The first domestic supervision measures for online small loans are here:

The 5 billion threshold and the 30% red line of joint loans affect geometry

The first domestic regulation on online microfinance is here.

In order to regulate the online small loan business of small loan companies and unify the regulatory and operating rules, the China Banking and Insurance Regulatory Commission, in conjunction with the People’s Bank of China and other departments, drafted the Interim Measures for the Administration of Online Small Loans (Draft for Comment) (hereinafter referred to as " Method").

Among them, regarding "small loan companies that operate online microfinance business across provincial administrative regions, the registered capital will not be less than RMB 5 billion (and is a one-time payment)" and "small online loans" in a single joint loan Regulatory requirements such as the investment ratio not less than 30%, have become the focus of discussion.

According to the company's data statistics, it is currently shown as "existing". There are only 5 small loan companies nationwide that meet the requirements of 5 billion yuan deposit. They are: Chongqing Ant Small and Micro Loan Co., Ltd. (12 billion yuan) ), Nanning Jintong Microfinance Co., Ltd. (8.989 billion yuan), Chongqing Duxiaoman Microfinance Co., Ltd. (7 billion yuan), Chongqing Suning Microfinance Co., Ltd. (6 billion yuan), and Sino-Singapore (Heilongjiang) Internet Small Loan Co., Ltd. (5 billion yuan).

And from the perspective of the business scope of the five companies, with the exception of Nanning Jintong Small Loan Co., Ltd., the remaining four are all shown as online small loan companies with a national scale.

Among them, Chongqing Ant Small and Micro Loan Co., Ltd. is the main operating entity of Ant Huabei.

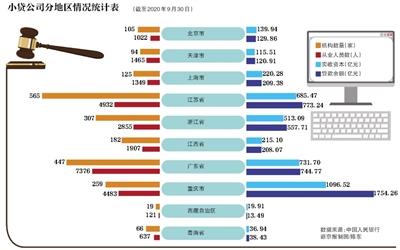

According to the "Statistics Report on Microfinance Companies for the Third Quarter of 2020" issued by the People's Bank of China on October 31, as of the end of September 2020, the total number of small loan companies nationwide was 7,227.

Is the 5 billion entry barrier too high?

"The deposit of 5 billion yuan is very difficult for the vast majority of small online lenders to satisfy."

"Currently, small online loans, especially those in the province and not across regions, are not financial institutions in the strict sense, but are still local financial organizations under local supervision", but "the threshold fee of 1 billion yuan or even higher has been referred to In addition to the standards of licensed financial institutions such as consumer finance,” Bi Yanguang believes that the 5 billion yuan deposit is “difficult to satisfy” for the vast majority of small online lenders.

According to Article 12 of the "Administrative Measures for the Pilot Administration of Consumer Finance Companies" (China Banking Regulatory Commission Order No. 2 of 2013), the minimum registered capital of consumer finance companies is 300 million yuan.

According to an enterprise search, since 2019, the registered capital of consumer gold companies approved by the China Banking and Insurance Regulatory Commission, such as Ping An Consumer Financial and Chongqing Xiaomi Consumer Financial, have been 1 billion yuan or more.

"If there is 5 billion yuan, the industry may not register a small online loan company, but choose to work hard with a licensed consumer finance company." Bi Yanguang went on to say, "If the function positioning of the online small loan is small and decentralized Inclusive financial services, the threshold should be appropriately lowered."

On the whole, Yu Baicheng, Dean of Zero One Research Institute, believes that the "Measures" are relatively strict, with clear requirements in terms of cross-regional operations, leverage, joint loans, and loan investment.

However, the "Measures" greatly increased the registered capital of online small loans, which attracted his attention.

In the eyes of Baicheng, this means that it will be more difficult for online small loan companies to apply for national business.

"The online microloan operating across provincial administrative regions requires 5 billion yuan, and is a one-time paid-in monetary capital. This threshold will limit most current online microloan companies."

What is the impact on practitioners?

"The license-related financial business and its technology business will face the possibility of splitting."

