The credit rating industry welcomes heavy new regulations-

compacting the responsibility of the “gatekeeper” in the bond market

Our reporter Chen Guojing

The credit rating industry ushered in new regulations.

Recently, the People's Bank of China, together with the National Development and Reform Commission, the Ministry of Finance, the China Banking and Insurance Regulatory Commission, and the China Securities Regulatory Commission jointly issued the "Notice on Promoting the Healthy Development of the Bond Market Credit Rating Industry", which will be officially implemented on August 6, 2022.

This is another major regulatory measure for the rating industry following the cancellation of the mandatory rating of debt financing instruments by the Association of Dealers in March this year.

Why strengthen the supervision of the rating industry at this time?

What changes will the industry have?

The Economic Daily reporter interviewed industry insiders, experts and scholars.

Rectify rating chaos

Credit rating is an important basic institutional arrangement for the bond market.

In recent years, my country's rating industry has made great progress in unifying rules, improving supervision, and opening up to the outside world. However, there are also problems such as false high ratings, insufficient rating differentiation, and weak pre-warning functions, which restrict the high-quality development of my country's bond market.

"The phenomenon of inflated ratings is very prominent." Li Xin, head of ChinaBond's credit rating department, said that with the rapid growth of the bond market, the rating industry has begun to take shape, but it has also exposed many problems.

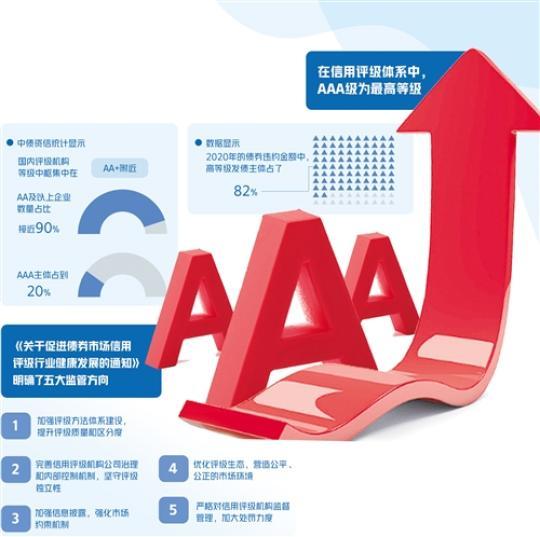

In the credit rating system, AAA level is the highest level.

Data shows that among the bond defaults in 2020, high-level bond issuers accounted for 82%.

Chinabond credit statistics show that the domestic rating agency's rating center is concentrated near AA+. The number of AA and above companies accounted for nearly 90%, and AAA subjects accounted for 20%.

In contrast, AAA-level companies in developed bond markets such as the United States and Japan account for no more than 5%.

From the perspective of level adjustment, the average number of credit ratings of domestic bond issuers has been increased by 3.6 times in the past five years.

These data all show that the bond rating is falsely high, and the credit rating results, which are an important reference for investors, have not played the role of early warning.

In recent years, the frequent occurrence of AAA bond defaults has raised questions about the rating results of credit rating agencies.

For example, Li Xin said that the credit qualifications of enterprises at the same level are very different.

For example, PetroChina’s rating result was AAA, and the credit rating of Brilliance Auto, which defaulted last year, was also AAA.

This shows that the level of the entity can no longer truly reflect its credit status, and the level of distinction is seriously insufficient.

"Insufficient early warning and sharp downgrade after the event" also shows that the accuracy and forward-looking of the rating results are insufficient.

Last year, Yongmei Coal Holdings, which received much market attention and broke out of default, had the highest credit rating of AAA before the default, but after the default, the rating was quickly downgraded to BB.

Li Xin believes that the subject level has obviously not truly reflected the credit status, and the default of high-rated bonds not only led to increased market volatility, but also planted hidden dangers of systemic risks.

Back to the roots of the industry

In this context, the "Notice on Promoting the Healthy Development of the Bond Market Credit Rating Industry" began to solicit public opinions on March 28 this year and will be released in the near future.

The "Notice" clarifies five major regulatory directions: First, strengthen the construction of rating methods and systems, improve rating quality and differentiation; second, improve corporate governance and internal control mechanisms for credit rating agencies, and adhere to rating independence; third, strengthen information disclosure and strengthen the market Constraint mechanism; the fourth is to optimize the rating ecology and create a fair and just market environment; the fifth is to strictly supervise and manage credit rating agencies and increase penalties.

Wu Yuhui, professor of finance at the School of Management of Xiamen University, said that the "Notice" puts forward some new regulatory ideas for the past problems in the bond market and the credit rating industry, such as clarifying the rating quality verification mechanism with default rate as the core, and realizing the reasonable distinction of ratings. Draw lessons from the practices of accounting firms to improve the independence of rating agencies; expand the scope and role of the investor’s payment model; reduce regulatory requirements for external ratings, etc.

