Youth asks for policy "14th Five-Year Plan"

How much room does the "14th Five-Year Plan" reduce taxes and fees

The story of tax cuts and fees will continue.

The just-concluded Central Economic Work Conference emphasized that it is necessary to continue to stimulate the vitality of market players, improve tax and fee reduction policies, strengthen inclusive financial services, and make greater efforts to promote reform and innovation to increase the vitality of market players, especially small, medium and micro enterprises and individual businesses .

---------------

Financial work is like dancing on the tip of a knife, and every subtle change in funds is closely related to people's livelihood.

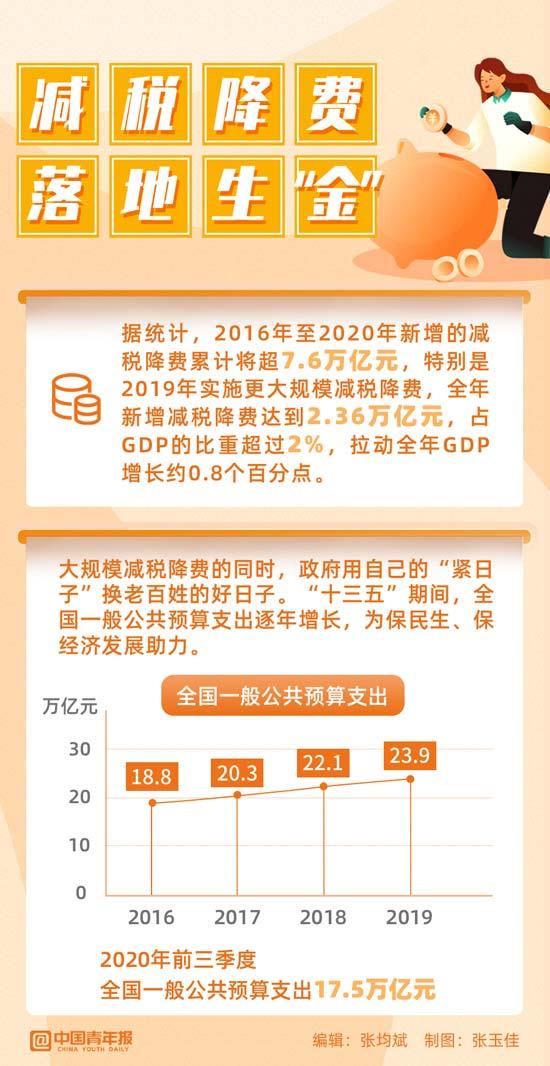

In the past five years, tax and fee reductions have become the main line of fiscal work. According to statistics, the cumulative tax and fee reductions from 2016 to 2020 will exceed 7.6 trillion yuan.

Tax cut dividends are not only driving economic growth, but also people's livelihood.

Now that the "14th Five-Year Plan" is about to begin, how much room is there for tax and fee reduction?

This year, a team of nearly 20 people from the Chinese Academy of Fiscal Sciences of the Ministry of Finance spent 10 months to sort out China’s financial situation, collecting data from 31 provinces (autonomous regions and municipalities), 333 cities and 136 districts across the country. The county’s economic and social indicators, general public budgets, government fund budgets, state-owned capital operating budgets, social insurance fund budgets, and debt revenue data from 2017 to 2019, the analysis concluded that: “large-scale tax cuts and fee reductions Space is limited, and there is room for structural tax cuts."

This team is led by Liu Shangxi, President of the Chinese Academy of Fiscal Sciences, and Liang Ji, Deputy Director of the Public Revenue Research Center of the Chinese Academy of Fiscal Sciences.

Liang Ji told the China Youth Daily and China Youth Daily that from the current macro tax burden level and fiscal risks, there is very limited room for continuing to implement large-scale universal tax (fee) reductions.

During the "14th Five-Year Plan" period, the government will promote structural tax (fee) reductions that increase and decrease under the background of stabilizing the macro tax burden.

