Questions and answers on the electronic management and operation of VAT electronic special invoices from the Department of Economics and Technology Archives Business Guidance Department of the State Archives Administration of the Ministry of Finance

On December 20, 2020, the State Administration of Taxation issued the “Announcement on Issues Concerning the Implementation of the Electronic Value-Added Tax Invoices for New Taxpayers” (No. 22 of 2020), which decided to start 3 years ago in Ningbo, Shijiazhuang and Hangzhou. On the basis of pilot projects in various regions, the electronic VAT invoices will be implemented among new taxpayers nationwide.

With the gradual promotion and application of electronic invoices, all units shall, in accordance with relevant laws and regulations, regulate the use of electronic invoices for reimbursement, entry and filing activities.

In December 2015, the Ministry of Finance and the National Archives Administration issued the newly revised "Administrative Measures for Accounting Archives" (Order No. 79 of the National Archives Administration of the Ministry of Finance), and subsequently issued the "Regulations on Standardizing Electronic Accounting by the National Archives Administration of the Ministry of Finance" in March 2020. Notice on Filing of Voucher Reimbursement in Accounts" (Cai Kuai [2020] No. 6).

The above-mentioned documents have clearly stipulated the reimbursement entry and filing of various electronic accounting documents including electronic invoices.

In order to further respond to social concerns, serve and guide grassroots units to use electronic invoices in a more standardized manner, relevant departments of the Ministry of Finance, the State Archives Administration, and the State Administration of Taxation have combined relevant documents that have been issued to provide special electronic invoices for value-added tax (hereinafter referred to as "electronic special invoices"). ) The answers to related questions such as the entire process of electronic management operations are as follows:

1. Is the legal effect of an electronic special ticket as an electronic accounting document the same as that of a paper accounting document?

Answer:

Electronic accounting vouchers refer to all kinds of accounting vouchers that are generated, transmitted, and stored in electronic form, including electronic original vouchers and electronic bookkeeping vouchers.

The electronic special ticket is an electronic accounting original document.

Article 2 of the Announcement No. 22 of 2020 of the State Administration of Taxation stipulates: “The electronic special invoices are supervised by the taxation bureaus of various provinces and use electronic signatures instead of special invoice stamps. They belong to special value-added tax invoices. The special paper-based VAT invoices are the same." "Notice of the State Archives of the Ministry of Finance on Regulating the Reimbursement and Filing of Electronic Accounting Vouchers" (Cai Kuai [2020] No. 6) stipulates: "The source is legal and authentic electronic accounting vouchers and paper accounting vouchers Have the same legal effect." Article 37 of the "Archives Law" stipulates: "Electronic files should have reliable sources, standardized procedures, and compliant elements." "Electronic files and traditional carrier files have the same effect and can be used in electronic form as a certificate." .

Therefore, electronic special tickets with legal and authentic sources have the same legal effect as electronic accounting vouchers and paper accounting vouchers, and can be stored and archived as electronic files.

2. How can new taxpayers who implement electronic special ticket issue electronic special ticket?

Answer:

New taxpayers who implement electronic special ticket can receive tax UKey for free from tax authorities, apply for electronic special ticket verification through the electronic tax bureau, tax service hall and other channels, and check the value-added tax invoice platform of the State Administration of Taxation ( After downloading and installing the VAT invoice issuing software (Tax UKey version) on https://inv-veri.chinatax.gov.cn), an electronic special ticket will be issued.

After the invoice is issued, the taxpayer can remotely deliver the electronic special ticket to the invoice recipient via email, QR code, etc.

3. After receiving the electronic special ticket, how to check the authenticity of the invoice?

Answer: The

electronic special ticket uses a reliable electronic signature to replace the original invoice special seal, and the electronic invoice supervision seal signed by the tax digital certificate replaces the original invoice supervision seal, which better meets the needs of the electronic invoice reform.

Taxpayers can download the VAT electronic invoice format file reader through the national value-added tax invoice verification platform (https://inv-veri.chinatax.gov.cn), view the electronic special invoice and verify the validity of the electronic signature and the electronic invoice supervision chapter .

