April is approaching, can A shares usher in a bottom turning point?

On March 30 (Monday), the A-share gapped lower and weakened. Although there was some recovery in the afternoon, the Shanghai Composite Index closed down 0.9% at 2747.21 points, the Shenzhen Component Index fell 2.03% to 9904.95 points, and the GEM Index fell 2.28%. It closed at 1864.48 points, ending the previous rally.

"Dangerous March" is coming to an end. Under the large-scale stimulus policy, will A-shares usher in an inflection point in April? Some institutions believe that the worst time for the market has passed.

Major countries in the world implement "anti-epidemic" policies intensively

In order to cope with the impact of the epidemic, the major countries in the world have recently intensively negotiated and implemented "anti-epidemic" policies.

Last Friday, the Political Bureau of the Central Committee of the Communist Party of China held a meeting to study and propose a package of macro policies and measures. Active fiscal policies should be more proactive and prudent. Monetary policies should be more flexible and appropriate. The fiscal deficit rate should be appropriately raised. The scale of special bonds by local governments has guided the decline in interest rates on the loan market and maintained reasonable and sufficient liquidity.

The central bank also demanded that it continue to unleash the potential of reforms to promote the reduction of real interest rates on loans, and guide financial institutions to increase their support for the real economy, especially small, micro, and private enterprises.

Overseas, the Fed has a series of moves. Urgently cut interest rates by 100 basis points to the level of 0-0.25%; unlimited QE; establish emergency tools to support the credit market; expand liquidity swap lines with foreign central banks; through plans to provide loans directly to US companies, etc.

The European Central Bank also injected liquidity into the market through additional long-term reverse repurchase operations; further reduced lending rates; relaxed mortgage policies; and increased additional purchases of 870 billion euros in assets (equivalent to 7.3% of euro area GDP).

As for the Bank of England, the interest rates were cut by 50bp and 15bp on March 11 and March 20 respectively, and the current interest rate is 0.10%. The scale of QE has been increased by 200 billion pounds to 645 billion pounds.

At the emergency policy meeting on March 16, the Bank of Japan also increased the purchase of commercial paper and corporate bonds by 2 trillion yen per year, promoted corporate financing, and increased the purchases of ETFs and J-REITs to the upper limit (6 Trillion yen and 90 billion yen).

In addition, France, Australia, Saudi Arabia, and the United Arab Emirates have also introduced fiscal stimulus plans.

Agency: Worst time has passed

With the domestic epidemic nearing its end, and the introduction of national policies to save the market, can the A-share market see a turnaround in April?

Qin Peijing, chief strategy analyst of CITIC Securities, believes that the signal of global liquidity inflection points has recently appeared. At the same time, large-scale fiscal stimulus in various countries is expected to prevent the global economic recession from turning into a global economic crisis. Capital entry is the most important support at the bottom.

Southwest Securities strategic analyst Zhu Bin made it clear that the worst time for the market has passed. Long and short factors are undergoing subtle changes, and positive factors are gradually gaining the upper hand. The worst time for the market has passed, and it is turning to a positive direction. At the current point in time, we should not be pessimistic about the market.

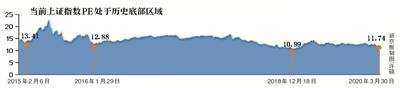

Chen Guo's team from Anson Securities pointed out that with the successive introduction of global monetary and fiscal policies this week, market concerns about liquidity risks have gradually subsided; the overall valuation of the A-share market is already at the bottom of history, and it should be strategically optimistic. Currently in a transition period in a bull market.

However, some analysts are relatively cautious. Founder Securities Chief Economist Dang Chongyu pointed out that from an international perspective, the current epidemic is spreading globally and has not been curbed, affecting China's export business orders and financial market risk appetite; domestically, economic data to be disclosed in April and The earnings data of listed companies will have a double suppression on the stock market. Positive and negative presence, or shock market will appear.

Beijing News reporter Zhang Siyuan