In the first week of February, 793 thousand people applied for unemployment benefits in the United States.

The value turned out to be worse than the initial forecasts of analysts.

Earlier it was expected that the number of applications for receiving payments would not exceed 750 thousand - 757 thousand. This is evidenced by data from the US Department of Labor and the Trade Economics portal.

Although the overall unemployment rate in the country has already moved away from last year's highs (14.8%) and dropped to 6.3%, the situation in the American labor market remains tense.

Pyotr Pushkarev, chief analyst of TeleTrade Group, told RT about this.

According to him, the re-introduction of quarantine restrictions in a number of states puts pressure on the employment sector in the United States.

“The specific number of temporarily“ left ”workers from the economy, carefully calculated from the payroll, gives a more objective picture.

So, in December 2020, the number of employed workers outside the agricultural sector fell by 227 thousand. In January, only 49 thousand jobs were created throughout the country, of which 43 thousand were state vacancies.

This is a clear indication: in the private sector, employment losses are not yet being replenished, ”the expert explained.

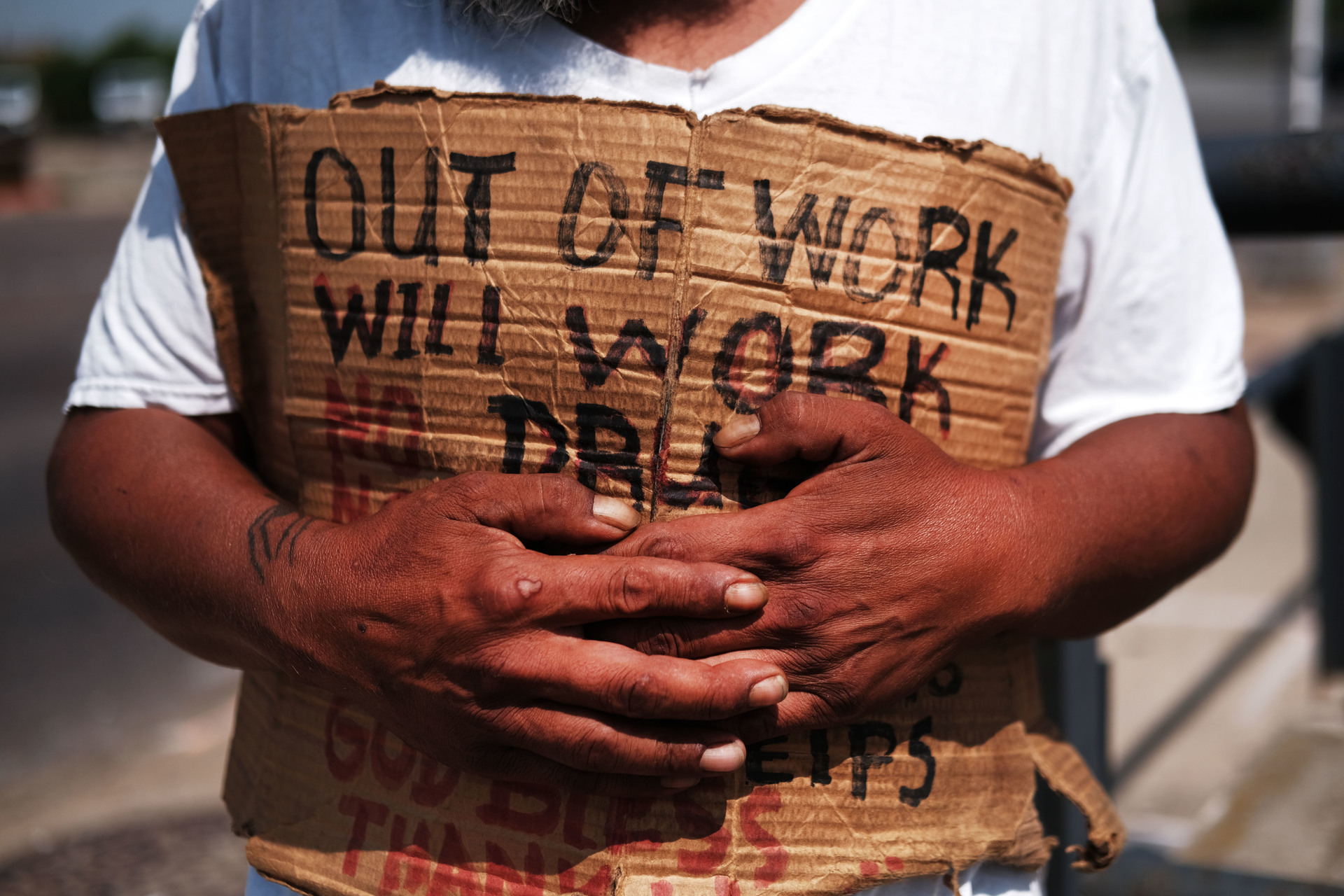

At the same time, the problem of long-term unemployment is becoming more acute in the United States.

We are talking about an increase in the number of citizens who remain unemployed for more than six months in a row.

According to the US Department of Labor, the number of such Americans has been steadily increasing since April 2020 and has quadrupled since then, to 4 million.

The value has become the maximum since November 2013.

Moreover, over the past nine months, the share of unemployed citizens among the total number of unemployed has increased almost tenfold and in January 2021 it was 39.5%.

The last time a similar indicator could be observed at the end of 2012.

“This is the so-called stagnant unemployment, when people cannot find a job for a long time after being laid off.

The growth of the indicator is due to the fact that the US economy is recovering unevenly.

In some sectors, the recovery is faster, while in others it is slower, as, for example, in the service sector, ”Viktor Supyan, deputy director of the Institute of the USA and Canada of the Russian Academy of Sciences, explained in a conversation with RT.

Thus, the restrictive measures introduced against the background of the coronavirus pandemic hit the American hotel sector, tourism, transport, catering and entertainment the hardest.

Senior analyst at Alpari Eurasia Vadim Iosub told RT about this.

“The restoration of employment in these areas is possible only with the abandonment of restrictions or a significant weakening of restrictive measures aimed at social distancing.

