Banca.CaixaBank and Bankia prepare an imminent merger accelerated by the coronavirus crisis

Keys: This will be the largest bank in Spain after the merger of CaixaBank and Bankia

The dance begins.

That was the first impression that the entire economic sector had on Thursday night, just after the news that CaixaBank and Bankia are studying to merge to create the largest bank in the country.

The announcement surprised for the moment and for the protagonists, but not for the operation itself.

The market has long been warning of the need to undertake a consolidation process and the coronavirus pandemic has only served to accelerate it.

The music, then, has begun to play but there are still many bars to know how the negotiations will end.

Could they get frustrated?

Could.

Among experts and analysts there is optimism, but also prudence because it is not the first time that two Spanish entities have attempted an operation of this type and it does not end up being executed.

Liberbank and Unicaja are the closest example, but there are more.

In any case, the general perception is that it is a positive operation for the sector and with a clear strategic sense.

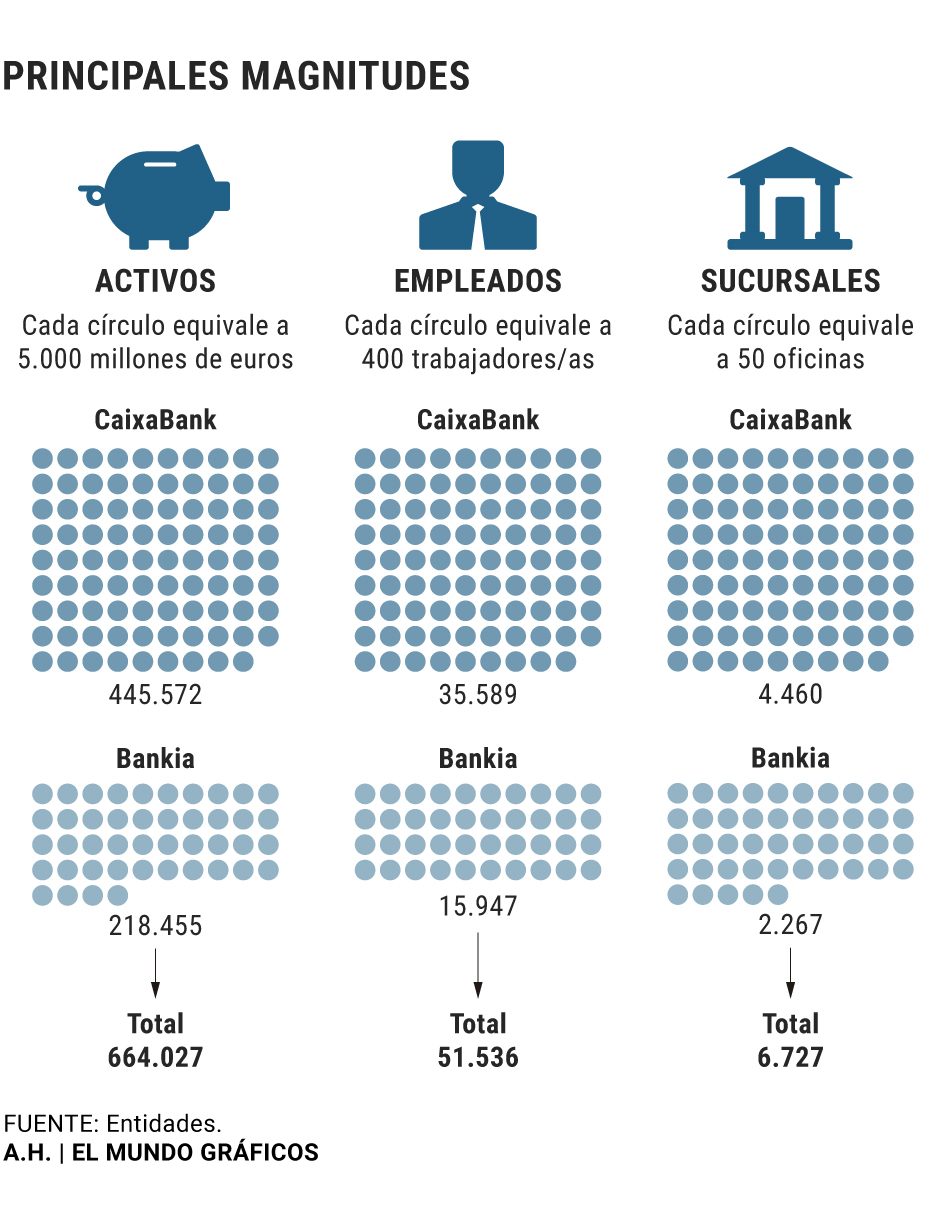

The merger would give rise to a giant with more than 664,000 million euros in assets and would allow the two groups to face the main problem affecting the Spanish and European financial sector: the low profitability of the business.