Open the curtain of tax and fee reduction

The curtain of tax reduction and fee reduction in my country in the new century opened in 2009.

In order to cope with the impact of the financial crisis and promote stable economic development, the "implementation of structural tax reduction policies" was first included in the government work report that year as one of the important elements of the proactive fiscal policy.

Over the next ten years, "tax reduction and fee reduction" became the main tone of tax policy adjustments.

As a result, my country’s small-caliber macro tax burden has changed from a continuous upward trend since 1994, from a historical high of 18.62% in 2012 to 15.94% in 2019, and the growth rate of tax revenue has also dropped from 23% in 2011 to 1% in 2019 has effectively reduced the burden on market entities, stimulated market vitality, and played an important role in stabilizing economic growth and improving the quality of economic development.

In 2019, tax cuts and fees were cut by 2.36 trillion yuan, which drove the year's GDP growth by 0.8%, fixed asset investment by 0.5%, and total retail sales of consumer goods by 1.1%.

This year, in order to hedge against the impact of the new crown pneumonia epidemic, the scale of tax and fee reductions has been even greater. In the first three quarters, the total amount of new tax and fee reductions nationwide reached 2,092.4 billion yuan.

Jiang Xiaoping, general manager of Guangdong Xinglian Precision Machinery Co., Ltd., said that in the past two years, companies have enjoyed additional deductions for R&D expenses and high-tech corporate income tax incentives, with a cumulative income tax reduction of nearly 7 million yuan; and the reduction of the value-added tax rate is expected to increase the value of enterprises. Tax reduction of 1 million yuan.

These saved funds have been invested in product research and development, equipment renewal and talent introduction. The innovative development of the company has also attracted businesses from home and abroad to come to cooperate.

Starting from February 2019, the Budget Working Committee of the Standing Committee of the National People's Congress (hereinafter referred to as the "Budget Working Committee") has formed a research team to conduct field investigations and conduct related special investigations in Jiangsu, Heilongjiang, Xinjiang and other provinces (autonomous regions).

A questionnaire survey organized by the Budget Working Committee shows that among the 753 survey respondents, more than 92% believe that the implementation of tax and fee reduction policies and measures is good or better.

Judging from the survey results, the tax and fee reduction policies and measures are strong, with a wide range of benefits and obvious results.

More critical is market expectations.

Since 2018, stabilizing expectations, as one of the "six stability" contents, has become an important part of macro-control. Behind the expectations is confidence.

Liang Ji said that tax cuts and fee reductions naturally have the effect of stabilizing expectations. It can increase residents' disposable income and investment profitability, expand domestic demand, enhance corporate investment confidence, and enhance market vitality.

The positive signal of "government giving benefits to the people" conveyed by the policy can also stimulate individual residents' willingness to consume, boost entrepreneurs' confidence, and inject certainty into economic development.

Fiscal operation is "tightly balanced"

The core issue of the continuation of the tax and fee reduction policy is how to make up for the fiscal revenue and expenditure gap caused by large-scale tax and fee cuts, and to ensure the sustainability of finance, especially local government finance.

From the perspective of the central government, fiscal balance mainly comes from two aspects: one is to moderately increase the deficit rate, and the other is to increase the profits paid by certain financial institutions and central enterprises.

Therefore, the fiscal sustainability of the central government itself is not a big problem.

But for local governments, if the economic boost is not effective under the influence of external factors, then the decline in revenue brought about by tax cuts and fee cuts will cause certain fiscal revenue and expenditure pressures.

So far, national and provincial fiscal data have been included on the Ministry of Finance website. These data can be found in the "China Fiscal Yearbook" as early as 1992.

But if you want to observe the full picture of China's fiscal operations, data on the grassroots fiscal is essential.

This is the original intention of Liu Shangxi and Liang Ji's team to compile the "Chinese Government Revenue Panorama (2020)".

