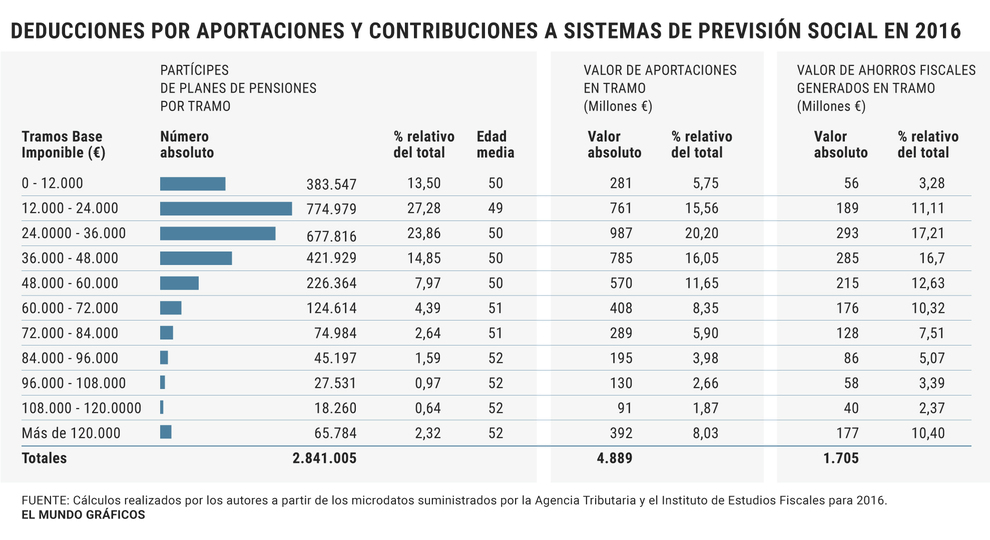

Pension Plans are assets that are being unfairly discredited. The two arguments used by its detractors are its high collection cost and its negative distributional impact. Both ills, according to his critics, derive from an excessively benevolent tax treatment. However, neither the Pension Plans enjoy a particularly advantageous treatment, nor do they generate a high collection cost, nor are they assets that only "the wealthy" monopolize. Do these assets receive really benevolent tax treatment? The answer is no, your tax advantage is limited to a deferral of the income tax payment of

To continue reading, go Premium

Already Premium? Log in

Monthly

Summer Sale

€ 1

/ month for 2 months

and then € 7.99

I want itAnnual

4 months free

€ 59

Free 1 year of Standard Legálitas (valued at € 240)

I want itFind out what Premium is

Cancel whenever you want

Check the terms and conditions of the service

According to the criteria of The Trust Project

Know more