The "Measures" "The Internet microfinance business of financial technology giants such as Ant Group is relatively clear, and there is no doubt." Faced with reporters’ questions, well-known financial writers, China Small and Micro Credit Institutions Business Innovation Cooperation Alliance The initiator Ji Shaofeng said first.

In his view, the so-called technological assistance of some financial technology giants is precisely through technology "bypassing" financial regulation in disguise, and "now "frame it" at once."

Regarding the support behind the financial technology giants providing credit services, Ji Shaofeng believes that “they now have a license for consumer finance (ie consumer finance companies) in addition to online small loans, but the supervision of consumer finance is very strict."

Regarding the future of the giants, Ji Shaofeng puts forward his own point of view, that is, the license-related financial business and its technology business will face the possibility of splitting.

Chen Wen, director of the Digital Economy Research Center of the School of Finance of Southwestern University of Finance and Economics, told reporters that in fact, most of the online small loans approved by a large number of local governments have problems with cross-provincial operations.

For the online small loan industry, "the next three years need to undergo rectification."

"A large number of online microfinances have been set up in the past, and there is a phenomenon of'regulatory arbitrage.' They register companies in some regions such as the central and western regions, and then use the Internet to conduct national exhibitions. The actual operating headquarters are in first-tier cities such as Beijing, Shanghai, Guangzhou and Shenzhen or economically developed regions. If the business shrinks to the province or region where the registration is located, there will be almost no market space." He explained.

However, considering practical requirements such as higher thresholds for actual payment of registered capital for online small loans operating across provinces, Chen Wen said frankly that after the "Measures", a large number of online small loans will face withdrawal or transformation.

In the view of Bi Yanguang, a senior researcher at Qicai Think Tank, the "Measures" detailed the investment ratio of a single joint loan. "At least 30% of the investment is to prevent some online small loans from using 10% of the funds and leveraging the remaining 90%. lever."

Taking the Ant Group as an example, Bi Yanguang specifically explained the impact of joint lending, “Before, the joint lending model of Huabei Borrowing was investigated by the central bank, and many of the Huabei Borrowing and other models were based on the inherent logic of combined lending. If so. If the leverage ratio is not controlled, it is easy to create risks caused by'overlending'."

According to Chen Wen's analysis, the 30% red line rule will play two roles.

"First, prevent several online microfinance joint loans from increasing the size of a single loan, so as to ensure the'small' and'dispersion' of online microfinance; second, prevent online microfinance from transferring a large number of credit asset risks to banks Wait for financial institution partners to realize effective constraints on online small loans."

Huang Xinyu, Shell Financial Reporter, Beijing News

■ Comments

1 The sustainable development of online microfinance should take into account social and moral responsibilities

On November 2, the China Banking and Insurance Regulatory Commission and the Central Bank issued the Measures for the Administration of Online Small Loans and an article by an official of the China Banking Regulatory Commission pointed out the problem of online small loans, which showed that the government has paid great attention to the issue of online small loans and is determined to rectify it. A clear attitude to include small loans in the scope of effective supervision.

In the past ten years, due to my country’s implementation of the financial innovation strategy, a large number of Internet companies involved in online microfinance have emerged in the field of technology. Many technology companies have also launched online microfinance businesses, launched credit products with the nature of bank credit cards, and created Loan products such as "borrowing" similar to bank microloans have indeed played an important role in solving the problem of inclusive finance.

However, the development of online microfinance in recent years has also caused many problems: the failure to fully incorporate all online microfinance activities into the scope of effective supervision has led to the current diversification of financial service providers, including both licensed financial institutions and emerging financial technology companies. Off-line service channels and on-line marketing methods, while providing a diversified consumer experience, have appeared disorderly competition, leading to regulatory arbitrage, improper competition with licensed financial institutions, and inevitably infringing on financial consumption Some chaos in the rights and interests of consumers: For example, a few banking institutions have problems such as exaggerated returns and insufficient risk warnings. They seek personal gains through "flying orders" and "radish chapters", infringing on consumers' property security and income rights.