Statistics show that some local governments across the country are operating in a "tight balance" state.

For example, the team found that the per capita financial resources of a province is weak, which is a typical "food" finance.

At present, the implementation of some major national strategies in the province has entered a critical period, and there is a great need for expenditures such as fighting the "three tough battles", implementing the national livelihood indicator policies, and promoting the province's economic transformation and upgrading.

At the same time, three-quarters of the counties (cities, districts) in the province belong to the “food subsidy” weak counties, and nearly 80% of the counties (cities, districts) accounted for more than half of the general public budget expenditures.

From January to June 2019, there were 23 counties (cities, districts) where the growth rate of general public budget revenue was less than 6%, 11 of which had negative growth, and fiscal operations were always in a state of "tight balance".

With the increase in tax and fee reduction, especially after the implementation of the larger-scale tax and fee reduction policy in 2019, rigid expenditures such as superimposed on people's livelihood have not been reduced, and the pressure on local fiscal revenue and expenditure has become more prominent.

From 1992 to 2013, my country’s general public budget expenditure growth rate remained at 10% for 22 consecutive years, of which 8 years remained above 20%; from 2014 to 2019, it fell to less than 10%, but it was still higher than income growth for 5 consecutive years. The above situation resulted in deficits in most years.

“There is a limit to the risks that finance can bear. When the limit is exceeded, it will not only push up hidden deficits and debts, but also increase public risks.” “The key to this is balance,” said Liang Ji. There are many issues that finance needs to consider. , Such as long-term and current, development and stability, supply and demand, rhythm and intensity, etc.

She emphasized that in the face of the uncertainty of the external development environment and the downward pressure of the economy, the tax and fee reduction policy should neither be absent nor offside.

The cake cannot be infinitely bigger

Tax cuts have three effects. One is to expand domestic demand and stimulate economic growth, the other is to reduce costs, and the third is to guide and stabilize expectations.

The prerequisite and key point for reducing taxes and fees to stimulate economic growth is that enterprises and residents should use the "benefits" of tax and fee reductions, that is, investment or consumption, otherwise they will not bring about economic growth.

And whether it is investment or consumption, the follow-up transmission mechanism is also to bring about an infinite cycle of consumption. Only when the consumption cycle continues, can it produce the multiplier effect of tax reduction and fee reduction.

In 2019, my country’s tax cuts and fees will be 2.36 trillion yuan, of which 0.58 trillion yuan will be reduced for residents, and 1.79 trillion yuan will be reduced for enterprises (1.43 trillion yuan will be reduced for turnover tax, income 0.36 trillion yuan in taxes and fees).

According to the calculations of the Chinese Academy of Fiscal Sciences team, tax cuts for residents will drive economic growth by 0.57 trillion yuan, and tax cuts and fee cuts for enterprises will drive economic growth between 1.42 and 2.28 trillion yuan, of which reduction in taxes and fees will drive GDP growth. 1.18-1.79 trillion yuan, reducing income taxes and fees will drive GDP growth by 0.23-0.48 trillion yuan.

At the same time, tax cuts and fee reductions pose increasing challenges to fiscal sustainability, and the general public budget revenue and expenditure gap rate has been rising year by year.

Between 1994 and 2012, only a few years (mainly concentrated in 2000-2003 after the 1998 Asian financial crisis) the general public budget revenue and expenditure gap rate exceeded 2%, but since 2015, the general public budget revenue and expenditure gap rate It has expanded dramatically, breaking through 3% in 2015 and reaching 4.89% in 2019. The general public budget balance is increasingly dependent on transferred funds and debt.

The "Proposals of the Central Committee of the Communist Party of China on Formulating the Fourteenth Five-Year Plan for National Economic and Social Development and the Long-Term Goals for 2035" in the chapter "Comprehensively deepen reforms and build a high-level socialist market economic system" pointed out that we must establish a modern Fiscal, taxation and financial system.

