Health insurance suffers from "growth troubles" in the first 5 months of compensation, a year-on-year increase of 74%

Our reporter Su Xianggao

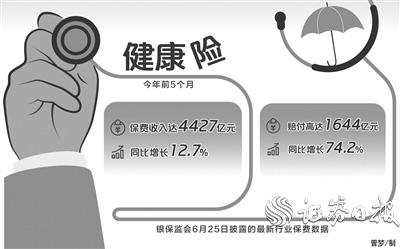

The latest industry premium data disclosed by the China Banking and Insurance Regulatory Commission on June 25 showed that in the first five months of this year, health insurance premium income reached 442.7 billion yuan, a year-on-year increase of 12.7%, which was higher than the industry's total premiums year-on-year growth rate (5.5%), which was sluggish. The growth rate of industry premiums adds a touch of color.

However, the reporter compared the data of the same period last year and found that in recent years, health insurance, which has seen rapid growth in premiums, has encountered “growth troubles” this year: health insurance claims have reached 164.4 billion yuan in the first five months, a significant increase of 74.2% year-on-year Something abnormal.

From 2016 to 2020, the year-on-year growth rate of health insurance claims did not exceed 35%.

As a dark horse insurance product in the insurance market in recent years, health insurance companies have high hopes due to the huge market space and continued premium growth rates higher than the industry average.

However, for insurers, if the growth rate of compensation for any insurance type continues to be much higher than the growth rate of premiums, operations will inevitably be unsustainable.

Regarding the high growth rate of health insurance claims this year, many people in the industry told reporters that the low base last year was the main reason, and it is not ruled out that the high growth rate of short-term medical insurance claims will promote the growth of health insurance claims.

Health insurance stands out

In the past five years, as the supervision continues to advocate insurance and consumer insurance awareness, health insurance has ushered in a golden growth period.

According to data disclosed by the China Banking and Insurance Regulatory Commission, from 2018 to 2020, the year-on-year growth rate of health insurance premiums reached 26.2%, 29.7%, and 20.3% respectively, and the growth rates were all higher than the growth rate of the industry's total premiums.

This year's health insurance growth rate is also "outstanding."

In the first five months, health insurance premium income increased by 12.7% year-on-year, higher than the 5.5% growth rate of the industry's total premiums, and higher than life insurance (5.2%), personal accident insurance (7.7%), property insurance (5.5%), etc. The growth rate of insurance premiums for major types of insurance.

However, as health insurance premiums have continued to increase at a high rate in recent years, its compensation expenditure has also seen high growth.

According to the reporter's analysis, from 2018 to 2020, the year-on-year growth rate of health insurance compensation expenditure was 34.7%, 34.8%, and 24.2%, respectively, and the growth rate of compensation was higher than that of insurance premiums.

In response to this high growth rate, Xu Yuchen, a senior insurance actuary who has long been engaged in health insurance and other insurance research, told the "Securities Daily" reporter that there are two main reasons for the rapid growth of health insurance claims.

First, the base of health insurance claims was relatively low last year.

In the first five months of last year, due to the impact of the new crown epidemic, many people did not go to the hospital for treatment, and the corresponding compensation for critical illness insurance and medical insurance was lower (most of the compensation requires a diagnosis and certificate from the hospital).

The data also shows that in the first five months of last year, the growth rate of health insurance compensation expenditure was only 11% year-on-year. Compared with the growth rate of compensation in the past three years, this growth rate is indeed much lower than the industry average growth rate in recent years.

Second, the high growth rate of health insurance claims may be related to the high growth rate of short-term medical insurance claims.

Health insurance is divided into critical illness insurance and medical insurance.

"Consumers have purchased more million-dollar medical insurance this year. This type of insurance is short-term reimbursement (mostly one year), so the amount of indemnity is higher. But whether this view holds true depends on specific data." Xu Yuchen said.

A person in charge of health insurance of a medium-sized insurance company also told reporters that the premiums of short-term health insurance including Huimin Insurance and Million Medical Insurance have increased rapidly this year, and it is very likely that there will be a high growth rate in compensation, but it is limited by industry data. Missing, whether this is the case, remains to be further verified.

At present, life insurance companies can operate various types of health insurance including critical illness insurance and medical insurance, but property and casualty insurance companies can only operate short-term medical insurance, which is what the market calls "million medical insurance".

From the perspective of the first quarter alone, the short-term medical insurance compensation expenditure of property and casualty insurance companies reached 19.4 billion yuan, an increase of 37% year-on-year, and also showing a rapid growth trend.

Health insurance is a bad business

In fact, both the high growth rate of insurance premiums and the high growth rate of compensation for health insurance show that this is a type of insurance that is in a period of rising growth.

But when many insurance companies reached a consensus on this, the health insurance market changed from a "blue ocean" to a "red ocean."

In recent years, major insurance companies have actively deployed health insurance and seized the health insurance market.

The proportion of health insurance income of listed insurance companies such as Ping An, China Life, China Pacific Insurance, and Xinhua Insurance has increased year by year, and industry competition has intensified.

The entry of more entities puts forward higher requirements for insurance companies to manage health insurance. Insurers not only need to control moral hazard and many other risks at the underwriting side, but also need to integrate medical and insurance resources.

In 2016, with the emergence of million-dollar medical insurance and tax incentive insurance, health insurance premium income increased rapidly.

After some health insurance products were removed from the shelves in 2017, health insurance premiums still maintained an annual growth rate of more than 20%.

However, the difficulty of risk control before underwriting, the possibility of false health notifications for consumers, and the disconnection between medical and health services and insurance after underwriting and many other pain points continue to test the operating capabilities of insurers.

Health insurance needs a more professional way of operating to help insurance companies increase revenue and reduce costs.

A person in charge of the operation center of a large insurance company told reporters that since this year, many insurance companies have launched Huimin Insurance (a type of short-term medical insurance), which is beneficial to popularizing insurance awareness and improving the insurance protection level of the whole people. However, the most important thing to operate this type of insurance is the support of medical big data, otherwise it is easy to fall into a loss.

Health insurance operations are also faced with the problems of high risks and difficult business profitability.

According to a research report released by Yiou Think Tank, according to the operating data disclosed by six professional health insurance companies including PICC Health, Ping An Health, and Fosun United Health, since 2015, PICC Health, Ping An Health, and CPIC Allied Health have all achieved meager results. profit.

Based on this, some domestic insurance companies are currently reducing costs by strengthening the linkage between medical and health services and insurance, such as acquiring hospitals and preparing for the establishment of retirement communities. However, the specific operating benefits still need time to test.

(Securities Daily)