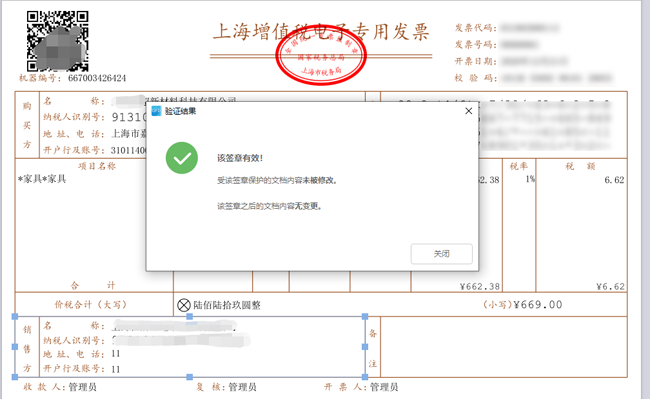

The specific method for verifying the electronic signature is as follows: open the downloaded electronic special ticket layout file through the VAT electronic invoice layout file reader, move the mouse to the relevant information of the "seller" in the lower left corner, click the right mouse button, and then click "in the prompt box" "Verify" button, the verification result will pop up.

If the verification result is "The signature is valid! The content of the document protected by the signature has not been modified. The content of the document after the signature has not changed", it indicates that the seller's electronic signature is valid.

The specific method for verifying the electronic invoice production stamp is as follows: open the downloaded electronic special ticket layout file through the VAT electronic invoice layout file reader, right-click the oval invoice production stamp above the invoice, and select "verify" to display the verification result .

In addition, taxpayers can also check electronic special invoice information by entering fields such as invoice code, invoice number, invoice date, and invoice verification code on the national value-added tax invoice inspection platform.

4. After the ticket recipient receives the electronic special ticket, how can I apply for deduction of the input value-added tax or export tax rebate, and agency tax rebate?

Answer: If

the recipient obtains an electronic special ticket to declare input tax deduction for VAT, or apply for export tax refund or tax refund, it should log in to the comprehensive service platform of value-added tax invoice to confirm the purpose of the invoice. The login address is determined and announced by the provincial tax bureau.

5. What are the basic rules for using electronic tickets for reimbursement, entry and filing?

Answer:

According to Caikuai [2020] No. 6, an electronic special ticket, as a type of electronic accounting document, can only be used for reimbursement and filing if the following conditions are met at the same time:

(1) The received electronic accounting documents are verified to be legal and authentic;

(2) The transmission and storage of electronic accounting vouchers are safe and reliable, and any tampering with electronic accounting vouchers can be discovered in time;

(3) The accounting system used can accurately, complete and effectively receive and read electronic accounting documents and their metadata, can complete accounting operations in accordance with the national unified accounting system, and can output electronic accounting in accordance with the format specified by the national archives administration department The vouchers and their metadata have set up necessary procedures for handling, review, and approval, and can effectively prevent the repeated entry of electronic accounting vouchers;

(4) The filing and management of electronic accounting documents conform to the requirements of the "Administrative Measures on Accounting Files" (Order No. 79 of the State Archives Administration of the Ministry of Finance).

If an electronic special ticket is used for reimbursement and accounting, and the financial information system of the unit can export the electronic filing format that meets the requirements of the national archives department, the electronic special ticket shall be archived and stored together with other electronic accounting vouchers, and the electronic special ticket is no longer needed Print and save paper documents; if a unit that does not meet the above conditions uses the paper printout of the electronic special ticket for reimbursement and entry into the account, the electronic special ticket should be handed over to the accounting archives staff together with the paper printout.

6. How to use standardized means to support the accounting system to automatically receive, identify and enter the electronic special ticket?

Answer: The

Ministry of Finance will soon issue data standards for electronic invoice entry, and will carry out pilot projects with the State Administration of Taxation in some enterprises to further standardize the entry of electronic vouchers such as electronic invoices, and facilitate the automatic receipt, identification and entry processing of the invoice party’s accounting system. .

7. Can the paper printout of the electronic special ticket be used as the basis for reimbursement and filing?

Answer:

can not.