There are also some fintech companies that use the advantage of guiding customers to directly charge executive fees. Generally, the fee is as high as one-third, and the high can reach more than two-thirds, which will be used by the people and used by the people. Data has become the capital for seeking self-interest and charging high service fees from consumers.

The most serious is that some financial technology companies rely too much on personal consumption and repayment willingness, and lack effective assessment of repayment ability, forming excessive credit and stimulating advanced consumption, causing many low-income groups and young people to fall into debt traps and ultimately harm Consumer rights and even harm the family and society.

There are also some financial technology companies that pay attention to their own benefits in terms of fees, which are inconsistent with their philosophy of inclusive finance. In fact, they are "inclusive but not beneficial."

The emergence of these financial chaos problems is mainly because a small number of institutions have forgotten their original intentions, put their own benefits above the rights and interests of consumers, and lacked moral awareness and social responsibility awareness.

The lack of awareness of social responsibility means that some fintech companies take the government's green light to give development opportunities as a matter of course. Not only do they not know how to be grateful, but they use their own development strength to put pressure on the government's financial supervision, lack of financial political awareness and overall awareness, and lack of finance. Risk prevention awareness.

If we continue to develop under this status quo, letting finance expand blindly can easily induce financial risks.

In this way, not only the relevant companies themselves are trapped on all sides, but eventually the people across the country will suffer and the country's economic development will suffer severe trauma.

Therefore, bringing all financial activities into the scope of effective supervision is the need for China's financial stability and development, and it is also the need for the sustainable development of related companies themselves. In fact, it is time to "operate" on online small loans.

While pursuing their own business development, online small loan companies should have a sense of social responsibility and moral responsibility. Protecting consumer rights and preventing financial risks should be the foundation of their business and survival and development, and they should also be duty-bound. Righteousness.

□Mo Fan (Researcher of China Local Finance Research Institute)

2 The most stringent regulatory "storm" of online microfinance is approaching, investors should invest cautiously and rationally

The China Banking and Insurance Regulatory Commission and the People’s Bank of China issued the Interim Measures for the Administration of Online Small Loan Business, which put forward a number of requirements in terms of business area and registered capital, and complemented the shortcomings in the supervision of online small loan business. Supplement and refinement of the "Notice on Strengthening the Supervision and Management of Small Loan Companies" (referred to as the "Notice") promulgated by the General Office of the China Insurance Regulatory Commission.

According to the "Notice", small loan companies should, in principle, conduct business within the county-level administrative area where the registration place is located; for small loan companies with good business management, strong risk control capabilities, and good regulatory evaluations, the approval of the local financial regulatory authority , You can relax the restrictions on the operating area, but not beyond the provincial administrative area where it is located.

However, in recent years, some small loan companies in my country have used the online small loan business to break through the limitation of operating areas and quickly expand their business to the whole country through cross-provincial operations; on the other hand, they integrate funds through asset securitization and other methods to break through the constraints of financing leverage. Sharply magnify the leverage.

Due to the lack of unified and clear rules for online microfinance business across the country, local governments have different standards and standards for microfinance companies' online microfinance approval, resulting in inter-regional arbitrage problems.

A small number of local governments have approved a large number of small loan companies' online microfinance qualifications, which has laid hidden dangers for the brutal growth of the online microfinance business.

According to statistics, there are currently about 250 small loan companies operating online small loan business, of which nearly 100 are registered in Guangdong Province and Chongqing City. For example, two small loan companies under the Ant Group are registered in Chongqing City.

In addition, Jiangsu, Zhejiang, Shanghai and Jiangxi provinces also have many small loan companies operating online small loan business.

In November 2017, the Office of the Leading Group for the Special Rectification of Internet Financial Risks issued the "Notice on the Immediate Suspension of the Approval of Online Microfinance Companies", requiring no new approval of online microfinance and prohibiting small loan companies from operating across regions.