Since the "Notice" was jointly issued by five major regulatory agencies in the credit rating industry, Wu Yuhui believes that it can be expected that the "Notice" will play a vital role in the development of the credit rating industry. With effective restraint, the credit rating industry will also regain its reputation and continue to develop better and healthily.

In fact, since the release of the draft for comments in March, the "Notice" has played a certain guiding role in the behavior of market entities.

Since the beginning of this year, the number of entities whose ratings and outlooks of bond issuers have been upgraded has dropped sharply, and the number of downgrades has increased significantly.

Li Xin believes that the "Notice" comprehensively regulates the internal construction of rating agencies and the external rating ecology, and focuses on supervision of the most core and urgently needed rating quality issues in the current rating industry, which will help the accuracy of rating results. The gradual improvement of the rating agencies will gradually return to better reveal risks and serve as a reference for bond pricing.

This will also have a significant impact on the current competitive landscape of the rating market, and those rating agencies that have high rating quality and can better meet the needs of investors will stand out.

Improve related systems

For a long time, credit rating agencies have been hailed as the "gatekeepers" of the bond market.

Prior to this, the reason why the role of “gatekeeper” was not fully utilized was that Li Xin believes that the first reason is that my country’s rating industry has been developed for a relatively short period of time. There is not enough time, and the industry’s talent mobility is also high; second, the rating industry is at the end of the financial industry chain, and the right to speak is not high; third, the rating agencies pay too much attention to the pursuit of short-term economic benefits and ignore reputation accumulation and brand building.

At the same time, under the issuer payment model, there is a natural interest relationship between rating agencies and issuers, and it is very difficult for rating agencies to maintain their independence.

The "Notice" clearly proposes to encourage the introduction of investor-paid ratings, and to play the role of cross-validation of dual ratings, multiple ratings, and ratings of different models.

Li Xin believes that the influence and guiding role of investors' paid ratings has yet to be fully brought into play.

Judging from the practical effects of domestic investor-paying institutions, ChinaBond Credit Ratings has an average early warning period of 29 months for defaulting companies in the past 10 years, and entities with AA and above levels have never defaulted, and high-level AA and above accounted for only 17%, which is generally in line with the characteristics of the risk distribution of bond issuers in the Chinese bond market.

Although the investor-paying institutions have a better level of distinction and higher rating quality, this model lacks a reciprocal policy environment and mechanism arrangement, has not been fully applied, and it is difficult to have a direct impact on bond risk pricing.

The relevant encouragement policies and mechanisms to prescribe the right medicine will help the sound and orderly development of the rating industry.

Next, improving the credit rating system is still one of the important tasks to promote the high-quality development of the bond market.

When talking about the main policy ideas for the next phase, the People's Bank of China recently stated that it must adhere to both risk prevention and development, and continue to promote the high-quality development of the bond market.

Strengthen the construction of the rule of law in the bond market, consolidate the responsibilities of intermediary agencies, implement the information disclosure requirements of corporate credit bonds, and improve the credit rating system.

Wu Yuhui said that in order to improve the credit rating system, some of the regulatory objectives in the "Notice" must be implemented, and more detailed supporting measures need to be introduced.

In the promotion and application of the investor payment model, a clearer institutional guarantee is needed.

The "Notice" proposes that in the mechanism arrangements for bond valuation and pricing, bond index product development, and pledge repurchase, investors can refer to the results of investor-paid ratings, or select investor-paid ratings as a reference for internal control.

Wu Yuhui said that in actual operation, it faces a series of problems such as "under what circumstances and how to refer".

In addition, the sustainability of the investor payment model is also an issue.

Wu Yuhui introduced that one of the important reasons for the U.S. rating agencies to change from an investor-paying model to an issuer-paying model is financial unsustainability.

Therefore, a reasonable path should be taken to enhance the financial soundness of the investor payment model to ensure its objective independence and maintain long-term sustainable development.

Wu Yuhui suggested that the information asymmetry problem of rating agencies should also be broken.

Credit rating agencies should be supported to strengthen cooperation and share data with industrial and commercial departments, taxation departments, and financial institutions to better predict the issuer’s default risk.

In strengthening the accountability of rating agencies, Wu Yuhui believes that while consolidating responsibilities, rating agencies should also be given corresponding rights protection.

For example, appropriately improving the status of rating agencies and rating results, including urging issuers to adopt more reasonable and standardized procedures when selecting rating agencies, and requiring issuers to better cooperate with rating agencies in collecting internal information.

Only in this way can the industry form a virtuous circle and give full play to the role of rating agencies as the "gatekeeper" of the bond market.

Chen Guojing