According to the regulations of Caikuai [2020] No. 6, no matter what kind of reimbursement and accounting methods are adopted by each unit, as long as the electronic special ticket is received, it must be archived and stored.

If the unit uses the paper printout of the electronic special ticket as the basis for reimbursement and filing, it must also save the electronic special ticket that printed the paper.

8. How should the ticket recipient prevent the risk of repeated reimbursement and entry of the paper printout of the electronic special ticket?

Answer:

The paper printout of the electronic special ticket is only the carrier of the electronic special ticket invoice information, does not have the physical anti-counterfeiting function, and has the characteristics of being reproducible.

In order to avoid repeated reimbursements of the paper printout of the electronic special ticket, each unit should establish a sound internal control mechanism, strictly in accordance with Caikuai [2020] No. 6 regulations.

If the paper printout of the electronic special ticket is used as the basis for filing the reimbursement, the electronic special ticket printed on the paper must be kept at the same time.

At the same time, it is recommended that all units check the invoice code and number when reimbursement is entered into the account.

For units that have already used the financial information system, the system can be upgraded by establishing an invoice database, and the system can be used for automatic comparison; for units that have not yet used financial software to implement purely manual accounting, they can establish an invoice database through electronic forms, etc. Invoices are manually booked to effectively prevent risks such as repeated reimbursement and false entry.

9. How to archive various electronic invoices, including electronic special tickets?

Answer: The

filing and preservation of electronic invoices is divided into the following situations.

Units that have established an electronic file management system have implemented an accounting information system. The accounting vouchers and reimbursement vouchers related to electronic invoices have all been electronic (excluding paper vouchers, the same below), and electronic invoices can be combined with related Electronic accounting vouchers such as accounting vouchers and reimbursement vouchers can be sorted, archived and stored for a long time through the archive interface or manually imported into the electronic file management system. For the filing method, please refer to the "Enterprise Electronic File Filing and Electronic File Management Guide" (File Office Issue [2015 ] No. 4); if the accounting vouchers and reimbursement vouchers related to the electronic invoices are not electronic, the electronic invoices can be separately imported through the archive interface or manually into the electronic archive management system for sorting, filing and long-term preservation; sorting, filing, For long-term preservation methods, please refer to the "Guidelines for the Management of Enterprise Electronic File Filing and Electronic Archives" (File Banfa [2015] No. 4).

For units that do not have an electronic file management system, if an accounting information system is implemented, the accounting vouchers and reimbursement vouchers related to electronic invoices have all been electronicized, and the electronic invoices and related accounting vouchers and reimbursement vouchers can be transferred to accounting files The manager saves and compiles the file number, and the storage structure is suggested to adopt the following diagram:

At the same time, establish a ledger or catalog of electronic accounting files. The structure of the ledger or catalog is suggested as follows:

Serial number |

File number |

Voucher number |

Summary |

Voucher date |

Number of e-vouchers |

Remarks |

If the accounting information system has not been implemented, and the accounting vouchers and reimbursement vouchers related to electronic invoices have not been electronicized, the electronic invoices are handed over to the accounting file management personnel in electronic form for storage. The storage structure is recommended as shown in the following figure:

At the same time, establish an electronic invoice ledger or catalog. The structure of the ledger or catalog is suggested as follows:

Serial number |

Taxpayer Identification Number |

year |

Transaction |

Name of billing party |

Invoice number |

Issuance date |

Reimbursement document number |

Accounting Voucher Number |

file name |

Remarks |

When storing electronic invoices, methods such as multiple backups and regular testing shall be adopted to ensure that the electronic invoice files will not be lost and can be read within the specified storage period.

10. How should the relevant paper accounting vouchers be ensured and managed by the unit receiving the electronic special ticket?

Answer: For

units that accept electronic special invoices, paper vouchers are still used for reimbursement and entry of certain businesses, and this part of paper vouchers should still be managed in accordance with the management methods of traditional paper accounting files.

11. Does the above-mentioned Q&A on e-voucher reimbursement, entry and archiving apply to other VAT electronic invoices?

Answer: The

same applies.