Since then, except for a few due to the transformation of P2P online lending, the online small loan business has not been added.

The "Notice" also emphasized once again that "local financial regulatory authorities should, in accordance with existing regulations, suspend new microfinance companies from engaging in online microfinance business and other cross-provincial (autonomous regions, municipalities) businesses", and clearly: Unless otherwise specified for loan business, etc.

Therefore, in response to the problems and deficiencies in the online microfinance business, the regulatory authorities issued a document to comprehensively improve and adjust the previous regulatory policies, focusing on five aspects of standardization.

First, it is emphasized that the online microfinance business should be operated in the provincial administrative region.

Only very few can cross-provincial operations after approval, and the approval authority for cross-provincial operations will be received from the China Banking and Insurance Regulatory Commission.

This greatly reduces the value of the qualifications for operating online small loans and also helps reduce the risks associated with cross-provincial operations.

In addition, as a major shareholder, the number of small loan companies that participate in cross-provincial online small loan business shall not exceed two, or the number of small loan companies that hold a controlling stake in cross-provincial online small loan business shall not exceed one.

For Ant Group, which owns two small loan companies, even if they are allowed to operate across provinces, they can only keep one.

Second, online microfinance should adhere to the principle of small amount and decentralization.

Personal loans do not exceed 300,000 yuan and the lower one-third of the three-year annual income, and institutional loans do not exceed 1 million yuan.

However, the "Notice" does not limit the specific loan amount, but only requires: the loan balance of the same borrower shall not exceed 10% of the net assets of the small loan company, and the loan balance of the same borrower and its related parties shall not exceed the net assets. 15%.

Third, limit the proportion of joint loans for online small loans.

In a single joint loan, the proportion of small loan companies operating online small loan business shall not be less than 30%, in order to restrain small loan companies from expanding too quickly through joint loans.

Among the small loan companies under the Ant Group, in issuing joint loans with some small and medium-sized banks, their capital contribution ratio is as low as 5%, and the lowest is only 1%.

According to estimates, with the aid of the joint loan model, Ant Group leveraged its 36 billion on-balance sheet assets to leverage 1.8 trillion joint loans, which has become the most important tool for its credit expansion, and it has also planted greater risks.

Fourth, restrict the financing leverage of small online loans.

It is clear that small loan companies operating online small loan business shall not exceed 1 times their net assets through bank loans and shareholder loans; financing through ABS and bond issuance shall not exceed 4 times their net assets.

As a result, small loan companies operating online small loan business have a total leverage ratio of 5 times.

This is consistent with the "Notice"'s requirements on the leverage ratio of small loan companies, but it has a great impact on the small loan companies under the Ant Group, strictly restricting their access to funds through asset securitization and boosting their unlimited expansion.

At the same time, the draft also includes the authority to adjust the leverage ratio of online small loans to the China Banking and Insurance Regulatory Commission to prevent local regulatory deregulation from causing inconsistent standards.

Fifth, raise the capital threshold for operating online small loans.

The registered capital of small loan companies engaged in online microfinance is no less than 1 billion yuan, and the registered capital of small loan companies that operate online microfinance across provinces is no less than 5 billion yuan.

This is not too much pressure for small loan companies under large Internet companies, but it is still not a low threshold for new entrants, making it more difficult for some Internet platforms to transform into small loan companies.

In short, the regulatory authorities adhere to the combination of decentralization and regulation. On the one hand, they have issued the "Notice" to relax some policy requirements for small loan companies, and on the other hand, they intend to strengthen the guidance and supervision of online small loan businesses.

In general, this will help regulate the operation of online small loan business, improve the service capabilities of small loan companies, and better serve the real economy while preventing risks.

If the relevant measures are officially implemented, the online microfinance business will usher in a larger round of adjustments, and large technology companies that wantonly expand through the online microfinance business will be significantly impacted.

When Ant Group is about to go public, investors should fully anticipate policy risks and invest prudently and rationally.

□Dong Ximiao (Chief Researcher of Zhongguancun Internet Finance Research Institute)