The coronavirus crisis has hit household finances and left tens of thousands of households with water around their necks due to falling incomes and the slow processing of public aid implemented by the government. One of the indicators that reflects this financial suffocation is that of requests to postpone the payment of credits to banks.

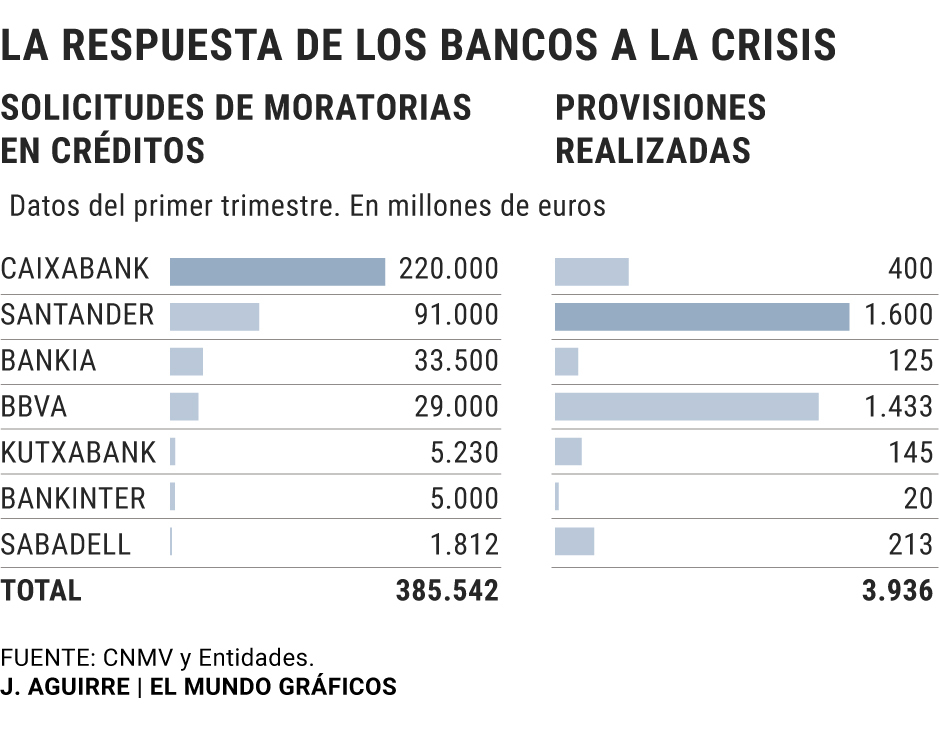

According to the figures that the entities themselves manage, in just over a month there have been 385,542 requests for a moratorium on the payment of the bill for both mortgage loans and others intended for consumption. This amount would represent a daily average if weekends of more than 12,800 applications are excluded, although the figures vary greatly depending on the entity.

Most of these requests are linked to the financial relief mechanism approved by the Government in the Royal Decree of economic measures during the State of alarm. This mechanism allows the payment of loans to families that have been affected by the coronavirus crisis to be deferred for a period of three months, either as part of an ERTE or by a significant decrease in their income in the case of self-employed. To achieve the postponement, the beneficiaries must meet various conditions and present to the entities a multitude of documents that prove their economic status and ownership of the property.

Apart from the Royal Decree-Law, the financial sector is jointly promoting an additional moratorium of up to 12 months on the payment of the principal in mortgage contracts and 6 months in consumer loans. In this way, those who avail themselves of this measure would only pay the interest on the loans during this time.

The requests formalized to date affect, in each case, loans that represent between 5% and 10% of the domestic loan portfolio , around 16,000 million euros, although its main executives advanced last week that they anticipate that this figure it rises to around 15% in the short term, when the real impact of the crisis on families is known.

The high level of requests is an alarm signal for the banks, although for now they consider this to be a conjunctural episode and try in every possible way to clarify that requests for a moratorium do not currently amount to late payment.

To reinforce their arguments, at CaixaBank - leader in the mortgage market and the entity that has processed the most requests for now - point out that 95% of the loans affected by the deferment of payment are "healthy" and were up to date with payment before the crisis.

Despite this, the reality is that the main financial groups in the country have made a sharp increase in their provisions charged to the first quarter of the year to cover potential credit defaults in the coming months. This mattress on the occasion of the coronavirus already amounts to almost 4,000 million euros only among the seven major listed banks in the country that presented results last week: Santander, BBVA, Bankia, CaixaBank, Sabadell, Bankinter and Kutxabank.

Provisions have been the main item in the latest presentations in the sector and the main cause behind the sharp fall in profits. But the worst seems to be yet to come and all the main swords that have appeared in recent days before investors and the media agree that they will have to increase the volume of provisions when the uncertainty that currently surrounds their business gives way to actual losses from the crisis.

According to the criteria of The Trust Project

Know more- Santander

- Mortgages

- economy

- Settlement

Actualidad EconómicaElectricas and banks seek social reconciliation amid the pandemic

CoronavirusMass provisioning of medical equipment in companies in the face of doubts about de-escalation

CoronavirusThe daily battle of bank branches: "The situation of many regular customers is dramatic"