Thus, the decline in long-term unemployment will begin only after the victory over the coronavirus pandemic, ”the expert emphasized.

AFP

© SPENCER PLATT / GETTY IMAGES NORTH AMERICA

Keeping long-term unemployment high may pose a threat to the overall US economic recovery.

This is the conclusion reached by experts of the international rating agency Moody's.

According to experts, citizens who have not been working for a long time are losing their professional skills, and the changing requirements of employers only complicate the task of finding a job.

In addition, the consumption of essential goods and services is decreasing in the country, and the more active use of social protection programs leads to an increase in government spending and increases the pressure on the budget.

“In addition, prolonged periods of unemployment among low-income families and a simultaneous rise in inequality in income, wealth and opportunity can exacerbate social tensions.

This, in turn, will increase the pressure on politicians and the course they are pursuing, ”the agency's research says.

Budget sacrifice

Note that in the near future, the new US administration plans to allocate $ 1.9 trillion to support the economy and the population.

In particular, the authorities intend to pay the Americans $ 1.4 thousand in addition to the previously approved $ 600.

At the same time, large-scale economic stimulus measures can accelerate the growth of the US budget deficit and national debt, Viktor Supyan is sure.

“To take such amounts of money, they have to be borrowed, that is, to increase the national debt.

The volume of US debt obligations already significantly exceeds the size of the country's economy.

Money is not just printed, it is taken in the form of borrowings, and it must be covered with budgetary funds.

Now the United States should spend about $ 400 billion annually on servicing its national debt, and in the future this amount will only grow, ”the expert emphasized.

According to the US Congressional Budget Office, in fiscal 2020 (ended September 30), the US treasury deficit exceeded $ 3 trillion and approached 15% of GDP.

The rate is the highest since 1945.

At the same time, the national debt of the country is today near the maximum values in history and amounts to $ 27.8 trillion.

This is evidenced by the materials of the US Treasury.

“Pumping the economy with money could lead to a surge in inflation in the United States. And when this happens, the Fed will not be able to raise its rate and contain the rise in prices, because such a decision will increase the cost of servicing the public debt and further increase the budget deficit. Thus, if the problem of unemployment can still be solved by flooding with money, then the growth of the national debt is a time bomb, and no one knows at what point it will explode, ”Alexey Kirienko, managing partner of EXANTE, said in an interview with RT.