Strengthen the overall planning of financial resources, strengthen the management of mid-term financial planning, and strengthen the financial guarantee for major national strategic tasks.

This is the first time that policy-makers have mentioned "strengthening the overall planning of financial resources." The signal is self-evident that the government must live a "tight life". How to reduce fiscal expenditures and spend money on the knife is at all levels. An exam question before the government.

Obviously, as a short-term policy measure, there is very little room for tax reduction and fee reduction.

Liu Shangxi believes that the continued implementation of tax and fee reduction policies in the future should be combined with the improvement of the tax system. "Tax reduction and fee reduction should be a by-product of a sound system."

The cake cannot be made unlimited. In the future, dividing the cake has become a more important option.

Liang Ji said that my country is in a period of tackling key problems in transforming its development mode, optimizing economic structure, and transforming growth momentum. Periodic, structural, and institutional issues are intertwined. Tax and fee reduction policies are needed to hedge the downward pressure on the economy. Use tax and fee policy adjustments to comply with and guide economic structural changes, and use tax and fee system reforms to solve deep-level institutional and institutional problems in economic development.

Promote structural tax cuts

The story of tax cuts and fees will continue.

The just-concluded Central Economic Work Conference emphasized that it is necessary to continue to stimulate the vitality of market players, improve tax and fee reduction policies, strengthen inclusive financial services, and make greater efforts to promote reform and innovation to increase the vitality of market players, especially small, medium and micro enterprises and individual businesses .

In Liang Ji’s view, when it comes to tax burdens, it means implementing structural tax cuts (fees) that increase and decrease while maintaining a relatively stable macro tax burden, that is, through structural adjustments to the tax and fee system (policies). , To achieve a more balanced development of my country’s tax system structure, tax revenue structure, tax source structure and taxpayer structure.

She said that structural tax (fee) cuts are not only needed to cope with the temporary economic "cliff" decline caused by the current new crown pneumonia epidemic, but also determined by the superimposition of the "three phases" that my country is currently in, and it is a comprehensive deepening. Reform and accelerate the formation of a new development pattern.

For example, through a more scientific and reasonable value-added tax system arrangement, it can reduce the "interference" to the decision-making behavior of producers and consumers, and improve the efficiency of market operation; by optimizing the income tax system (policy), it can improve the willingness and ability of individuals and enterprises to innovate. Enhance the vitality of micro-subjects, promote a virtuous circle of real economy and finance, expand middle-income groups, and activate dormant development potential.

Li Xuhong, director of the Institute of Fiscal and Taxation Policy and Application of Beijing National Accounting Institute, believes that the implementation of tax reduction and fee reduction is a major step towards a modern tax system and adapting to the external environment of economic globalization. The next step needs to be based on the direction of establishing a modern tax system. The reform of value-added tax and personal income tax reflects the requirements of tax reduction, and promotes tax reduction through reform; it also aims to establish a market-oriented, legalized, and internationalized modern tax system.

She suggested that while consolidating and expanding the effects of tax and fee reduction policies, the government should further deepen the reform of the tax system and pension insurance system, and vigorously improve the level of institutionalization and standardization of government funds, administrative fees and other enterprise-related fees. , Vigorously strengthen the legalization of government revenue, further strengthen budget management, and promote the modernization of the national governance system and governance capabilities.

Yu Hong, deputy dean of the China Institute of Public Finance at Shanghai University of Finance and Economics, also mentioned the space for tax and fee reductions. She felt that the dividends of tax and fee reductions would continue to be released next year, and efforts could be made in certain fees, such as some public utilities. There is some room for fees or administrative expenses to be transferred to consumers.

During the "14th Five-Year Plan" period, it is necessary to achieve high-quality development while avoiding the accumulation of structural contradictions. The new round of proactive fiscal policies will test the government's ability and level of economic regulation.

China Youth Daily and China Youth Daily reporter Zhang Junbin Source: China Youth Daily