five years, mobile phone self-developed chips have become a trend." A head of a domestic chip company told reporters that mobile phone manufacturers have consolidated their core technologies such as chips. Undoubtedly, it will strengthen the competitiveness of products, and it is also an investment in exchange for "future space".

In order to form a self-developed chip team, in recent years, many mobile phone companies have arranged their recruitment interview locations next to the offices of these chip companies. In the latest recruitment, vivo provides a monthly salary of up to 150,000 yuan for the ISP chip director, and the annual salary is even as high as 1.8 million yuan.

"The competition in the mobile phone industry in the future will test the full-link technical capabilities of manufacturers. While not inferior to others, they must also take into account unique aspects. To transform market demand into IP, hardware is a carrier." Hu Baishan, executive vice president of vivo In a previous interview, I told reporters that the "V1" mounted on the X70s is a special-specification integrated circuit chip. The initial project was based on vivo's prediction of "existing image processing needs."

In addition to vivo, in the first half of this year, Xiaomi launched the MIX FOLD folding screen mobile phone, also built-in the surging C1 self-developed ISP chip.

"Self-developed chips are very important to mobile phone manufacturers. They can not only help differentiated competition, but also gain more bargaining chips in the game of the supply chain and increase their own profit margins. Chip research requires long-term accumulation of time and capital. The breakthrough of ISP is mainly in the ISP chip." Wu Yiwen, a senior analyst at Strategy Analytics, told reporters that compared with SoC, the threshold of ISP chip is relatively low, and ISP is directly related to the main imaging function of domestic manufacturers, which has an impact on domestic manufacturers. There is direct help.

Facing the next high-end market competition, Hu Baishan said that in-depth insights and meeting user needs are the core competitiveness of the future mobile phone industry.

"In the high-end market for mobile phones above 6,000 yuan, Apple alone dominates. For major domestic mobile phones, whoever has more short-term shares and whoever has less is not the key to the problem. The key is who can be in the future. The ability to compete with the top players inside is a goal that all Chinese mobile phone brands want to pursue in the future."

Chip shortages increase market variables

"The value of mobile phone product shipments and market share has long been not limited to hardware profitability. It is the entry point for manufacturers' smart ecosystem, software and services. Therefore, despite the severe squeeze of mobile phone hardware gross profit, it is still important to maintain and seize market share. "Liu Yixuan told reporters that the subdivision of product lines has become a common theme among manufacturers.

In addition to selling points such as images and cost-effectiveness that are familiar to users, we have also seen more targeted product lines launched for female users, e-sports players, Vloggers, online consumers, and Generation Z.

On the evening of October 25th, Honor officially released the Honor Play5 Vitality Edition, a new product of the Honor Play5 series, with a price starting at 1799 yuan. OPPO's K series mainly for e-commerce, vivo's T series and sub-brand iQOO for e-commerce Z series are also Recently, we have intensified product "new up" efforts.

"The positioning and label boundaries of products such as Xiaomi Civi, OPPO K9s, iQOO8, and GT Neo are very clear. From market feedback and shipment results, more refined products and marketing are already attracting consumers’ attention. Contribute to the stimulus to change the machine." Liu Yixuan said.

But judging from the overall market of smartphones, Wu Yiwen believes that the lack of key components and price increases are still a shadow of the entire smartphone industry.

Although Apple's upstream suppliers deny the reduction of orders, the supply chain problems caused by the shortage of chips are seriously affecting the normal supply of global smartphones.

Strategy Analytics predicts that smartphone supply constraints will continue, and the global shipment of iPhone 13 has been reduced from the initial 90 million shipments to the current 70 million.

"The shortage of chips not only restricts production capacity, but also raises costs and compresses manufacturers’ profits. We estimate that the chip problem will not be alleviated until next year. Relatively speaking, first-tier manufacturers benefit from their scale, which is in line with the supply chain. In the game, the safety stock is relatively high, so the impact is relatively small. The smaller manufacturers are more affected and more passive." Wu Yiwen told reporters.

According to the forecast of Strategy Analytics, the core shortage problem will be alleviated in 2022 and resolved in 2023.

The lack of cores is currently not limited to 5G chips, and the supply of 4G chips is also tight.

This will directly affect the overseas expansion plans of domestic manufacturers.

At the same time, the cost increase caused by the lack of core will also push up the price of smart phones, putting pressure on manufacturers' profits.

(Author: Li Na)