In an environment marked by low interest rates and economic difficulties caused by Covid-19,

the future of banks is increasingly complex

.

"The sector is under pressure, especially the parts of the business that have always been more profitable, that is, transfers, consumer credit, private banking and investment. The only way to survive is by reducing costs, but that is also complicated by the social and economic impact that it entails (layoffs, branch closures, etc.), hence integration in this case is the most logical way out because it accelerates this cost reduction process ", explains

Julián Pascual

, president and partner of Buy & Hold .

Generate synergies to reduce costs.

That is the key to the operation between Bankia and CaixaBank.

The businesses of both entities are complementary, with a greater weight of mortgage credit and real guarantee in Bankia (55% of the total gross loan portfolio in the first half of 2020 compared to 35% of Caixabank) and greater exposure to credit to companies and Caixanbak consumers (47% of the total gross loan portfolio compared to 39% of Bankia), as reflected in the Income 4 analysis. Regarding the geographical distribution in Spain, both would obtain synergies in areas such as Madrid and Catalonia, where the bulk of its business is located, although

the headquarters will remain in Valencia

.

Based on

Barclays'

average scenario

, the merger would cause a branch overlap of 23% if the postal code is considered and, assuming a 50% reduction in employees per closed branch, restructuring costs could be slightly higher than 1,000 million euros, with an annual savings potential of almost 500 million.

Together, the integration of personnel and branches could increase the entity's profit before tax by 18% in 2022.

Retrieve the ransom

The operation would take place through the exchange of shares and therefore the generation of value for the shareholders will depend on said exchange and the supposed premium it entails.

"The new entity would have Criteria (Caixabank's main shareholder) as majority shareholder, with an estimated participation of between 29% and 31%, followed by Frob (Fund for Orderly Bank Restructuring), which would own between 14% and 17% "says Barclays.

The price at which the operation is closed and the percentage that remains in the hands of the State (currently close to 62%) will also mark how much the State can recover after the rescue it paid in 2012,

more than 22,000 million euros

.

"It is unlikely that he will recover everything he put in, but the better the bank's business goes, the more the public coffers will recover," says Julián Pascual.

Analysts agree on this point and also that this merger would open the door to other operations in the sector.

The

European Central Bank

has been pressing in this direction for some time and entities know that they do not have much margin to ignore them.

"The Spanish banking sector continues to present a complicated environment for both business growth (volumes) and prices (interest rates), which is aggravated by the Covid-19 crisis due to the increase in delinquencies and therefore the Cost of Risk (provisions) ", says

Rafael Alonso

, an analyst at Bankinter.

"It is convenient to strengthen the sector and every time a merger of this type jumps, other similar operations come after it," recalls

Santiago Carbó

, director of Financial Studies at

Funcas

.

The unknown is who will be the next protagonists to hit the track.

Sabadell

has been part of all the pools for some time, but the movement of Bankia and CaixaBank complicates the scenario because the options are reduced.

There are fewer candidates for the dance and that adds pressure to him in his current state.

Only so far this year, the entity has put 63% of its value on the stock market and barely exceeds 2,000 million in capitalization.

Except for Bankinter, whose business is the healthiest and with the highest profitability, the rest of the large and medium-sized entities are playing a stealth game in which almost all combinations are possible.

BBVA admitted a few months ago that it was open to corporate operations, while Santander ruled it out.

Now, Gonzalo Gortázar also ruled it out for CaixaBank and just two months later things have turned 180 degrees.

According to the criteria of The Trust Project

Know more

economy

Bankia

Gonzalo Gortázar, the discreet man who will mark the passage of the largest bank in Spain

Savings and Consumption Accounts, cards, mortgages ... this is how the merger of Bankia and CaixaBank would affect customers

EmpresasCaixaBank and Bankia soar on the stock market after announcing that they are studying their next merger

See links of interest

Last News

Programming

English translator

Work calendar

Daily horoscope

Santander League Standings

League schedule

Movies TV

2019 cut notes

Topics

Stage 7: Millau - Lavaur, live