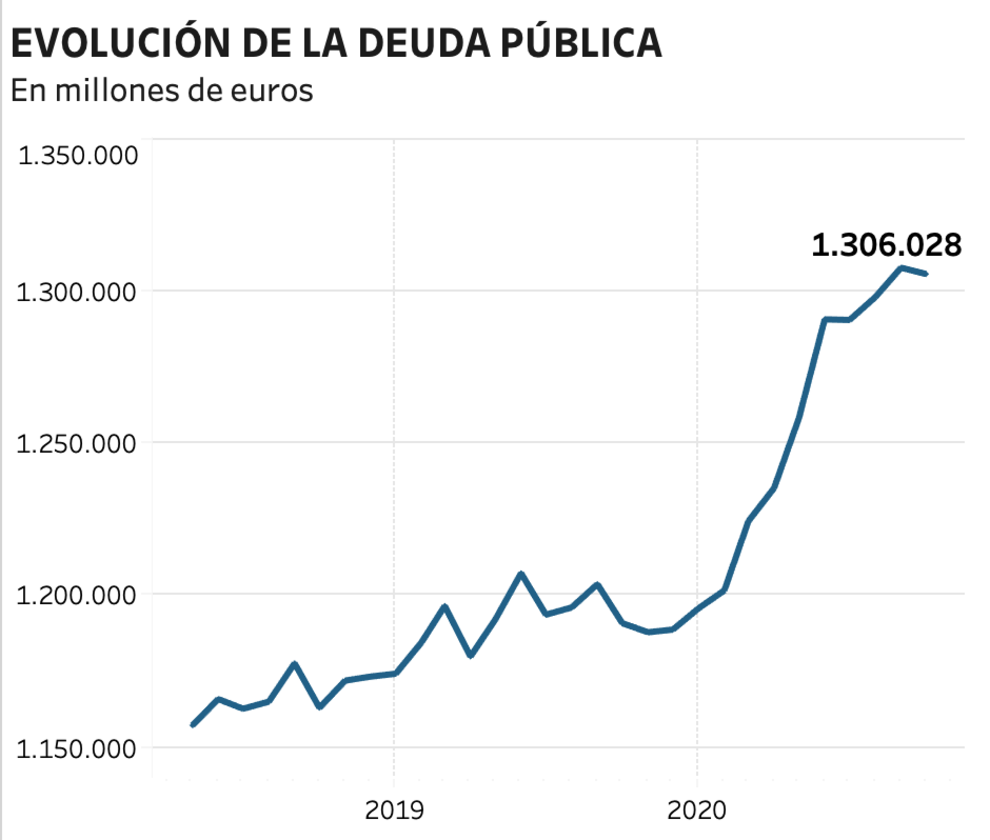

Covid-19 The coronavirus crisis has already triggered public debt by more than 30,000 million

Spain's public debt has skyrocketed by practically 150,000 million in the few more than two years that President Pedro Sánchez has led the Government.

From the

1.15 trillion to which the liabilities amounted at the end of May 2018 to the 1.30 trillion

at which it closed last October, the latest figure available according to data from the Bank of Spain.

And a good part of this notable increase is explained by the crisis derived from the coronavirus, yes, but another sum is equally important.

This is due to the spending policies of the PSOE and Podemos coalition Executive, so much so that between the aforementioned month of May 2018 and February of this year, the liabilities of the Public Administrations increased by more than 40,000 million, and within that same period, the blushing increase in the deficit that Spain suffered in 2019 was recorded. With the economy growing strongly and despite the warnings of national and international agencies and regulators, the Executive incurred an increase in the budgetary deviation that It has not been registered since 2012 and that has made Spain arrive, if possible,

worse off from the serious crisis unleashed by the coronavirus

A good example of the virulence of the recession that is hitting Spain is the collapse of the Gross Domestic Product (GDP) of more than 10% expected for this year and, of course, the increase of more than

100,000 million in debt registered only since February

.

And the forecast is that the figure will continue to grow significantly. This increase in spending, and unlike what happened until February, is recommended and indicated as necessary by the same organizations that warned in the past of the need to control the accounts .

But the problem, in addition to that same lack of control exhibited in the first 20 months - and also of the previous government, without a doubt - is the apparent lack of a future plan to redirect the debt and, of course,

Podemos' speech and the messages in which it conveys a total lack of concern about the increase in liabilities

.

In fact, this is precisely one of its main economic recipes. Precisely for this reason, the Independent Authority for Fiscal Responsibility (AIReF) has repeatedly called on the Government for a national fiscal strategy in the medium term, and that it present this project already in the month of April.

The president of the organization, Cristina Herrero, pointed out this month in Congress that the Recovery, Transformation and Resilience Plan plans a large disbursement thanks to European aid, but that at no time does it contemplate the debt containment measures that also must include.

"

It is not enough to know the projects, but they have to be accompanied by a budget plan that sets out a fiscal roadmap

The Bank of Spain, for its part, warned in its recent macroeconomic projections that the "

public debt will register a strong increase in 2020

, until it is close to 120% of GDP. "According to the latest data, the figure is already 118% of the Domestic Product, and for the next few years the body led by Pablo Hernández de Cos expects that, in the best of the cases, it falls back to 111.5% in 2023 or climbs to 128% in its most adverse scenario.

By areas

The information published by the BdE also shows that the central State is the area of the Administration with the highest liabilities: 1.306 trillion, with a spectacular increase in recent months as a result of the Government's decision to centralize the response before the crisis of the Covid.

But other figures also stand out, such as the 77,104 million that the

Social Security and that show the difficulties of sustainability that drag

the pension system.

To continue reading for free

Sign inSign up

Or

subscribe to Premium

and you will have access to all the web content of El Mundo

According to the criteria of The Trust Project

Know more